ImGeld Platform

What You Receive with ImGeld

ImGeld is a market structure and portfolio context system designed for disciplined equity traders. It does not generate signals or predictions. Instead, it provides the data, structure, and framing needed to make informed risk and allocation decisions.

All outputs are delivered on a consistent schedule and designed to integrate into professional trading workflows.

Daily Market Structure Coverage

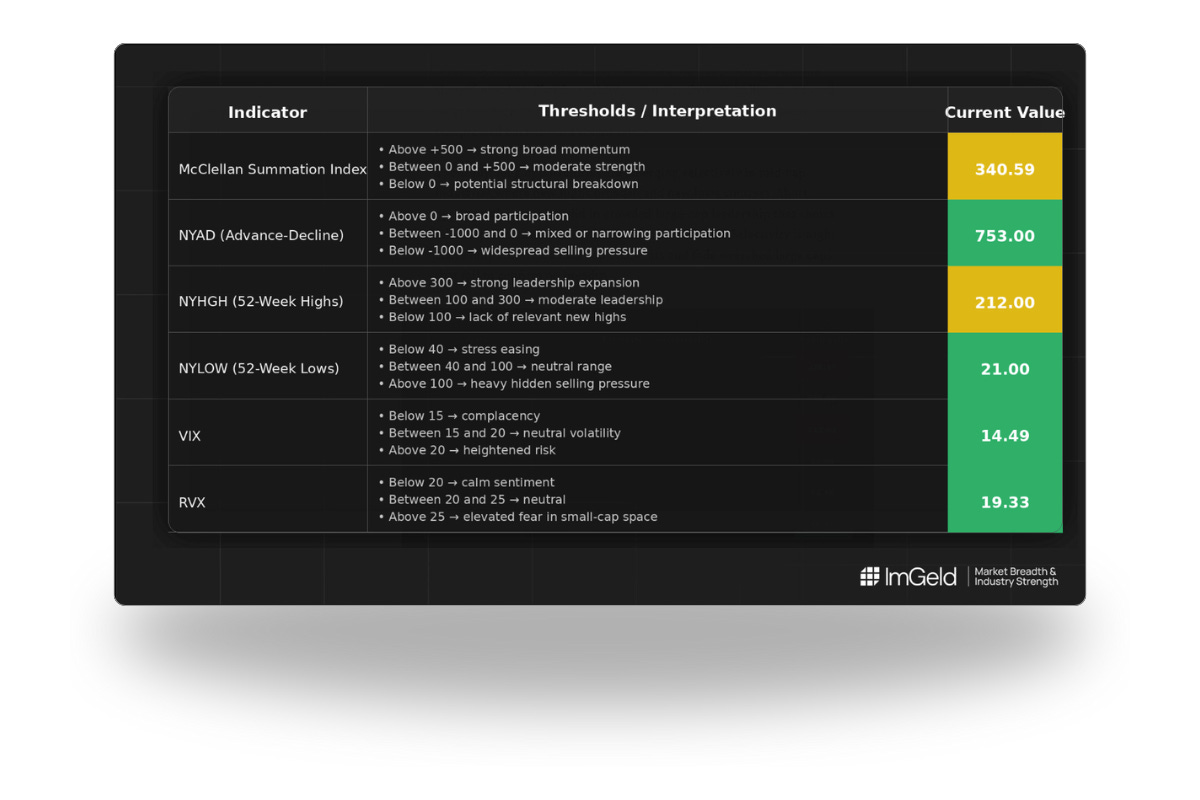

Market Breadth Update (Mon–Fri)

A daily snapshot of market participation and internal strength, focused on understanding risk regimes rather than index levels.

You receive:

NYSE advance–decline behavior

Participation and internal momentum context

Clear framing around risk-on, risk-off, or selective conditions

This update is typically used before initiating new exposure or adjusting portfolio risk.

