Breadth Narrows, Volatility Compresses: Rotate Now Into Selective Mid-Caps, Fade Crowded Large Caps

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2026-02-18

Executive Summary Date: 2026-02-18

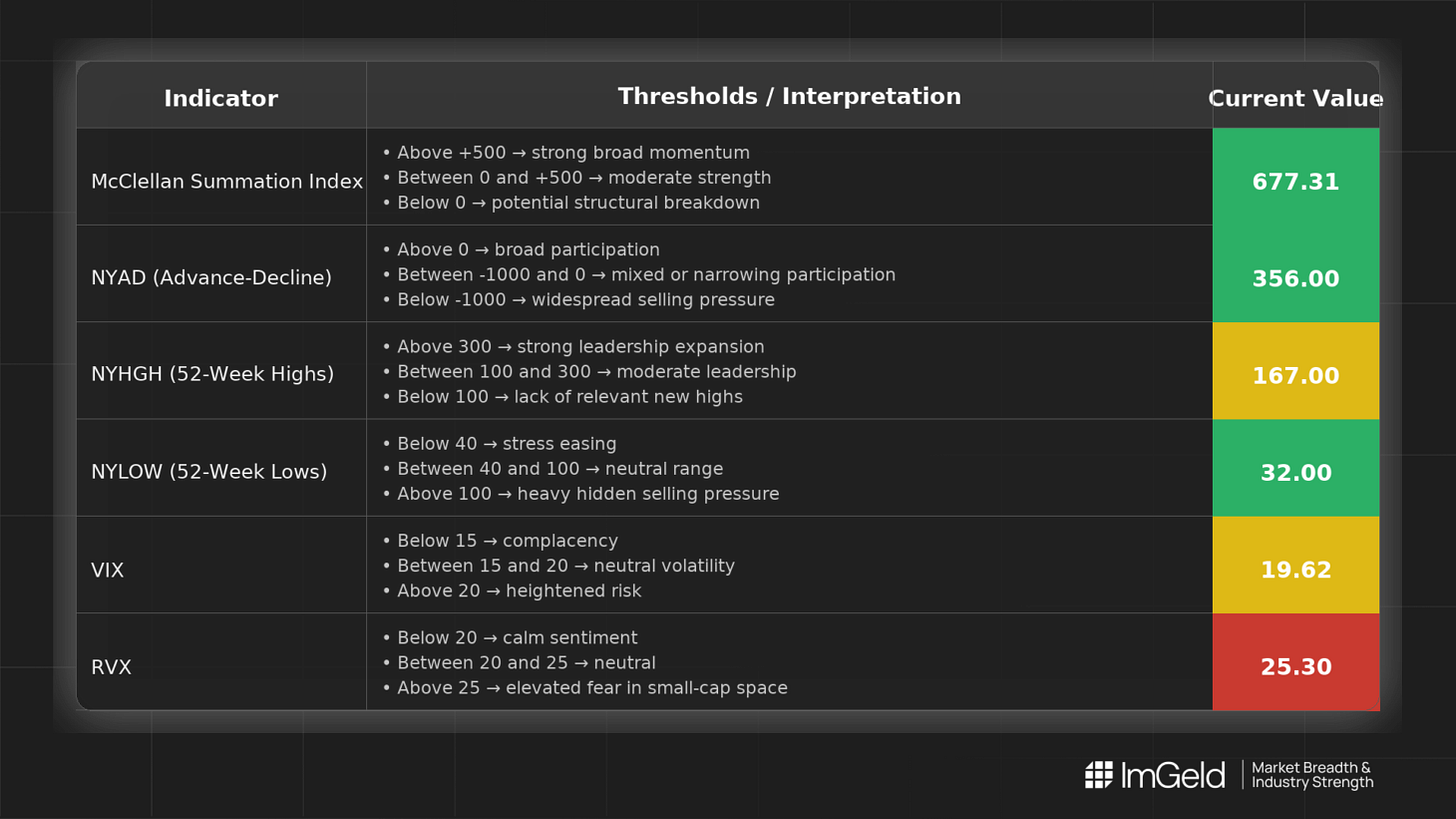

Breadth improved at the margin over the last five sessions, led by an upturn in NYSI (McClellan Summation Index), while NYAD (Advance–Decline Line) delivered mixed participation. New highs contracted and new lows stayed contained. VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) both eased, supporting a tentative risk-on stance with high selectivity. Long opportunities may be emerging in resilient mid-cap industries with stable internal momentum and pullback absorption. Short opportunities remain valid in overextended large caps that exhibit breadth divergences and crowding.

Get the Industry He3at Map — delivered by email only.

Global Read

Participation is narrowing, not broadening, as NYHGH fell for two consecutive sessions and NYLOW ended the week subdued. Leadership is becoming more concentrated, consistent with fewer new highs even as NYSI rises. Volatility is compressing, which favors incremental risk but also raises the risk of sharp rotations. There is a clear divergence between an improving NYSI and a choppy NYAD, implying that advances are driven by fewer names rather than broad participation. By the five-day consistency rule, NYSI is firmly improving, NYAD remains mixed, and volatility is firmly compressing. The pattern signals early accumulation but still tentative given the contraction in new highs and uneven daily breadth.

Indicator Breakdown

NYSI (McClellan Summation Index) Structure improved after a three-day plateau, advancing from 649.87 to 677.31 over the last two sessions. Momentum is rebuilding, indicating underlying accumulation, albeit not yet broad.

NYAD (Advance–Decline Line) Participation was steady early, then deteriorated sharply before a partial rebound into 356.0. The sequence remains mixed, pointing to uneven buying pressure and rotation beneath the surface.

NYHGH (New 52-Week Highs) Leadership expansion weakened from 192 to 167, indicating concentration and reduced follow-through at the highs.

NYLOW (New 52-Week Lows) Lows ticked up midweek then fell to 32, signaling that downside pressure remains contained and risk appetite is cautiously constructive.

Volatility Regime VIX declined from 20.6 to 19.62 and RVX eased to 25.30 after a brief uptick. The compression supports measured long risk in mid caps while maintaining discipline on entry points and respecting event risk.

Tactical Takeaway

Long: Prioritize selective mid-cap exposure in industries with improving relative breadth and constructive pullback behavior, such as industrial machinery, building products, life science tools, and niche software and cybersecurity.

Short: Overextended large caps with weakening breadth and leadership fatigue, particularly in momentum-heavy industries like semiconductors, internet platforms, and consumer growth franchises, remain candidates for tactical fades.

Access the ImGeld Fundamental Report

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.