NYSI/NYAD confirm early accumulation; volatility compresses, rotate into mid-caps, fade large-cap laggards now

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2026-02-09

Executive Summary Date: 2026-02-10

Breadth improved over the last five sessions after a brief mid-week setback. NYSI (McClellan Summation Index) dipped, then recovered to finish above last Tuesday. NYAD (Advance–Decline Line) delivered a strong two-day thrust into the close of the period, offsetting the single negative day. Volatility eased, with VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) retracing their mid-week spikes.

Tactically, long opportunities are emerging in select mid-cap industries showing rising new highs and declining new lows, with a preference for pullback entries. Short setups remain valid in large caps that are lagging breadth and losing leadership on rallies. Selectivity remains important.

Get the Industry Heat Map — delivered by email only.

Global Read

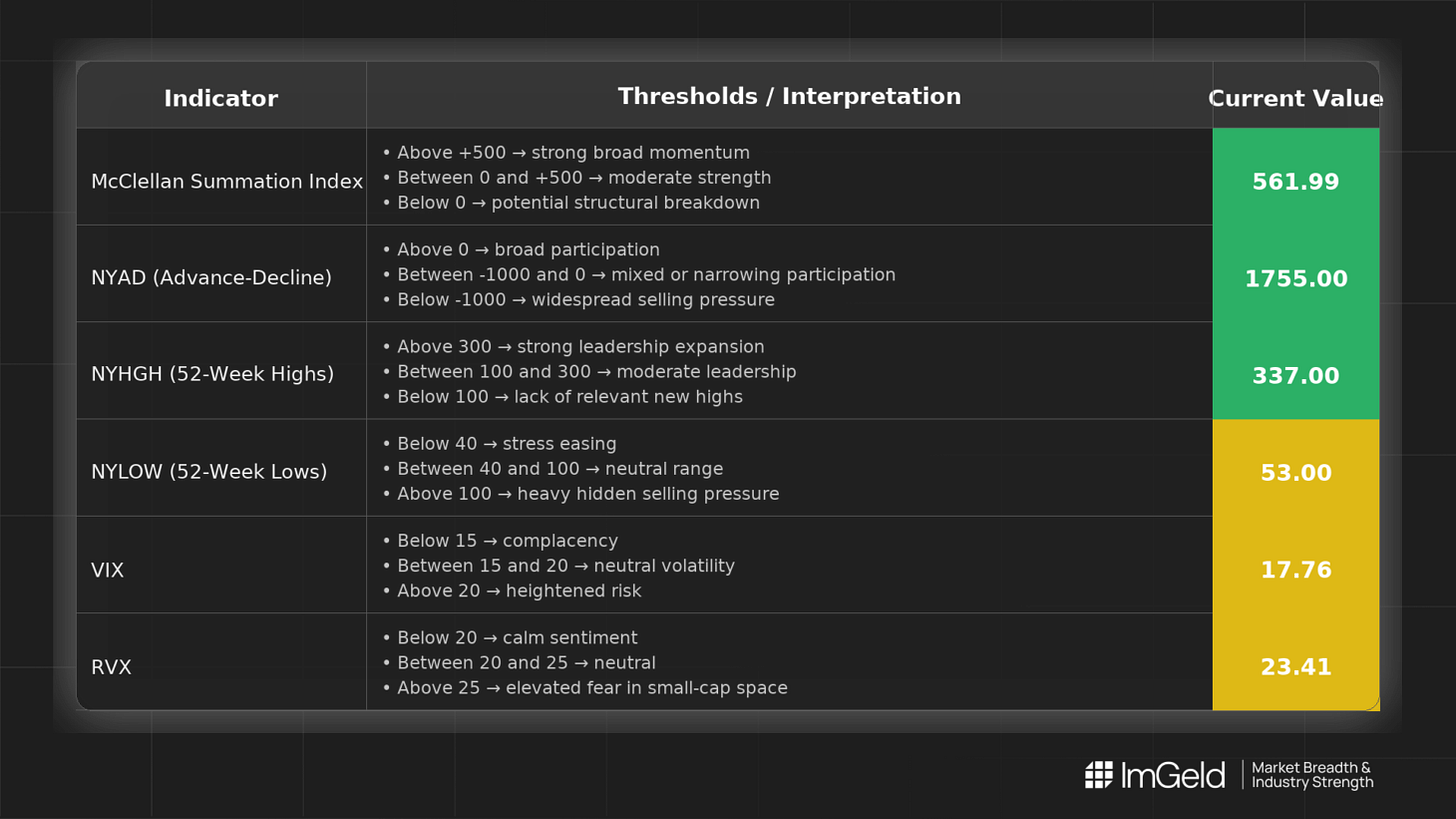

Participation is broadening, Firmly, given consecutive strong NYAD prints and elevated new highs into the latest session. Leadership is rotating toward a wider base rather than remaining concentrated, evidenced by higher NYHGH and falling NYLOW. Volatility is compressing, Firmly, after a one-day expansion. There is no adverse divergence between NYSI and NYAD; NYAD’s surge leads NYSI’s turn higher, typical of early accumulation. The five-day pattern signals early accumulation after a brief reset, not exhaustion.

Indicator Breakdown

NYSI (McClellan Summation Index) Structure improved modestly: 575.16 to 578.34, a pullback to 561.99, then a recovery to 575.43. The higher recovery suggests constructive momentum with a shallow drawdown and reassertion of buying pressure.

NYAD (Advance–Decline Line) Participation was choppy but net positive: +199, +449, then -897 followed by +1755 and +510. The two high-intensity advance days dominate, indicating broad buying interest and confirming the recovery in NYSI.

NYHGH (New 52-Week Highs) Leadership expansion is intact: 281, 323, 163, 337, 296. New highs rebounded sharply after the mid-week dip and remain elevated, consistent with broadening leadership.

NYLOW (New 52-Week Lows) Downside pressure eased: 127, 99, 106, 53, 63. Lows compressed to cycle lows late in the period, signaling improving risk appetite and fewer breakdowns.

Volatility Regime VIX moved 18.00, 18.64, 21.77, 17.76, 17.36; RVX 23.03, 24.12, 26.48, 23.41, 23.22. The mid-week spike was faded, leaving a lower, stable regime that supports risk-taking with disciplined entries. The RVX premium over VIX remains, favoring relative opportunities in non-mega-cap universes.

Tactical Implications

Long: Favor mid-cap industries with improving breadth and leadership expansion, including industrial machinery, building products, electrical equipment, regional banks, specialty insurers, application software, and semiconductor capital equipment. Prioritize pullbacks within uptrends and names printing or approaching new highs with low new-low backdrop.

Short: Large caps showing deteriorating advance–decline profiles and fading momentum on rallies remain candidates, particularly in household products, beverages, tobacco, and interactive media and services where leadership has narrowed.

Access the ImGeld Fundamental Report

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.