Volatility Firms, Under-the-Surface Breadth Builds: Mid-Cap Longs, Fade Large-Cap Leaders

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2025-12-30

Executive Summary — 2025-12-29

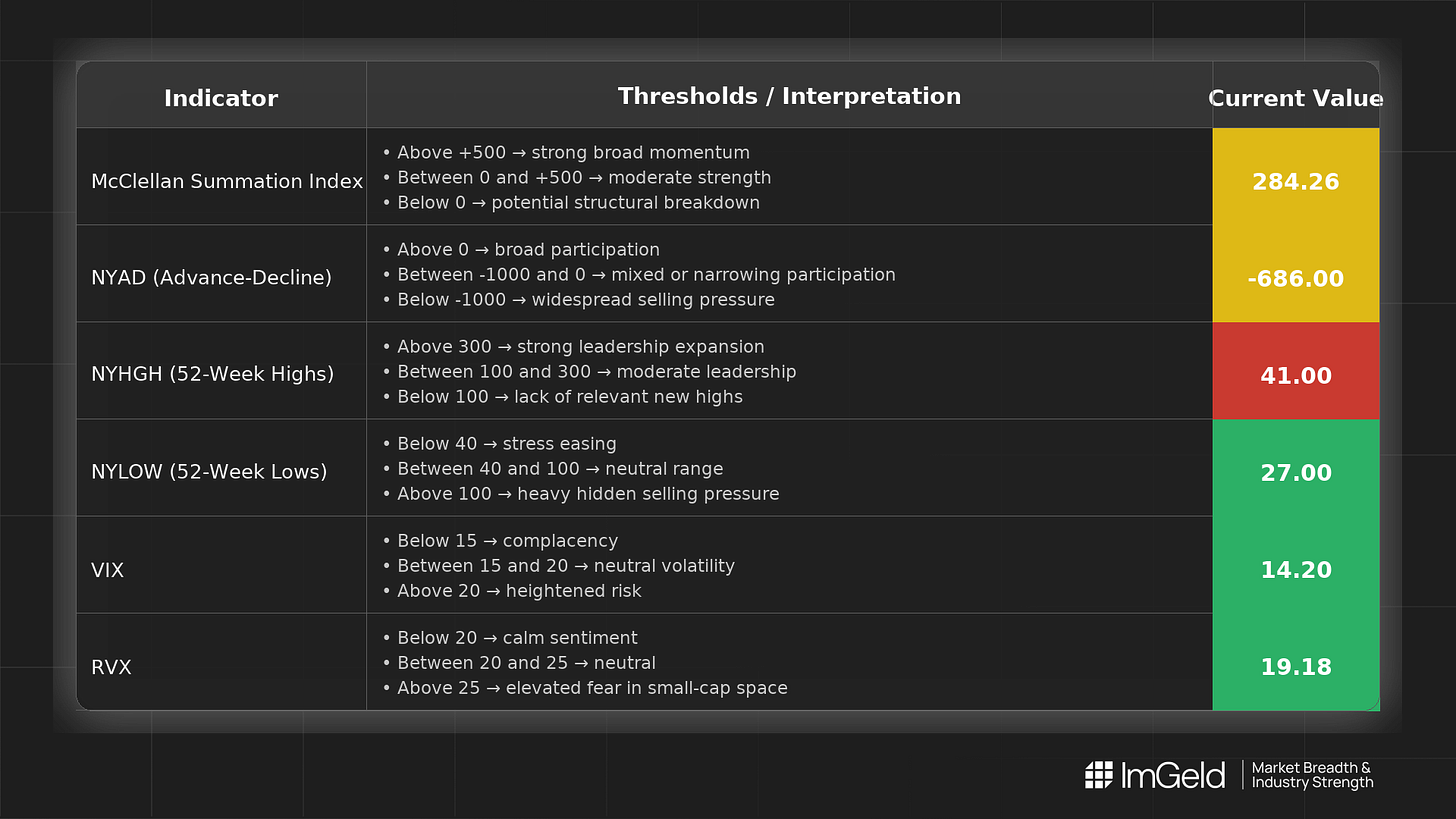

Breadth tone remains balanced. NYSI (McClellan Summation Index) advanced over the five-session window, while NYAD (Advance–Decline Line) turned negative in the latest print, creating a short-term divergence. Volatility firmed into the close of the period with VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) both ticking higher.

Tactically: selective mid-cap long opportunities are emerging where participation is improving and new lows remain muted. Short setups remain valid in large-cap, leadership-heavy industries showing breakout fatigue and narrowing highs. Selectivity is high.

Global Read

Participation is modestly broadening beneath the surface as NYSI rises, but leadership is becoming more concentrated, evidenced by a steady contraction in NYHGH. Volatility is tentatively expanding after prior holiday compression. A mild divergence appears with NYSI improving while NYAD finished negative, arguing for near-term chop. Five-day consistency rule: NYSI is firmly improving; NYAD remains mixed; leadership narrowing is firmly in place; volatility expansion is tentative. Overall pattern suggests a consolidation phase with early accumulation under the surface, alongside late-stage fatigue in prior leaders.

Indicator Breakdown

1. NYSI (McClellan Summation Index)

Structure improved: 243.39 → 264.16 (flat through holidays) → 284.26. The rising profile signals constructive intermediate breadth, albeit at a measured pace.

2. NYAD (Advance–Decline Line)

Participation was whipsaw: negative on 12-23, strong positive into 12-24, then negative on 12-29. This weak finish tempers the NYSI uptrend and supports maintaining balance.

3. NYHGH (New 52-Week Highs)

Leadership expansion narrowed materially: 125 → 91 → 41. Fewer breakouts indicate concentration risk and reduced follow-through in rallies.

4. NYLOW (New 52-Week Lows)

Downside pressure stayed contained but ticked up: 47 → 20 → 27. Risk appetite is intact but less forgiving; monitor for further creep in lows.

5. Volatility Regime

VIX drifted from 14.00 to 13.47, then up to 14.20; RVX eased to 18.13 before lifting to 19.18. The late uptick implies rising risk premia, supporting tighter risk controls and disciplined entries.

Tactical Implications

- Longs: focus on mid-cap industries showing improving advance–decline profiles and stable new lows, favoring areas with operational defensibility and pricing power. Avoid large-cap longs.

- Shorts: prioritize large-cap leadership industries where new highs are contracting and recent rallies look extended; fading strength is preferred over chasing weakness.

CTA

Market breadth is only the starting point.

Thinking of going long or short without knowing which industries are accelerating or breaking down?

Each industry moves in its own rhythm.

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.