Softening Breadth, Tentative Accumulation: Favor Mid-Cap Longs; Large-Cap Shorts Still Valid

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2026-02-02

Executive Summary Date: 2026-02-03.

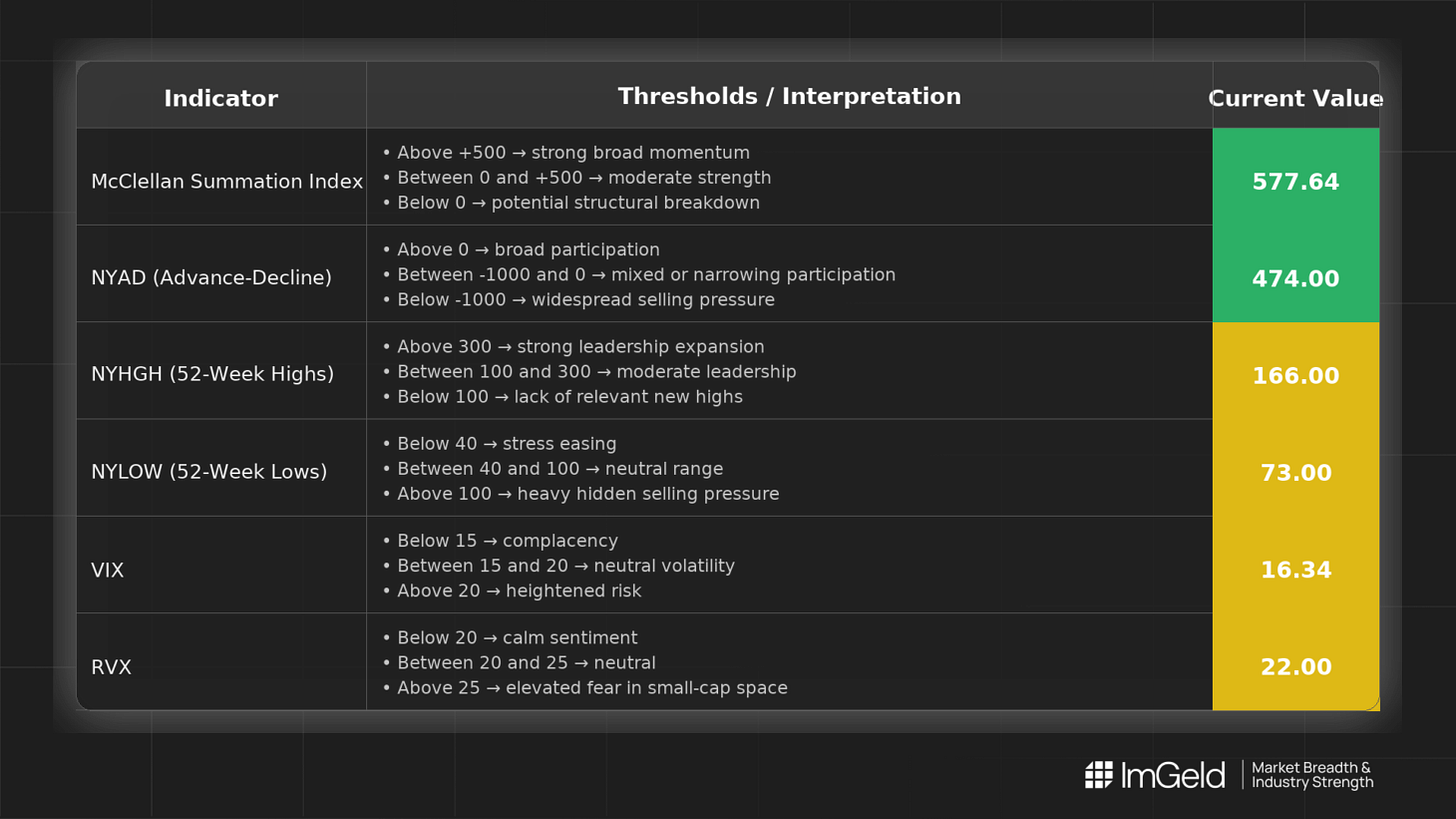

Breadth softened over the last five sessions. NYSI (McClellan Summation Index) declined from 598.81 to 577.64, signaling waning internal momentum. NYAD (Advance–Decline Line) was negative for three sessions before a single strong positive day, indicating unstable participation. VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) spiked on 2026-01-30 and eased by 2026-02-02, keeping volatility in a neutral-to-cautious regime. Long opportunities may be emerging selectively in mid-cap industries showing improving up-volume and resilience after the pullback. Short setups remain valid in large-cap leaders where breadth is narrowing and new highs are not confirming.

Get the Industry Heat Map — delivered by email only.

Global Read

Over five days, participation narrowed as NYSI trended lower and NYLOW (New 52-Week Lows) crept higher, while NYHGH (New 52-Week Highs) fell sharply then partially recovered. Leadership became more concentrated, with a tentative late-session attempt to broaden that has not yet been confirmed. Volatility expanded briefly then compressed, consistent with a churn rather than a decisive trend. A divergence is present: NYAD’s single-day rebound contrasts with the persistent decline in NYSI. By the five-day consistency rule, the pattern points to tentative accumulation, not a firm turn.

Indicator Breakdown

NYSI (McClellan Summation Index) The structure is declining, with one day of pause followed by continued slippage. This reflects a loss of intermediate-term breadth thrust and argues for selectivity on the long side.

NYAD (Advance–Decline Line) Participation weakened on balance, with three consecutive negative sessions offset partly by a strong final-day advance. The rebound needs follow-through to negate the prior deterioration.

NYHGH (New 52-Week Highs) Leadership contracted materially from ~220 to 95 before rebounding to 166. Expansion is incomplete, implying fewer resilient leaders and a need to focus on relative strength within mid-caps.

NYLOW (New 52-Week Lows) Lows rose from 51 to 73, showing incremental downside pressure and a still-elevated background risk, despite the late improvement in NYAD.

Volatility Regime VIX moved from 16.35 to 17.44 then back to 16.34; RVX from 21.39 to 22.85 then to 22.00. The brief expansion followed by compression favors tactical entries but with tight risk controls, especially as RVX remains elevated versus VIX, indicating greater fragility across small and mid-cap universes.

Tactical bias: Maintain a selective, tentative long posture focused on mid-cap industries where breadth is stabilizing, such as machinery, aerospace suppliers, specialty chemicals, and life science tools, prioritizing improving up-volume and participation in new highs. Large caps with narrowing leadership and deteriorating breadth remain candidates for tactical shorts.

Access the ImGeld Fundamental Report

Stay informed. Unlock the ImGeld Every Updates — subscribers only.