Industry Leadership & Dispersion

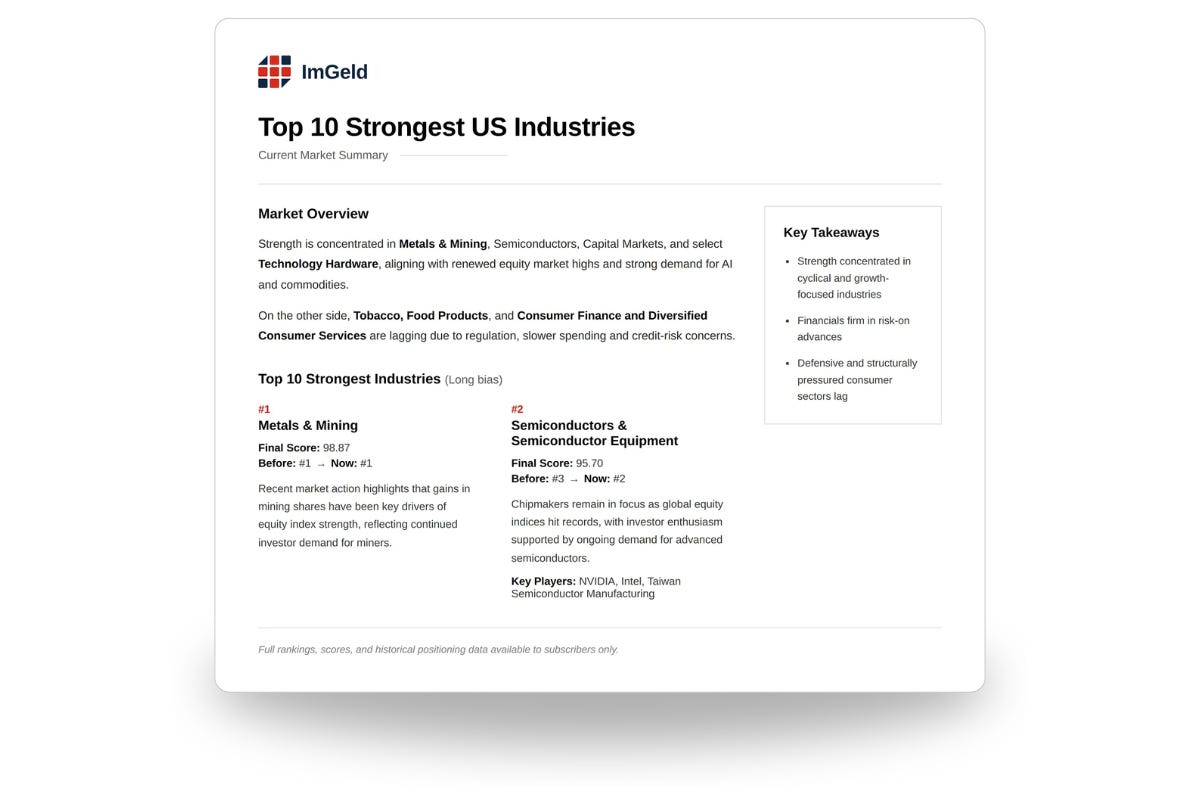

Top 10 / Bottom 10 U.S. Industries (Wed & Sun)

A concise view of relative industry strength and weakness across the U.S. equity market.

You receive:

Ranked industry leadership and laggards

Clear separation between structural strength and short-term noise

A framework for focusing attention where dispersion exists

This is designed to support capital allocation and idea prioritization, not stock picking.

