NYAD reverses as VIX surges: distribution risk rising, rotate to resilient mid-caps

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2026-02-1

Executive Summary Date: 2026-02-13

Breadth deteriorated into the week’s end. NYSI (McClellan Summation Index) advanced through Thursday, then slippedon Friday, signalling an improving but stalling structure. NYAD (Advance–Decline Line) flipped sharply negative on Friday after midweek strength, indicating a decisive setback in daily participation. Volatility tone turned risk-off: VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) spiked, pointing to wider ranges and tighter risk budgets. Long opportunities may be emerging selectively within resilient mid-cap industries printing persistent new highs and contained drawdowns. Short setups remain valid in extended large caps and in mid-cap laggards showing expanding new lows and weak advance–decline profiles. Selectivity is high.

Get the Industry He3at Map — delivered by email only.

Global Read

Participation broadened early, then narrowed firmly over the last two sessions as NYAD deteriorated and NYLOW expanded. Leadership, which was widening midweek via higher NYHGH, became more concentrated by Friday with highs cooling despite the negative A–D shock. Volatility moved from compressed to expanding with a single, outsized jump, which is Tentative by the five-day rule but tactically meaningful. A near-term divergence emerged: NYSI remains elevated while NYAD rolled over, flagging fragility and risk of further distribution. The five-day pattern remains mixed with signs of emerging exhaustion rather than clean continuation.

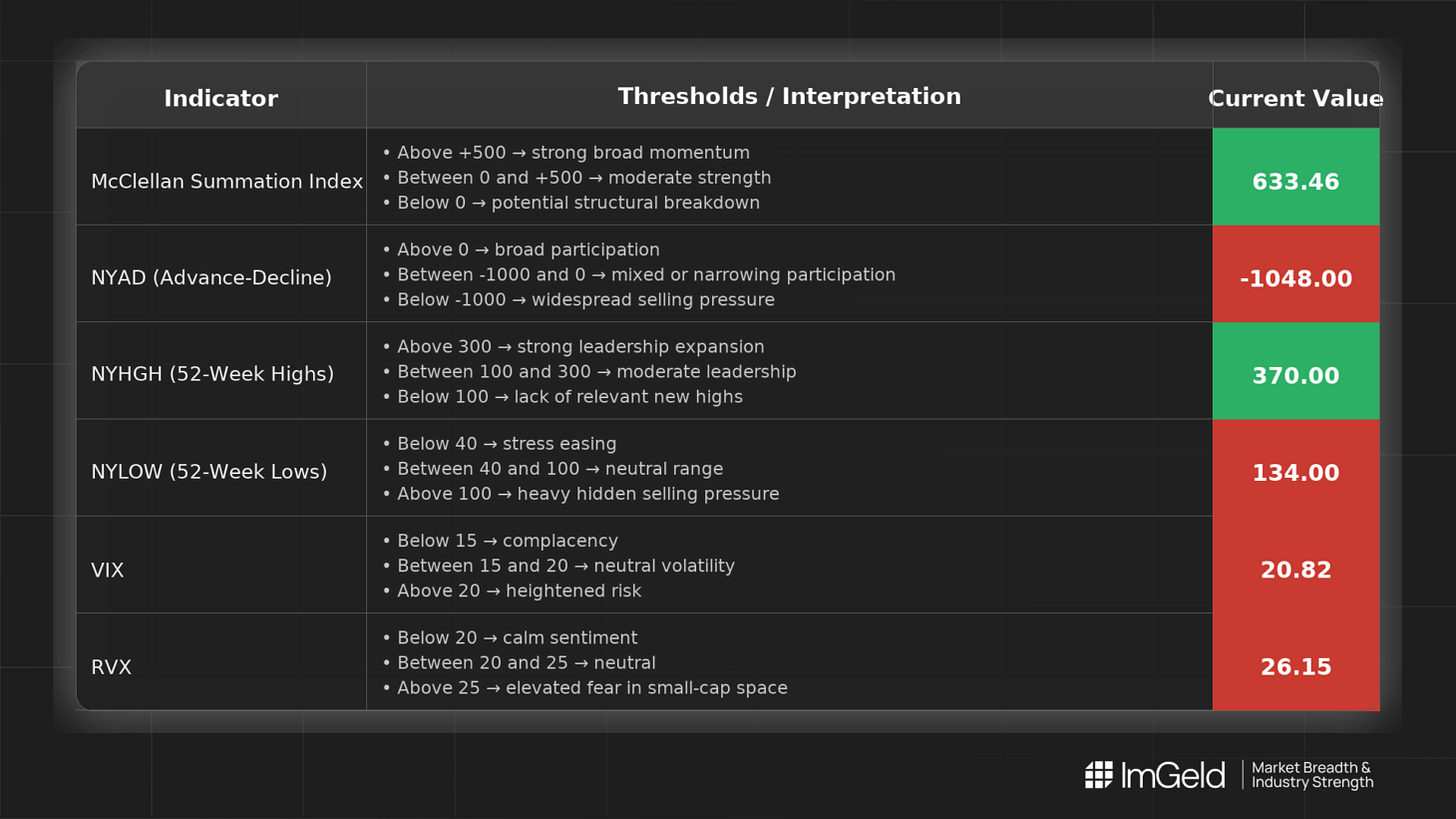

Indicator Breakdown

NYSI (McClellan Summation Index) Improving into 2/12 (575.43 → 637.61) with a modest pullback on 2/13 (633.46). By the five-day rule: Firmly improving, now plateauing.

NYAD (Advance–Decline Line) Strong breadth early (510, 695, 662), then deterioration (211, -1048). Last two sessions mark Firmly weakening participation.

NYHGH (New 52-Week Highs) Leadership expansion through 2/12 (296 → 417), modest retracement on 2/13 (370). Remains constructive but stalling into the volatility spike.

NYLOW (New 52-Week Lows) Compressed early (63, 38, 38), then rose (80, 134). Two-day pickup signals Firmly rising downside pressure and waning risk appetite.

Volatility Regime VIX steady near 17–18 for four sessions, then up to 20.82. RVX similar, jumping to 26.15. This is a Tentative but notable expansion, consistent with de-risking and greater payoff to relative-value and dispersion strategies.

Tactical Takeaway

Longs: Focus only on mid-cap industries demonstrating consecutive new highs, positive relative breadth versus peers, and muted new lows. Use staggered entries and tight stops given volatility expansion.

Shorts: Maintain exposure in crowded large caps where breadth has failed, and in mid-cap underperformers with deteriorating A–D and rising new lows. Favor names with earnings revision risk and extended multiples.

Overall: Neutral bias with elevated selectivity; prioritize liquidity and avoid adding broad beta into expanding volatility.

Access the ImGeld Fundamental Report

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.