Year-End Breadth Deterioration, Rising Volatility: Tactical Tilt Short; Selective, Quality Mid-Cap Longs

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2025-01-31

Executive Summary (2026-01-01)

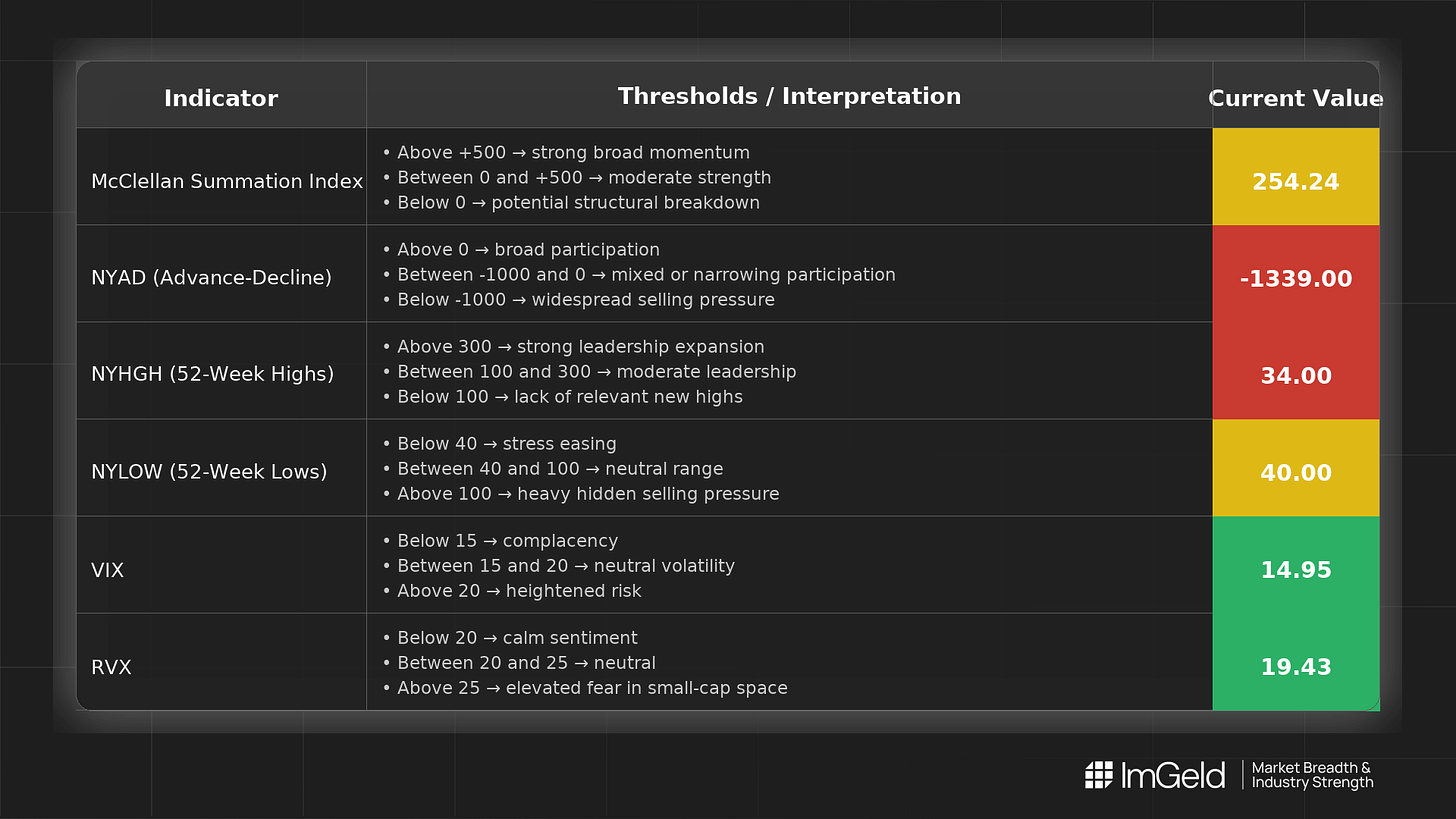

Breadth deteriorated into year-end. NYSI (McClellan Summation Index) rolled over after a brief uptick, finishing lower than five days ago. NYAD (Advance–Decline Line) posted three consecutive negative sessions, culminating in a deep -1339. VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) both expanded steadily, signaling rising risk premia.

Tactical bias: tentative short. Long opportunities, if any, are highly selective in mid-cap, low-beta, cash-generative industries showing relative strength. Short opportunities remain valid in extended growth and rate-sensitive groups, including large-cap leadership pockets where breadth is deteriorating.

Global Read

Participation is narrowing: NYHGH (NYSE New 52-Week Highs) contracted meaningfully while NYLOW (NYSE New 52-Week Lows) expanded. Leadership is becoming more concentrated, with fewer names sustaining breakouts. Volatility is expanding, as evidenced by higher VIX and RVX. A mild divergence appeared as NYSI pushed higher early while NYAD turned negative by mid-period, then NYSI reversed lower, confirming the weakness. By the five-day consistency rule, signals are mixed but lean negative; breadth remains deteriorating with signs of distribution rather than accumulation.

Indicator Breakdown

NYSI (McClellan Summation Index) Structure attempted to improve into 12/29, then rolled over sharply on 12/30–12/31 and closed below its 12/25 level. Momentum is weakening, indicating fading intermediate thrust.

NYAD (Advance–Decline Line) After two strong advances, breadth weakened for three straight sessions, ending with a broad-based decline. Daily participation is weakening, consistent with risk reduction.

NYHGH (New 52-Week Highs) Highs fell from 91 to 34, indicating leadership contraction and limited follow-through on breakouts. Leadership breadth is narrowing.

NYLOW (New 52-Week Lows) Lows rose from 20 to 40, showing growing downside pressure and deteriorating risk appetite.

Volatility Regime VIX rose from 13.47 to 14.95 and RVX from 18.13 to 19.43. The climb is orderly but persistent, consistent with a transition toward a higher-volatility, more selective tape. Position sizing and trade horizons should reflect a bumpier path.

Tactics

Longs: Only in selective mid-cap industries demonstrating relative strength and quality, such as specialty insurance, waste and environmental services, and regulated utilities with stable cash flows. Emphasize balance sheet quality and earnings visibility.

Shorts: Remain vigilant in extended growth industries where breadth is rolling over. Large-cap heavy groups like semiconductors and interactive media appear vulnerable to mean reversion. Rate-sensitive homebuilder and high-multiple software industries also screen as candidates on weak bounces.

CTA

Market breadth is only the starting point. Thinking of going long or short without knowing which industries are accelerating or breaking down? Each industry moves in its own rhythm. Stay informed. Unlock the ImGeld Industry Updates — subscribers only.