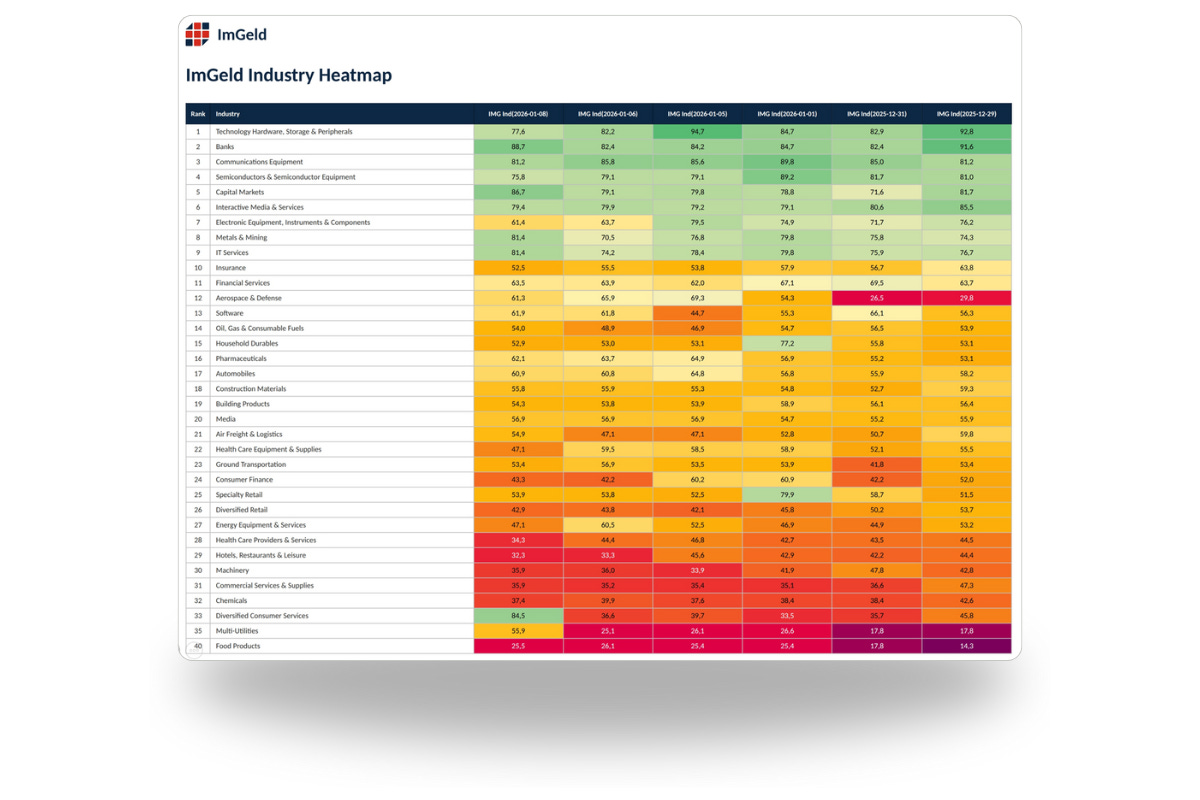

U.S. Industries Heat Map (Daily – Email Only)

A daily Excel-based dataset providing full industry rankings and momentum context.

You receive:

A complete ranked universe of U.S. industries

Strength and weakness indicators

A format suitable for tracking, filtering, and independent analysis

This dataset is email-only and not published publicly.

Structured Stock Analysis

One Stock Report (Sun, Tue, Thu)

A structured review of a single stock, designed to act as a second-layer filter, not a trade instruction.

Each report includes:

Fundamental context

Key technical reference levels

A TradingView link for independent validation

These reports are intended to complement your own screening and idea generation process.

Portfolio Construction Framework

ImGeld is built around a curated universe designed to reflect professional long–short construction principles.

Long candidates: Mid-cap equities (approximately $3B–$10B market cap)

Short candidates: Large-cap equities (greater than $20B market cap)

This segmentation is designed to:

Improve dispersion

Reduce factor overlap

Support more controlled risk expression

Full Reports & Extended Coverage

Registered subscribers receive ongoing market and industry analysis.

Subscribers who upgrade to the ImGeld Fundamental Report gain access to:

The complete long–short stock universe

Embedded fundamentals and technical references

Expanded datasets supporting deeper portfolio work

This tier is designed for traders who want full transparency and breadth, not just highlights.

Analytical Standards

ImGeld follows a disciplined, evidence-driven analytical process focused on:

Market structure

Participation

Relative strength

Risk context

All analysis is neutral in tone and avoids narrative-driven conclusions. The objective is clarity, not conviction.

Who ImGeld Is For

ImGeld is built for:

Independent equity traders

Portfolio-oriented investors

Traders who prioritize drawdown control and process

Users who already work with charts, spreadsheets, and structured data

It is not designed for:

Signal seekers

Day trading alerts

Short-term prediction services

Beginner education

How Professionals Use ImGeld

Most subscribers use ImGeld to:

Assess daily risk conditions before deploying capital

Narrow focus to industries showing real leadership

Validate ideas within a broader market regime

Maintain discipline during uncertain or volatile periods