Risk-Off Regime: Volatility Spikes, Breadth Narrows; Favor Selective Mid-Cap Longs, Short Large-Cap Leaders

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2026-02-05

Executive Summary (2026-02-06)

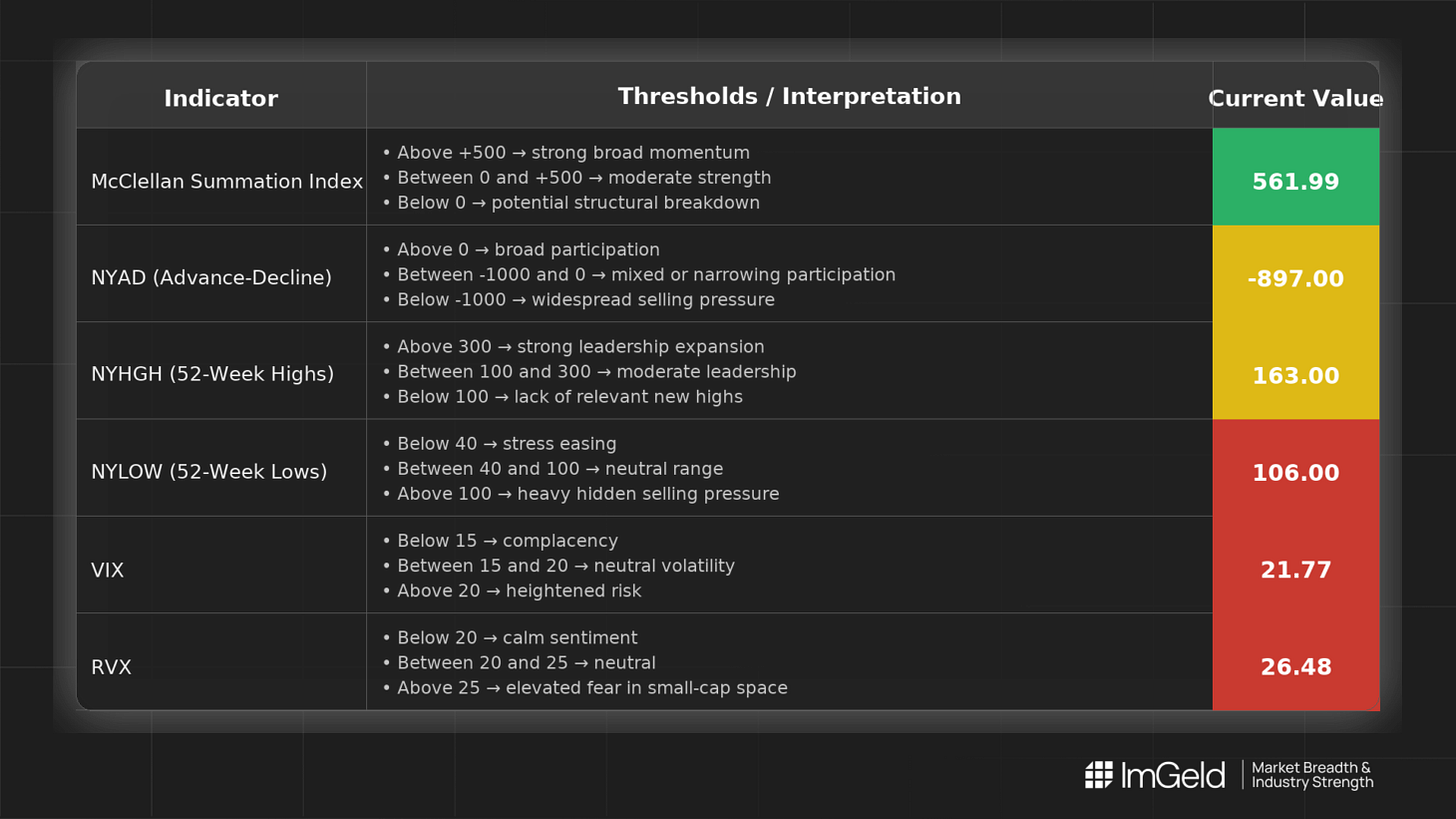

Breadth direction: NYSI (McClellan Summation Index) slipped net lower across the week with a brief uptick midweek, indicating a weakening structure. NYAD (Advance–Decline Line) was choppy but closed the period decisively negative, signaling fading participation.

Volatility tone: VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) expanded steadily, with a sharp spike into the close, shifting the regime toward risk-off.

Tactics: Maintain a selective, defense-first posture. Long opportunities may be emerging only in mid-cap names within resilient industries still printing net new highs on down days. Short opportunities remain valid in overowned large-cap leadership and in industries showing rising new lows and negative A/D pressure. Selectivity is high.

Get the Industry Heat Map — delivered by email only.

Global Read

Participation narrowed into the week’s end: early attempts at broadening fizzled as new highs contracted and new lows stayed elevated. Leadership briefly widened, then became more fragile, suggesting concentration risk rather than durable rotation. Volatility expanded materially, elevating whipsaw risk and compressing timeframes. A negative divergence persisted as NYAD posted three up days that failed to lift NYSI, implying that rallies lacked persistence and were not strong enough to turn the summation trend. By the five-day consistency rule, signals remain mixed with a downside tilt, consistent with a failed early accumulation attempt rather than continuation.

Indicator Breakdown

1. NYSI (McClellan Summation Index)

Trend: Net decline from 581 to 562 with one isolated improvement on 02/04. Structure is deteriorating and at risk of a roll-over if selling persists.

NYAD (Advance–Decline Line)

Participation: Alternated through the week and finished at -897, leaving a net five-day deficit. Breadth is weakening and susceptible to further risk reduction.

NYHGH (New 52-Week Highs)

Leadership: Expanded from 95 to 323 by 02/04, then contracted to 163. Leadership expansion stalled, indicating fragile upside follow-through.

NYLOW (New 52-Week Lows)

Downside pressure: Rose from 70 to 106 with an elevated midweek print. Risk appetite is constrained; sellers remain active beneath the surface.

Volatility Regime

VIX rose from 16.3 to 21.8 and RVX from 22.0 to 26.5 across five sessions. The rising-vol regime favors tighter risk controls, quicker profit-taking, and maintaining hedges. Elevated RVX relative to VIX underscores higher small- and mid-cap sensitivity to shocks despite selective long setups.

Tactical Implementation

Long: Be highly selective in mid-caps within industries showing persistent relative strength and stable new-highs cadence on down sessions.

Short: Large-cap index leaders and industries with expanding new lows and negative breadth remain actionable on bounces.

Cash and hedges: Maintain discipline given expanding volatility and mixed breadth.

Access the ImGeld Fundamental Report

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.