Broadening Breadth, Rising Volatility: Tentative Tilt to Selective Mid-Cap Longs

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2026-02-04

Executive Summary (2026-02-05)

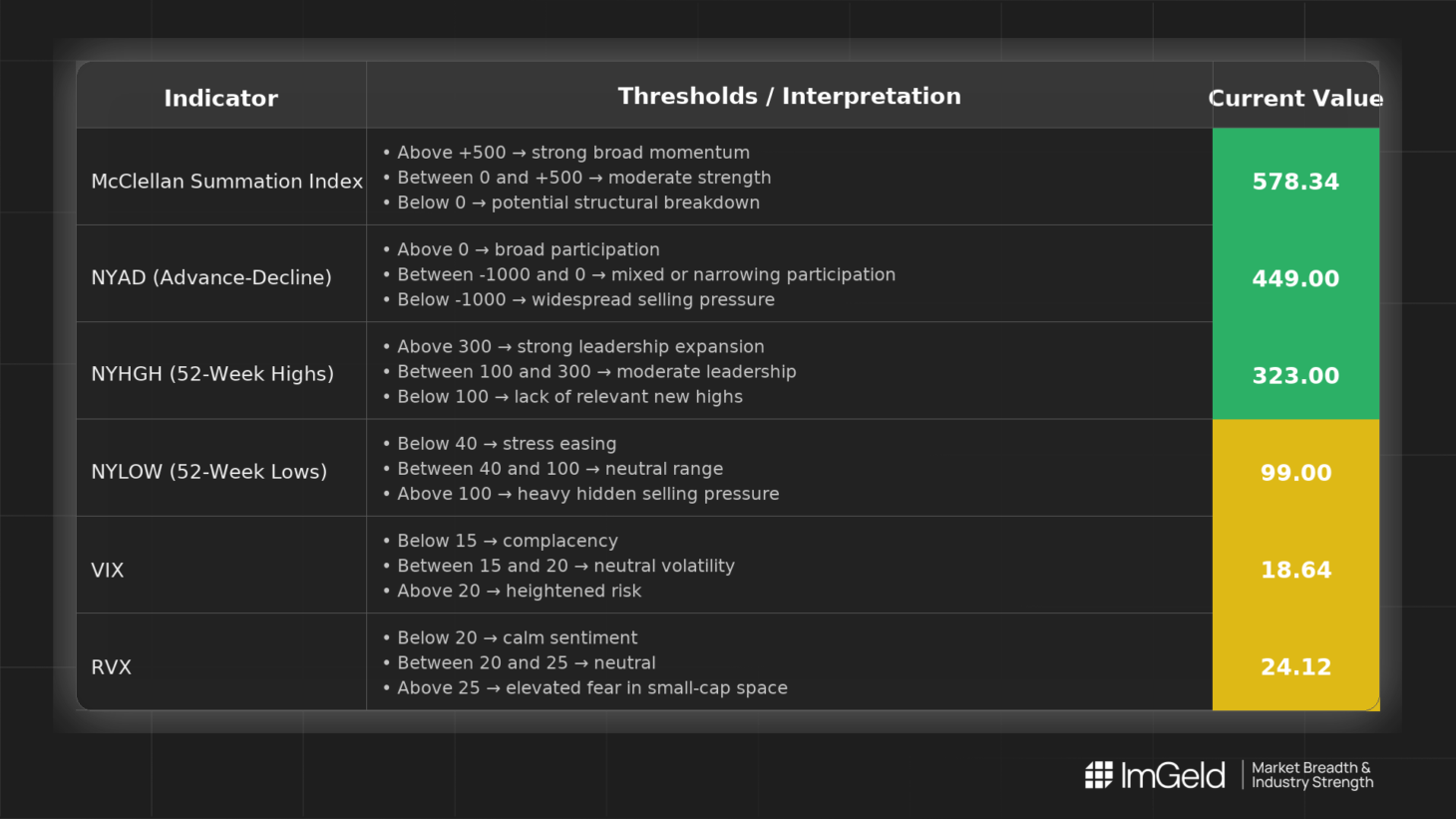

Breadth over the past five sessions shows a modest loss of momentum in NYSI (McClellan Summation Index), followed by a small stabilisation, while NYAD (Advance–Decline Line) improved for three consecutive days. Leadership is expanding as NYHGH (New 52-Week Highs) accelerated late in the period, and NYLOW (New 52-Week Lows) eased after a mid-week uptick. Volatility tone is risk-on cautious: VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) both trended higher, pointing to choppier tape and a need for disciplined entries.

Tactically, long opportunities are emerging selectively in mid-cap industries displaying expanding new highs and positive participation. Any short setups should be reserved for large-cap cohorts where leadership is narrowing under rising volatility. Selectivity remains high.

Get the Industry Heat Map — delivered by email only.

Global Read

Participation is beginning to broaden, evidenced by three consecutive positive NYAD prints and a sharp rise in NYHGH into the latest session. Leadership is rotating toward a wider list of names rather than remaining concentrated. Volatility is expanding as VIX and RVX advance. A near-term divergence persists: NYSI slipped for four days before a small uptick, while NYAD strengthened, suggesting early accumulation without full confirmation. By the five-day consistency rule, signals remain mixed, so the bias is tentative with improving undercurrents.

Indicator Breakdown

1. NYSI (McClellan Summation Index)

Structure modestly declined from 592.86 to 575.16 over four sessions, then ticked up to 578.34. This indicates waning intermediate momentum that is starting to stabilize. The bias is near a plateau, awaiting confirmation from continued positive breadth.

2. NYAD (Advance–Decline Line)

Daily participation weakened early (two negative readings) and then strengthened across three consecutive positives (+474, +199, +449), indicating improving breadth in the back half. This is a constructive near-term thrust.

3. NYHGH (New 52-Week Highs)

Leadership expanded meaningfully, rising from 95 to 323 over the last three sessions. This broadening of winners supports selective accumulation where breakouts are being rewarded.

4. NYLOW (New 52-Week Lows)

Downside pressure rose mid-week (127) but backed off to 99. Lows remain manageable but not negligible; ongoing monitoring is warranted while volatility rises.

5. Volatility Regime

VIX advanced from 16.35 to 18.64 and RVX from 21.35 to 24.12 across the period, confirming an expansionary volatility regime. Expect wider intraday ranges and higher failure rates on breakouts; prioritize staggered entries and strict risk controls.

Tactical stance: Maintain a tentative long bias focused on mid-cap industries demonstrating confirmed breadth thrusts and rising new highs. Large-cap shorts remain valid only where breadth is narrowing and momentum is fading under the expanding volatility backdrop.

Access the ImGeld Fundamental Report

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.