Elevated volatility, narrowing leadership: rotate to mid-caps before large-cap momentum stumbles

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2026-02-16

Executive Summary Date: 2026-02-17

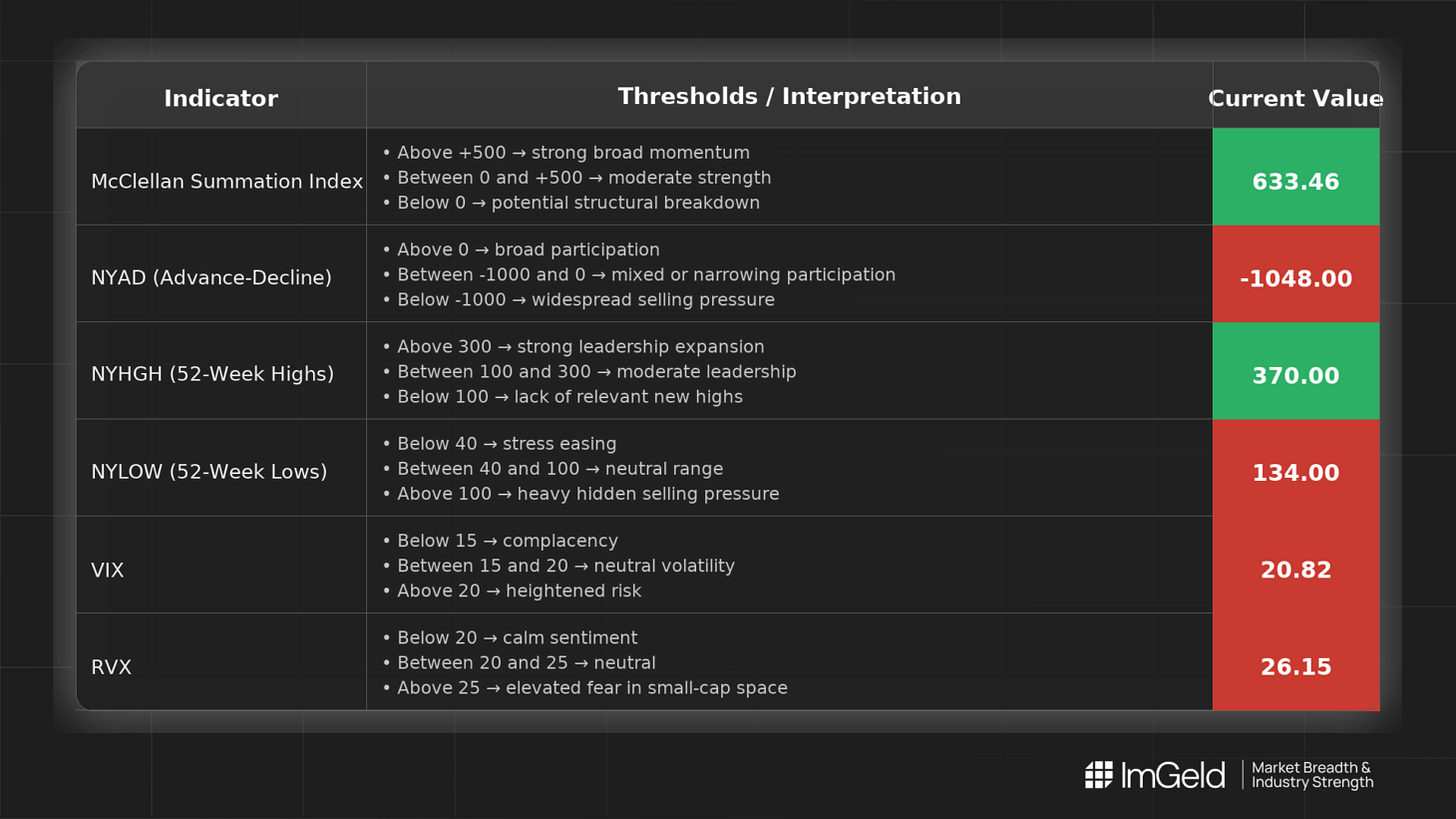

Over the last five sessions, breadth improved then stalled at elevated levels. NYSI (McClellan Summation Index) advanced early and then plateaued, while NYAD (Advance–Decline Line) turned decisively positive and stayed there. Volatility stepped higher, with VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) both jumping and holding at elevated regimes. This mix argues for selective risk-taking: long opportunities are emerging within mid-cap industries showing improving participation and fewer new lows, while short setups remain valid in overstretched large-cap leadership where new-high expansion is fading. Selectivity is high.

Get the Industry He3at Map — delivered by email only.

Global Read

Participation is broadly improving as signaled by the persistent positive NYAD, but leadership is narrowing given the sharp contraction in NYHGH (New 52-Week Highs). Volatility expanded and is holding higher, indicating more fragile trend persistence. There is a mild divergence: NYAD is firmly positive, yet NYSI has ceased advancing, suggesting breadth momentum is plateauing despite continued daily participation. Using the five-day consistency rule: participation is firmly constructive; leadership expansion is firmly contracting; volatility is firmly elevated. The pattern signals early accumulation beneath the surface with potential exhaustion in prior leaders and a rotation-driven consolidation rather than a broad breakout.

Indicator Breakdown

NYSI (McClellan Summation Index)

Structure improved from 637.61 to 649.87, then plateaued for four sessions. This is a stabilization at high levels, not fresh thrust.

NYAD (Advance–Decline Line)

Shifted from modestly positive to strongly positive (211 to 1269) and held there, indicating firmly broad participation across constituents.

NYHGH (New 52-Week Highs)

Fell from 417 to 192 and stayed muted, evidencing a narrowing in leadership and fewer successful breakouts.

NYLOW (New 52-Week Lows)

Declined from 80 to 49 and remained contained, reflecting easing downside pressure and healthier risk appetite beneath the headline indices.

Volatility Regime

VIX moved from 17.65 to 20.60 and RVX from 22.99 to 25.64, both holding at higher plateaus. Elevated, steady volatility favors staggered entries, tighter stops, and an expectation of shakeouts even in constructive tapes.

Tactical Takeaway

Longs: Focus only on mid-cap industries where participation has broadened and lows compressed, favoring pullback entries over breakouts. Examples include mid-cap Industrial Machinery, Building Products, Specialty Chemicals, and select mid-cap Regional Banks where downside prints remain subdued.

Shorts: Selective, tactical shorts remain valid in large-cap industries showing leadership fatigue and shrinking new-highs participation, notably mega-cap Internet & Interactive Media and Semiconductors. Prior strength with fewer new highs and higher volatility raises failure risk on momentum chases.

Access the ImGeld Fundamental Report

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.