Two Markets, One Message: The U.S. Economy Is Splitting in Two

Semiconductors and hardware are soaring as consumer staples collapse. The widest industry gap in 18 months reveals where capital is really flowing.

Executive Summary

U.S. industrial momentum remains sharply polarized. Hardware and manufacturing-linked industries are showing record leadership, while consumer defensives continue to weaken. The rotation is not random; it reflects a market driven by AI infrastructure expansion and away from low-growth consumption sectors. Such wide divergences, historically above 90 points, tend to signal late-stage momentum extremes rather than early trends.

Capital continues to flow into high-visibility, capex-driven areas of the market, while price fatigue and margin compression weigh on consumer segments. The key takeaway: momentum is powerful, but increasingly selective.

Top 5 Growing Industries

1 Electronics – Connectors

2 Computer – Integrated Systems

3 Electronics – Manufacturing Services

4 Electronics – Testing Equipment

5 Semiconductor Equipment

Why they dominate:

AI Capex Cycle: Hyperscalers are deploying over $200B annually in infrastructure, benefiting component suppliers.

Order Visibility: Backlogs in Applied Materials and Teradyne extend 6–9 months, signaling strong demand visibility.

Institutional Flows: Hardware segments attract more stable inflows than software amid earnings consistency.

Technical Strength: All above their 50-day moving averages; momentum is firm but not yet overextended.

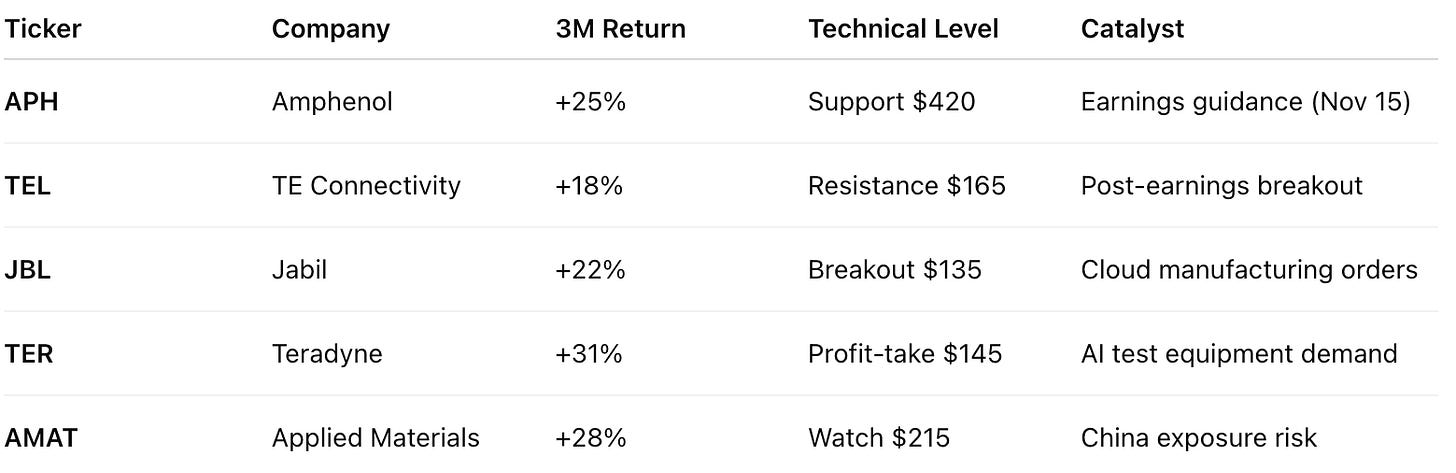

Key Players

Bottom 5 Contracting Industries

1 Food – Natural Foods

2 Food – Confectionery

3 Food – Meat Products

4 Retail – Restaurants

5 Fertilizers

Why they’re collapsing:

Margin Compression: Input costs up 8–12% YoY, with pricing power exhausted.

Consumer Downtrading: Shift toward private labels and discount chains.

Post-COVID Reset: Elasticities reverting to pre-pandemic norms, ending the premium pricing cycle.

Restaurant Traffic: -4% YoY, delivery unable to offset dine-in decline.

Fertilizers: Global oversupply plus weak grain prices pressure margins.

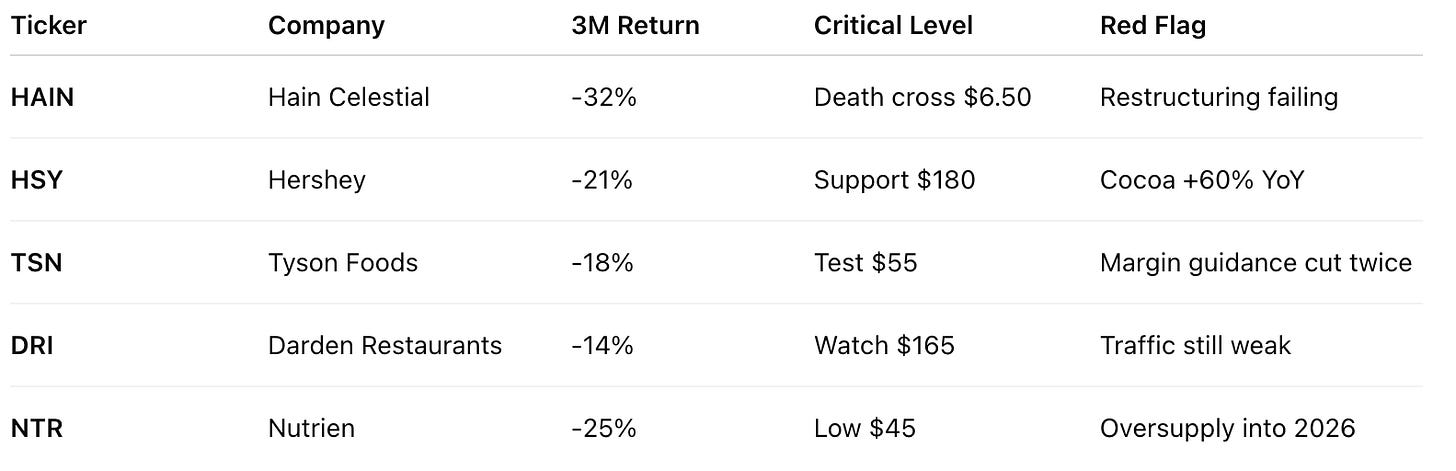

Key Players

Closing Note

Market leadership is narrowing fast. The semiconductor and electronics ecosystem continues to absorb institutional inflows, but the breadth behind the move is thinning. Historically, such extreme spreads have resolved either with a rotation into laggards or a sharp correction in leaders within 3–6 months.

Stay selective, focus on confirmed momentum, and avoid chasing overstretched strength.