Mid-cap breakout or dead-cat bounce: does NYADs surge mask NYSIs stall?

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2026-02-06

Executive Summary Date: 2026-02-09

Breadth is cautiously constructive into week-end. NYSI (McClellan Summation Index) drifted lower and then stalled, while NYAD (Advance–Decline Line) whipsawed but closed with a decisive positive surge. VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) spiked midweek and compressed by Friday, leaving a neutral-to-elevated volatility tone.

Tactically, long opportunities are emerging selectively in mid-cap industries where new highs are expanding and new lows are receding. Patience is key after Friday’s thrust; favor staged entry on pullbacks. Large-cap short setups remain valid into strength where leadership is overextended and breadth failed to confirm, particularly among crowded growth and defensive bellwethers.

Get the Industry Heat Map — delivered by email only.

Global Read

Participation broadened by week-end: rising new highs alongside a contraction in new lows and a strong NYAD rebound point to early accumulation pressures. Leadership shows signs of rotation away from narrow large-cap concentration toward more inclusive participation, with mid-caps benefitting from improving internal metrics. Volatility expanded into Thursday and then compressed, suggesting risk appetite is stabilizing but not complacent. A divergence persists as NYSI declined while NYAD finished strongly; this mix argues for a tentative, selective approach rather than outright aggression. By the five-day consistency rule, the pattern remains mixed, tilting tentative-constructive rather than firmly bullish.

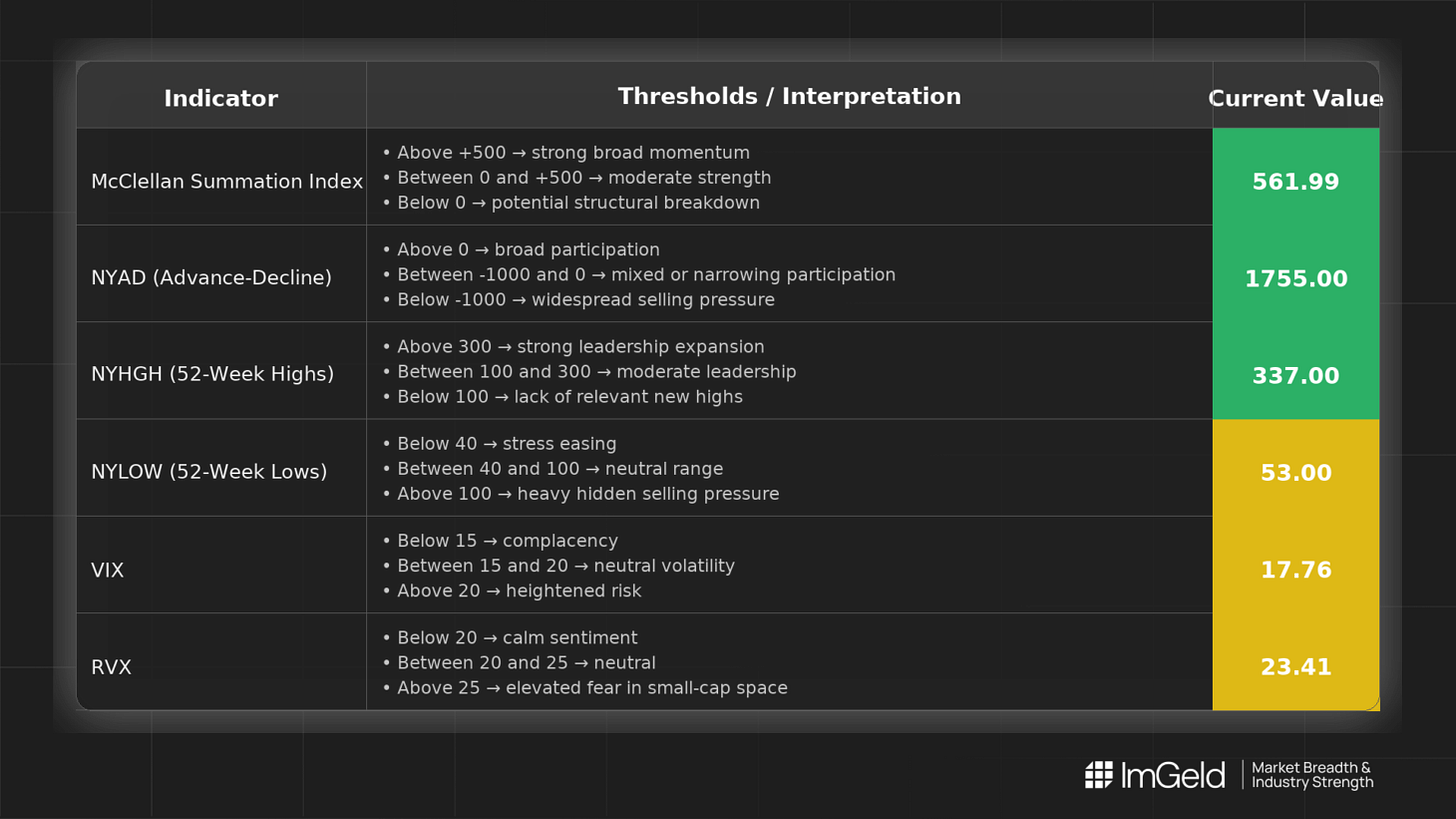

Indicator Breakdown

NYSI (McClellan Summation Index) Softening bias. The index slipped from 577.64 to 561.99 over five sessions, then plateaued, indicating waning momentum that requires confirmation from continued broad participation.

NYAD (Advance–Decline Line) Highly volatile participation: +474, +199, +449, −897, then +1,755. Despite the midweek drawdown, the strong finish indicates reinvigorated demand, but the path was uneven, keeping the signal mixed near term.

NYHGH (New 52-Week Highs) Leadership expansion is firming: 166, 281, 323, 163, 337. Four sessions with elevated prints and a weekly peak on Friday support selective upside follow-through in mid-cap leaders.

NYLOW (New 52-Week Lows) Downside pressure eased into week-end: 73, 127, 99, 106, 53. The Friday contraction improves risk appetite but, given midweek variability, remains tentatively favorable.

Volatility Regime VIX: 16.34, 18.00, 18.64, 21.77, 17.76. RVX: 22.00, 23.03, 24.12, 26.48, 23.41. A midweek volatility burst followed by compression argues for maintaining discipline on entries and sizing. Expect choppiness; use intraday weakness to scale into mid-cap opportunities and fade rallies in select large caps where internals lag.

Tactical Focus

Mid-cap longs: prioritize industries with improving highs and contracting lows, such as industrial machinery, electrical equipment, specialty chemicals, software and IT services, medical devices, and regional banks.

Large-cap shorts: into strength where breadth failed to confirm recent highs and volatility remains sticky, especially in crowded growth and low-beta defensives.

Access the ImGeld Fundamental Report

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.