Breadth Weakens, Volatility Expands: Fade Rallies; Only Selective Mid-Caps Show Promise

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2026-02-30

Executive Summary As of 2026-02-02,

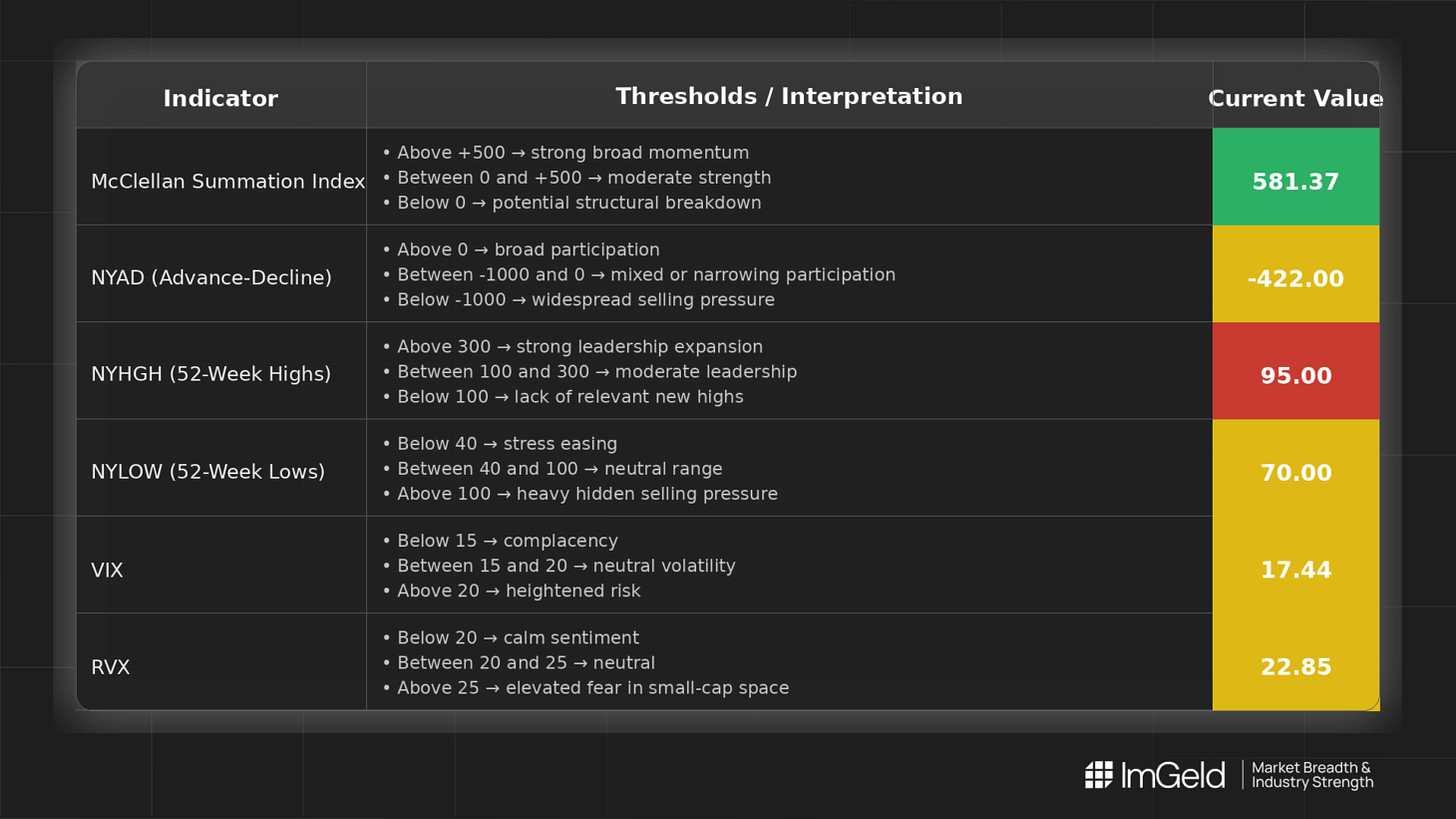

Breadth weakened over the last five sessions. NYSI (McClellan Summation Index) slipped from 598.81 to 581.37, while NYAD (Advance–Decline Line) printed negative readings in four of five days. Volatility firmed, with VIX (CBOE Volatility Index) rising to 17.44 and RVX (Russell Volatility Index) to 22.85. Long opportunities may be emerging only in highly selective mid-cap industries that still show constructive high-low dynamics. Short setups remain valid in large caps where leadership is narrowing and in mid-cap laggards within industries showing expanding new lows. Selectivity is high.

Get the Industry Heat Map — delivered by email only.

Global Read

Participation is firmly narrowing across the five-day window. Leadership is becoming more concentrated as NYHGH contracted sharply and NYLOW ticked higher. Volatility is expanding, evidenced by higher VIX and RVX, which argues for tighter risk controls and shorter holding periods. There is no constructive divergence between NYSI and NYAD; both deteriorated, indicating follow-through risk rather than a hidden bid. By the five-day consistency rule, the pattern firmly signals continuation of distribution rather than early accumulation.

Indicator Breakdown

NYSI (McClellan Summation Index) The structure is declining. After a minor plateau midweek, NYSI continued lower, pointing to loss of intermediate momentum and reduced thrust from advancing issues.

NYAD (Advance–Decline Line) Daily participation weakened. A single positive day was followed by persistent negative breadth, with back-to-back sizable net decliners, indicating broad pressure beneath the index level.

NYHGH (NYSE New 52-Week Highs) Leadership expansion deteriorated. New highs fell from about 220 to 95, signaling that fewer groups are carrying upside and breakouts are failing to propagate.

NYLOW (NYSE New 52-Week Lows) Downside pressure increased as new lows rose from low-50s to 70, a sign of broadening selling and waning risk appetite.

Volatility Regime VIX advanced from 16.35 to 17.44 and RVX from roughly 21.35 to 22.85. The uptick suggests a shift toward an expansionary volatility regime, favoring fade-the-rally tactics on weak breadth days and disciplined position sizing.

Get the Industry Heat Map — delivered by email only.