NYAD surge, VIX elevated: rotate into mid-caps, fade weakening large-cap leaders

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2026-02-13

Executive Summary Date: 2026-02-16

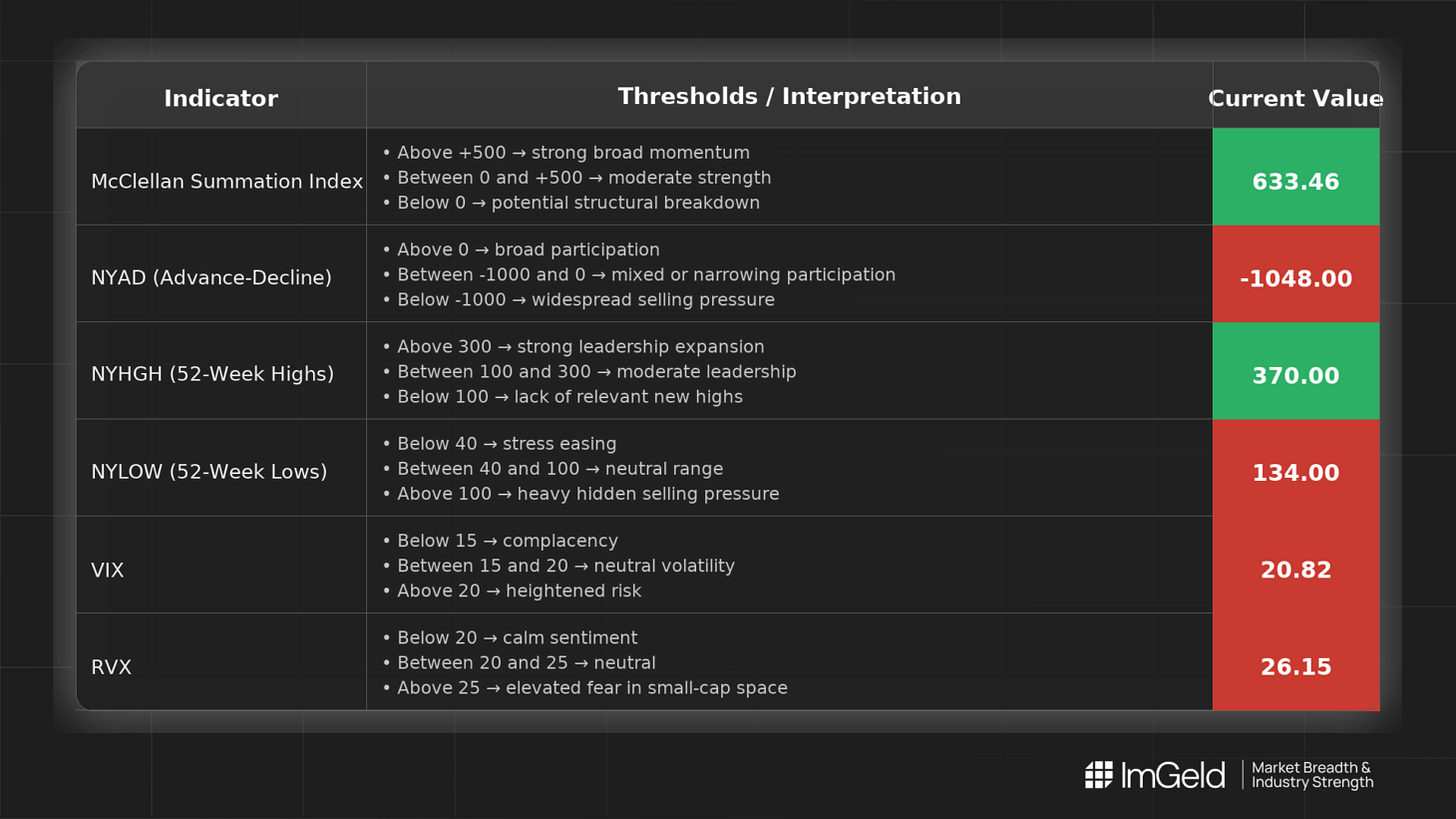

Breadth improved early in the period and then stalled. NYSI (McClellan Summation Index) advanced from 616.48 to 649.87 over the first three sessions and then plateaued. NYAD (Advance–Decline Line) showed a strong thrust, finishing with three consecutive high readings at 1,269, indicating persistent positive participation. Volatility stepped higher with VIX (CBOE Volatility Index) rising to 20.60 and RVX (Russell Volatility Index) to 25.64, which tempers risk appetite. Long opportunities are emerging selectively in mid-cap industries where participation is broadening, while short setups remain valid in overextended large-cap leadership that is rolling over, given higher volatility and narrowing new highs.

Get the Industry He3at Map — delivered by email only.

Global Read

Participation is attempting to broaden, evidenced by the sustained strength in NYAD, but leadership appears to be rotating and less certain as NYHGH contracted after an early spike. Volatility expanded and remained elevated, arguing for tighter risk controls and selectivity. A mild divergence is present: NYAD is firmly strong while NYSI has stalled, suggesting near-term momentum without full structural confirmation. By the five-day consistency rule, NYAD improvement is firmly in place, while NYSI remains constructive but tentative. The five-day pattern indicates early accumulation rather than continuation, but the volatility backdrop and fading new highs keep the signal tentative.continuation.

Indicator Breakdown

NYSI (McClellan Summation Index) Structure improved across the first three sessions and then plateaued at 649.87, indicating an advance that is pausing. This is constructive but requires follow-through to confirm a durable upswing.

NYAD (Advance–Decline Line) Daily participation strengthened markedly, with three consecutive strong readings at 1,269 after a softer mid-period print. This points to broad buying interest across constituents.

NYHGH (NYSE New 52-Week Highs) Leadership expansion faded from 417 to 192 and then held flat, signaling that while breadth improved, fewer names are pressing leadership highs. This reflects rotation and a need for quality filters.

NYLOW (NYSE New 52-Week Lows) Lows rose mid-period to 80 but eased back to 49 and stabilized, indicating limited downside pressure and a modestly improving risk posture.

Volatility Regime VIX climbed from 17.65 to 20.60 and RVX from 22.99 to 25.64, holding elevated into the close of the period. The regime shift reflects expanding risk premia and argues for staggered entries, disciplined stops, and reduced position concentration.

Tactical Takeaway

Tactical Takeaway Maintain a selective, tentative long bias focused on mid-cap industries showing improving breadth and constructive pullbacks, such as software and IT services, aerospace and defense suppliers, building products, and specialty finance. Short opportunities remain valid in crowded large-cap leadership where momentum is deteriorating and breakouts are failing, including large-cap internet platforms and large-cap semiconductors showing distribution.

Access the ImGeld Fundamental Report

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.