Breadth says accumulate, but VIX basing—are mid-cap breakouts a volatility trap?

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2026-02-10

Executive Summary Date: 2026-02-11

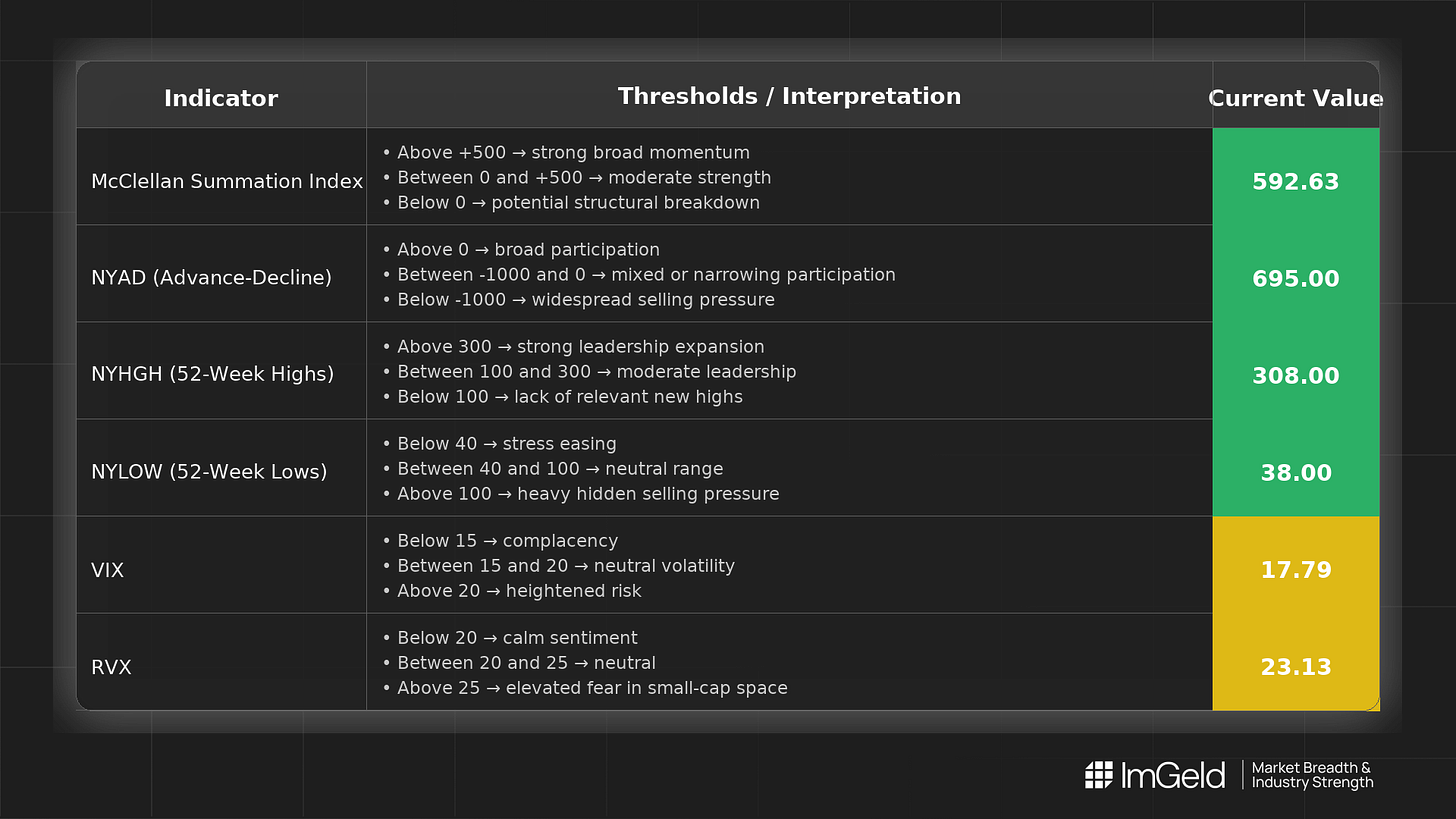

Tentative long bias remains intact. Breadth improved over the last five sessions: NYSI (McClellan Summation Index) advanced steadily, NYAD (Advance-Decline Line) printed four consecutive positive days after an initial drawdown, and leadership broadened as NYHGH (New 52-Week Highs) held near 300 while NYLOW (New 52-Week Lows) compressed to the high 30s. Volatility softened as VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) moved lower and then stabilized.

Tactically, selective long opportunities are emerging in mid-cap industries where participation and new highs are expanding. Short opportunities remain valid in large caps that show narrowing advance-decline profiles and leadership fatigue within their industries. Selectivity is required given the recent volatility compression.

Get the Industry Heat Map — delivered by email only.

Global Read

Participation is broadly improving: four of the last five sessions saw positive NYAD, and NYSI is trending higher, signaling accumulation. Leadership is rotating toward a wider set of issues, evidenced by elevated NYHGH and declining NYLOW, suggesting leadership is becoming less concentrated. Volatility is compressing, with both VIX and RVX declining and basing, which typically supports trend continuation but increases the risk of abrupt repricing on surprises. There is no material divergence between NYSI and NYAD; both point higher. By the five-day consistency rule, breadth is firmly improving, consistent with an early-to-mid accumulation phase and constructive continuation, contingent on follow-through.

Indicator Breakdown

NYSI (McClellan Summation Index)

Structure is improving. After a flat start, NYSI advanced each of the last four sessions (561.99 to 616.48), reflecting persistent buying pressure and healthier intermediate-term breadth.

NYAD (Advance-Decline Line)

Daily participation strengthened. After a sharp negative on 02-05 (-897), NYAD turned positive for four straight days (1755, 510, 695, 662). Momentum moderated from the 02-06 surge but remained constructive.

NYHGH (New 52-Week Highs)

Leadership expansion is evident. New highs jumped from 163 to the low 300s and stayed elevated (337, 296, 308, 309), indicating broadening leadership rather than narrow megacap dominance.

NYLOW (New 52-Week Lows)

Downside pressure is easing. New lows dropped from 106 to 38 and remained subdued, signaling improving risk appetite and reduced forced selling.

Volatility Regime

VIX (CBOE Volatility Index) fell from 21.77 to 17.36 and then stabilized near 17.79; RVX (Russell Volatility Index) declined from 26.48 to 23.13 and based. This compression supports carry and trend-following in mid-cap industries but counsels discipline on entries and exits given the potential for sharp reversals.

Access the ImGeld Fundamental Report

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.