Participation broadens, leadership narrows: position in selective mid-caps before rotation intensifies

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2026-02-17

Executive Summary Date: 2026-02-18

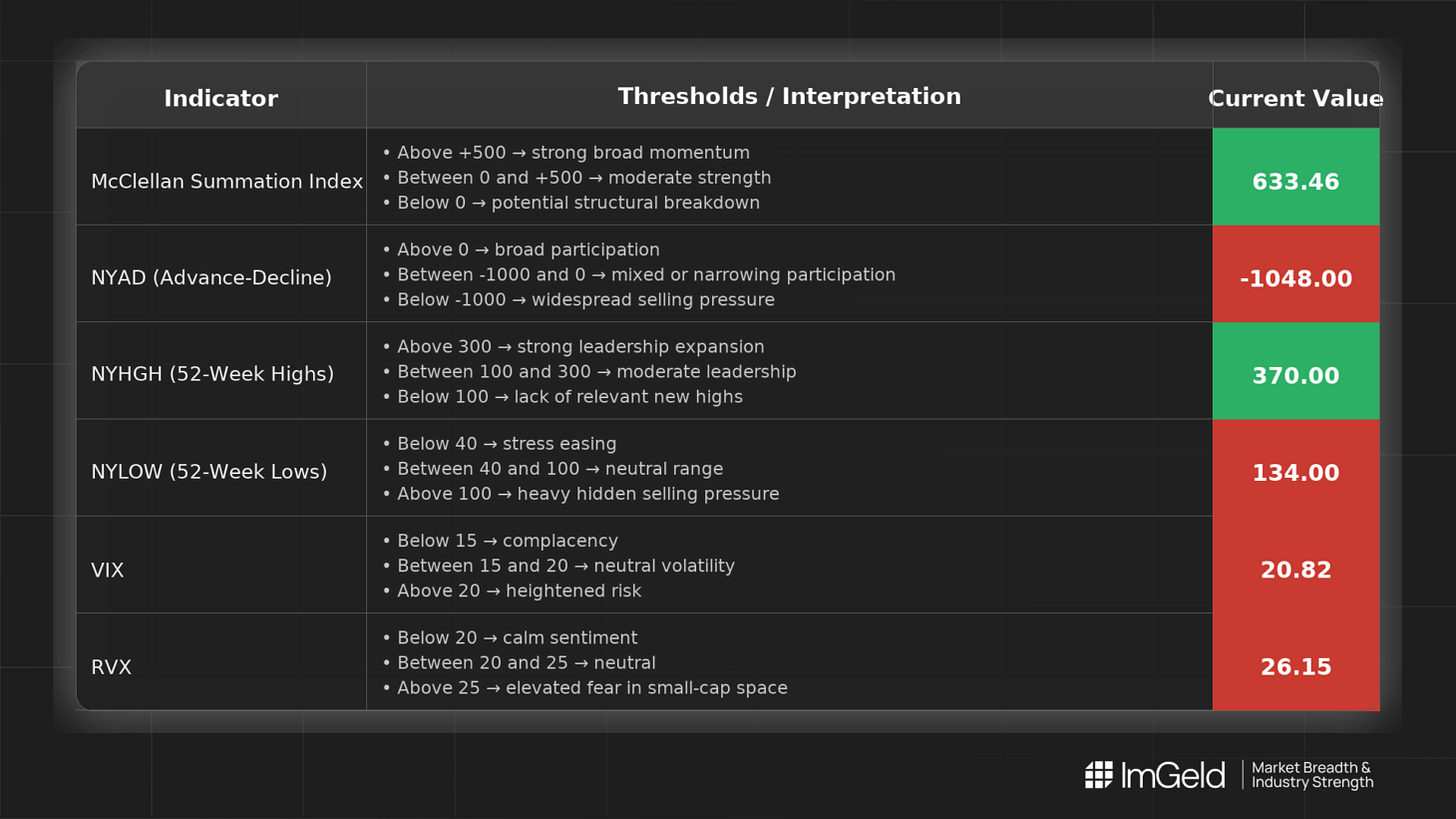

Breadth improved early in the period and then stalled. NYSI (McClellan Summation Index) advanced on 02-13 and held flat for the next four sessions, signaling a constructive but plateauing structure. NYAD (Advance–Decline Line) turned decisively positive with four consecutive strong readings, indicating firm participation gains. Volatility moved higher and held there, with VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) both stepping up and stabilizing at elevated levels.

Tactically, long opportunities are emerging but require high selectivity. Favor mid-cap industries showing improving participation and reduced new lows. Short opportunities remain valid in crowded large-cap leadership where momentum is extended and leadership breadth is narrowing.

Get the Industry He3at Map — delivered by email only.

Global Read

Participation is broadening, evidenced by four days of strong NYAD and declining new lows, but leadership is becoming more concentrated as NYHGH fell sharply and stayed lower. Volatility expanded and then stabilized at a higher regime, which argues for staggered entries and disciplined risk. A mild divergence is present: NYSI plateaued while NYAD strengthened, suggesting a short-term thrust not yet confirmed by longer-term momentum. By the five-day consistency rule, participation is firmly improving, leadership expansion is firmly contracting, and the overall pattern signals early accumulation rather than a decisive continuation. Selectivity remains essential.

Indicator Breakdown

NYSI (McClellan Summation Index)

637.61 to 649.87, then four sessions of unchanged readings. Structure improved and is now firmly plateauing. Momentum is constructive but not accelerating.

NYAD (Advance–Decline Line)

From 211 to four consecutive sessions at 1269. Daily participation is firmly strengthening, indicating broad buying across many listings.

NYHGH (New 52-Week Highs)

Dropped from 417 to 192 and stayed there. Leadership expansion is firmly contracting, consistent with rotation into laggards rather than fresh breakouts.

NYLOW (New 52-Week Lows)

Fell from 80 to 49 and persisted. Downside pressure is firmly easing, a supportive risk signal for selective accumulation.

Volatility Regime

VIX rose from 17.65 to 20.60 and held; RVX rose from 22.99 to 25.64 and held. Volatility is firmly elevated, implying choppier tape and emphasizing entry discipline and position sizing.

Tactical Takeaway

Maintain a tentative long bias with high selectivity in mid-cap industries where participation is improving and new lows are suppressed. Avoid chasing breakouts given the contraction in new highs. Consider tactical shorts only in overextended large-cap leadership within growth-oriented industries where crowding and elevated volatility raise the risk of mean reversion.

Access the ImGeld Fundamental Report

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.