Narrowing breadth, negative NYAD: RVX divergence imperils overextended large-cap leadership

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2026-02-19

Executive Summary Date: 2026-02-120

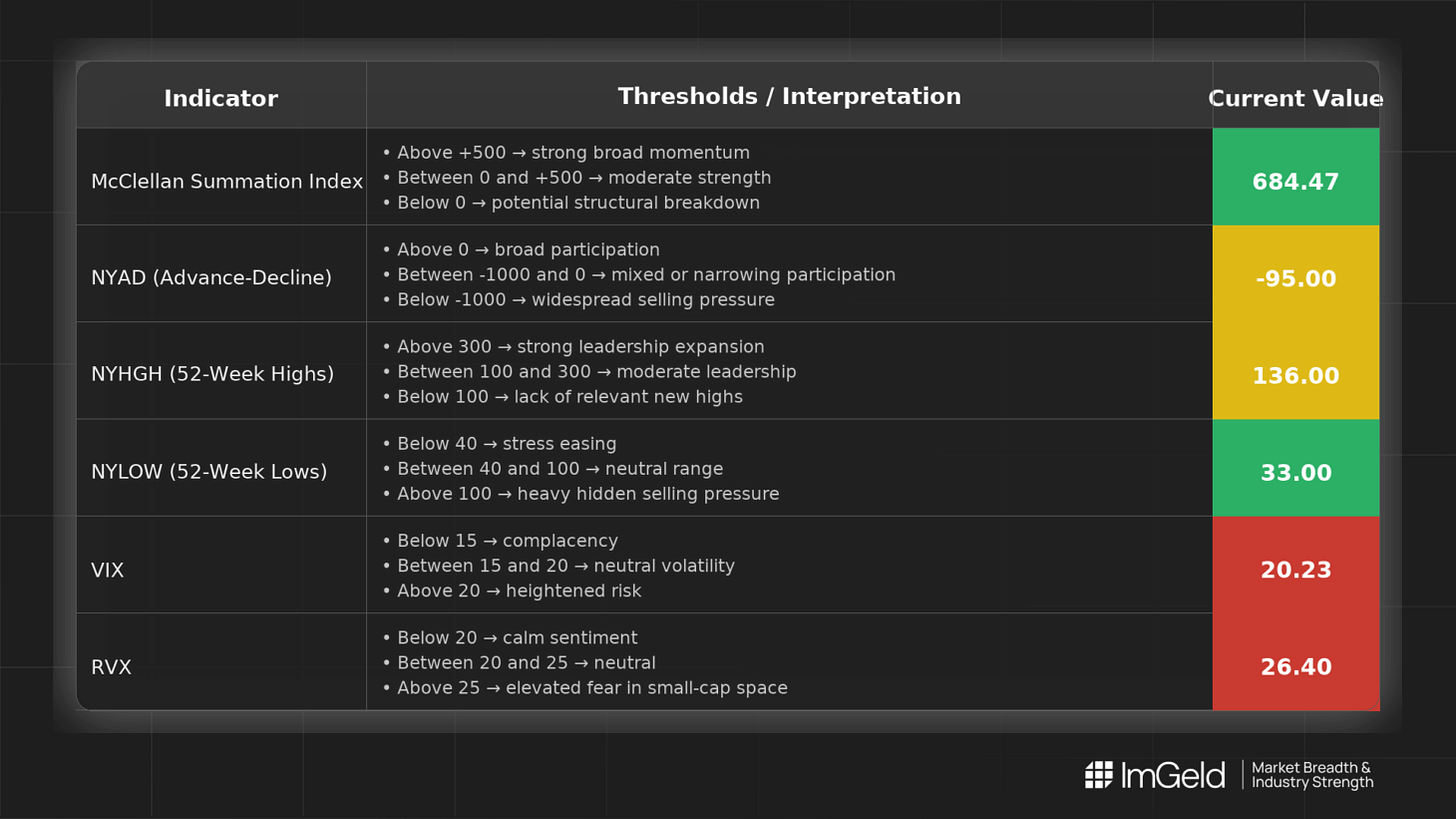

Breadth is deteriorating at the margin despite a late-week lift in NYSI (McClellan Summation Index). NYAD (Advance-Decline Line) flipped from elevated readings earlier in the week to negative territory into the close of the period. VIX (CBOE Volatility Index) drifted marginally lower, while RVX (Russell Volatility Index) rose, flagging rising relative risk in smaller capitalization universes. Leadership narrowed as NYHGH (New 52-week Highs) contracted and NYLOW (New 52-week Lows) stayed contained but choppy. Tactical bias remains a tentative short stance with elevated selectivity. Long opportunities, if any, are limited to resilient mid-cap industries with stable cash flows and idiosyncratic catalysts, while short setups remain valid in overextended large-cap leadership and fragile cyclicals.

Get the Industry He3at Map — delivered by email only.

Global Read

Across the last five sessions, participation is narrowing firmly over the most recent two days, with leadership becoming more concentrated as new highs declined from 192 to 136. Volatility shows a divergence: headline volatility compressed slightly, yet RVX rose, indicating stress building beneath the surface for smaller cohorts. A clear divergence has emerged between a still-rising NYSI and a rolling NYAD, suggesting the cumulative trend is lagging the deterioration in daily breadth. The five-day pattern leans toward early distribution and potential exhaustion of prior momentum rather than fresh accumulation. Given two consecutive days of weaker breadth, the signal is firm over that window, but the overall stance remains tentative short given muted headline volatility and still-contained lows.

Indicator Breakdown

NYSI (McClellan Summation Index) Structure improved late in the window, rising from 649.87 to 684.47 after a three-day plateau. This reflects residual cumulative strength, but it lags the deterioration visible in daily breadth.

NYAD (Advance-Decline Line) Participation weakened materially. After holding near 1269 for three sessions, NYAD fell to 127 and then negative at -95, consistent with near-term distribution and reduced risk appetite.

NYHGH (New 52-week Highs) Leadership expansion faded, slipping from 192 to 136 by week’s end. This indicates narrowing leadership and a higher bar for momentum continuation.

NYLOW (New 52-week Lows) Lows ticked up to 64 before easing to 33, remaining contained overall. Downside pressure is present but not yet broad-based, supporting a selective rather than wholesale risk-off stance.

Volatility Regime VIX eased slightly from 20.60 to 20.23, while RVX rose from 25.64 to 26.40. This cross-volatility divergence argues for disciplined hedging and careful sizing in mid-cap exposures.

Tactical Takeaway

Long side: Focus only on mid-cap industries with defensive cash flows and stable demand profiles such as regulated utilities, specialty insurers, waste services, and midstream energy. Emphasize balance sheet quality and catalyst visibility.

Short side: Large-cap leadership showing narrowing breadth remains vulnerable, notably in momentum-driven technology industries and semiconductor-heavy value chains. Consider also selective shorts in mid-cap cyclicals tied to discretionary and transport end-markets where RVX pressure is rising.

Access the ImGeld Fundamental Report

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.