Breadth Diverges, Volatility Climbs: Tactical Edge in Select Mid-Cap Longs, Large-Cap Shorts

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2026-02-03

Executive Summary — 2026-02-04

Breadth over the past five sessions is mixed with a defensive tilt. NYSI (McClellan Summation Index) has rolled lower for three consecutive sessions, while NYAD (Advance–Decline Line) turned positive in the last two sessions. Volatility tone deteriorated as VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) both rose into the close.

Tactically, long opportunities may be emerging in select mid-cap industries displaying persistent new-high expansion and improving daily advances. Short opportunities remain valid in large-cap benchmarks and in industries showing rising new lows and weak participation. Selectivity is high; execution discipline is critical.

Get the Industry Heat Map — delivered by email only.

Global Read

Participation is attempting to broaden late in the window (two straight positive NYAD readings) but remains constrained by a declining NYSI, indicating breadth momentum is weakening even as day-to-day advances improve. Leadership shows signs of rotation rather than concentration: NYHGH expanded materially into the latest session, yet NYLOW also surged, highlighting bifurcation. Volatility is expanding, with both VIX and RVX breaking higher, which argues for tempered risk and tighter stops. Divergence is clear: NYSI declining vs. NYAD improving. The five-day pattern signals tentative early accumulation but not confirmation; by the five-day consistency rule, the improvement in NYAD is Tentative, while NYSI deterioration is Firmly lower.

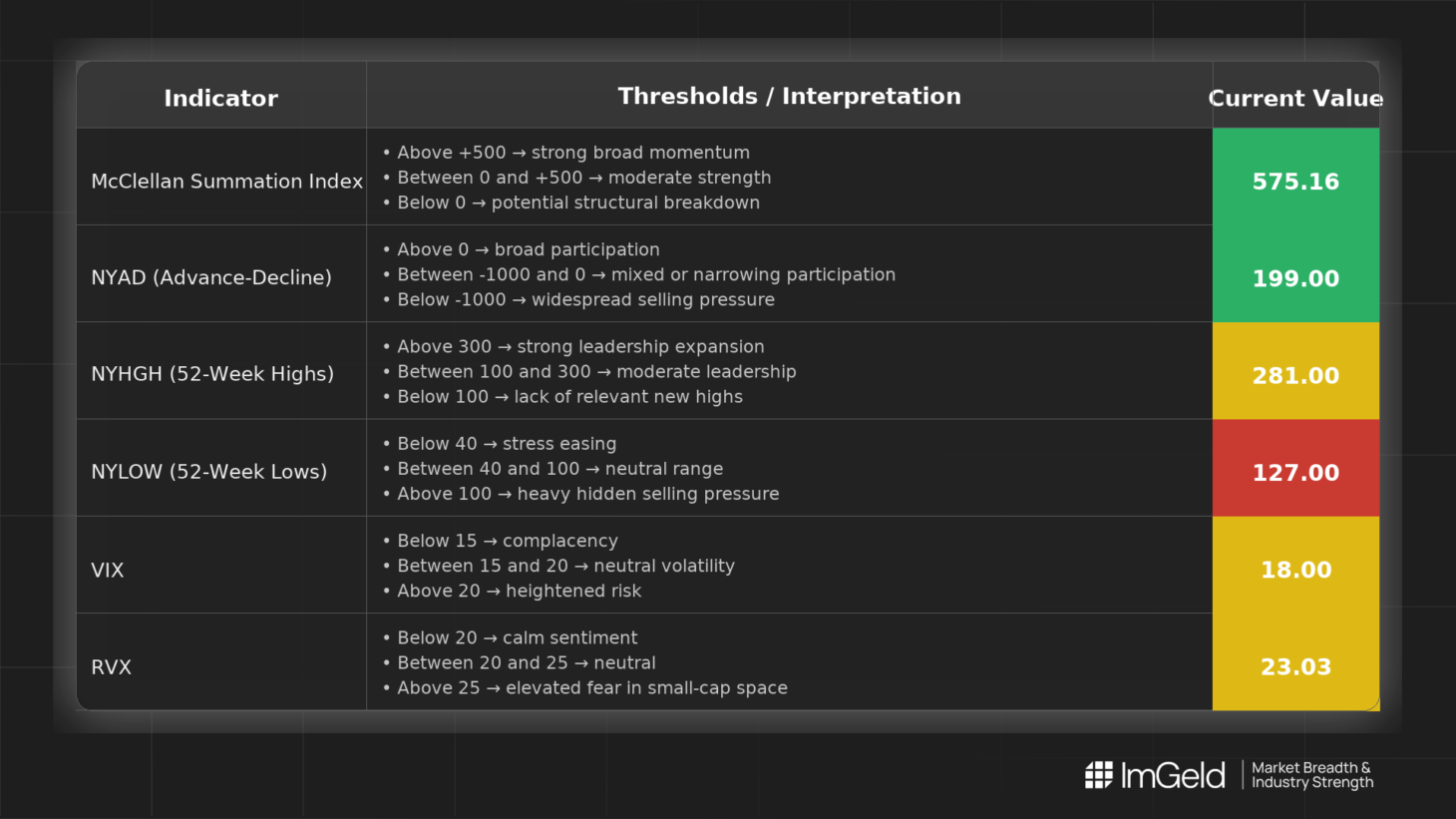

Indicator Breakdown

1. NYSI (McClellan Summation Index)

Structure is declining: 592.86, 592.86, 581.37, 577.64, 575.16. The plateau early in the period gave way to three consecutive lower prints, indicating waning intermediate breadth momentum.

2. NYAD (Advance–Decline Line)

Participation was negative for three days (−588, −588, −422), then flipped positive for two days (+474, +199). This shows short-term strengthening late in the period but remains mixed over five sessions.

3. NYHGH (New 52-Week Highs)

Leadership expansion improved into the latest session: 220, 220, 95, 166, 281. The strong rebound suggests emerging leadership pockets, supportive for selective mid-cap longs.

4. NYLOW (New 52-Week Lows)

Downside pressure increased: 55, 55, 70, 73, 127. The jump in lows flags underlying fragility and warns against broad risk-on.

5. Volatility Regime

VIX: 16.35, 16.35, 17.44, 16.34, 18.00. RVX: 21.35, 21.35, 22.85, 22.00, 23.03. Both indices expanded, with the small-cap skew (RVX) remaining elevated relative to VIX, implying wider distribution of outcomes and the need for selective positioning and dynamic hedging.

Tactical Takeaway

- Longs: Focus only on mid-cap industries evidencing rising new highs and improving advance–decline profiles, such as specialty chemicals, industrial technology suppliers, and niche healthcare services where price leadership is confirmed by breadth.

- Shorts: Remain active in large-cap index-heavy industries showing breadth divergences and rising new lows, and in capital-intensive cyclicals where volatility expansion is pressuring weak balance sheets.

Access the ImGeld Fundamental Report

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.