Breadth narrows as NYSI climbs: rotate to mid-cap breakouts, fade crowded large-caps

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2026-02-11

Executive Summary Date: 2026-02-12

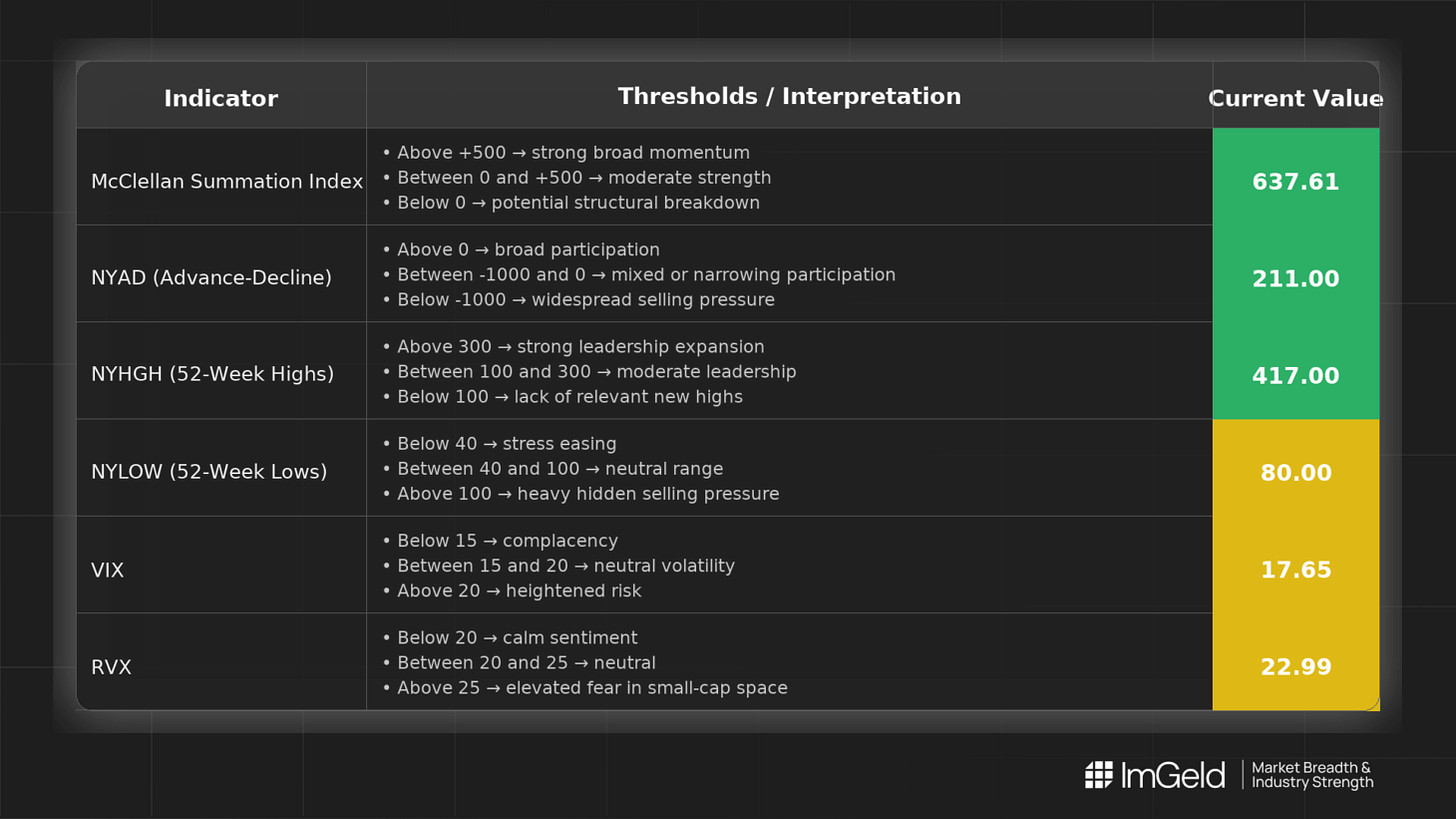

Breadth improved over the last five sessions as NYSI (McClellan Summation Index) advanced steadily to 637.61, while NYAD (Advance–Decline Line) remained positive each day but decelerated, indicating narrowing participation. VIX (CBOE Volatility Index) held in a tight 17–18 band and RVX (Russell Volatility Index) drifted lower, a mildly supportive volatility tone. New 52-week highs expanded late in the week, though new lows ticked up, signaling dispersion beneath the surface. Tactically, a tentative long bias is warranted but selectivity is high: prioritize mid-cap industries showing expanding new-highs with subdued lows. Large-cap leadership with deteriorating breadth remains suitable for relative short setups. Maintain a cash buffer while awaiting confirmation from participation.

Get the Industry Heat Map — delivered by email only.

Global Read

Across five days, structural breadth is firming via an unbroken rise in NYSI, but participation is narrowing as NYAD’s daily net advances fade from 1,755 to 211. Leadership appears more concentrated, with a late-week surge in new highs suggesting rotation into select breakouts rather than broad leadership. Volatility is stable to mildly compressing in mid-caps (RVX lower), while headline volatility (VIX) is flat, keeping the risk backdrop balanced. A modest divergence is present: NYSI is firmly improving, but NYAD is losing momentum. The five-day pattern signals early accumulation with concentration; by the five-day consistency rule, NYSI is firmly improving, while participation remains tentative.

Indicator Breakdown

NYSI (McClellan Summation Index) Consistent improvement: 561.99 → 575.43 → 592.63 → 616.48 → 637.61. Structure is firmly improving, pointing to a constructive intermediate trend.

NYAD (Advance–Decline Line) Positive each session but weakening: 1,755 → 510 → 695 → 662 → 211. Daily participation is narrowing, indicating thinning breadth even as the trend holds.

NYHGH (New 52-Week Highs) Leadership expanded late: 337 → 296 → 308 → 309 → 417. The surge in new highs confirms selective breakouts and improving leadership quality.

NYLOW (New 52-Week Lows) Contained early, then rose: 53 → 63 → 38 → 38 → 80. The uptick highlights emerging risk pockets and underscores the need for strict selection.

Volatility Regime VIX ranged 17.36–17.79, essentially flat, while RVX eased from 23.41 to 22.99. This mix signals a neutral-to-supportive backdrop for mid-cap risk, favoring disciplined entries over aggressive deployment given the lack of material VIX compression.

Tactical Takeaway

Long opportunities: selective in mid-cap industries where breakouts align with rising NYHGH and stable-to-low NYLOW.

Short opportunities: large-cap leaders showing breadth fatigue and crowding are candidates for relative shorts.

Selectivity: high. Wait for NYAD re-acceleration to broaden conviction.

Access the ImGeld Fundamental Report

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.