Three-Day Breadth Rebound, Volatility Compresses: Mid-Caps Lead Tentative Long Setup

Subtitle: ImGeld Market Breadth Update Based On Last Closing Date: 2025-11-25

Executive Summary

Bias: Tentative long. Over the last five sessions, breadth deteriorated early and then reversed with three consecutive days of improvement. NYSI (McClellan Summation Index) stayed negative but upticked on the latest print. NYAD (Advance–Decline Line) turned positive for three straight sessions, while NYHGH (New 52-Week Highs) expanded and NYLOW (New 52-Week Lows) contracted sharply. VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) both compressed, supporting risk-taking.

Tactically, long opportunities appear to be emerging in selective mid-cap industries where new highs are expanding and breadth is persistently positive. Short opportunities remain valid in large-cap defensives and any mega-cap leaders failing breadth confirmation. Selectivity remains high.

Global Read

Participation is Firmly broadening over the last three sessions as advances outpaced declines and new highs accelerated, while new lows collapsed. Leadership is rotating away from defensive concentration and toward higher-beta, cyclically sensitive mid-cap industries, indicating a dispersion-led recovery rather than a narrow large-cap rebound. Volatility is Firmly compressing, with both VIX and RVX falling steadily, improving the backdrop for upside follow-through. There is a constructive divergence: NYSI remains negative after a multi-day slide but turned up modestly as NYAD improved; this typically signals early accumulation rather than a completed regime shift. Under the five-day consistency rule, participation and volatility improvements are Firmly in place, while the overall signal remains Tentative until NYSI confirms.

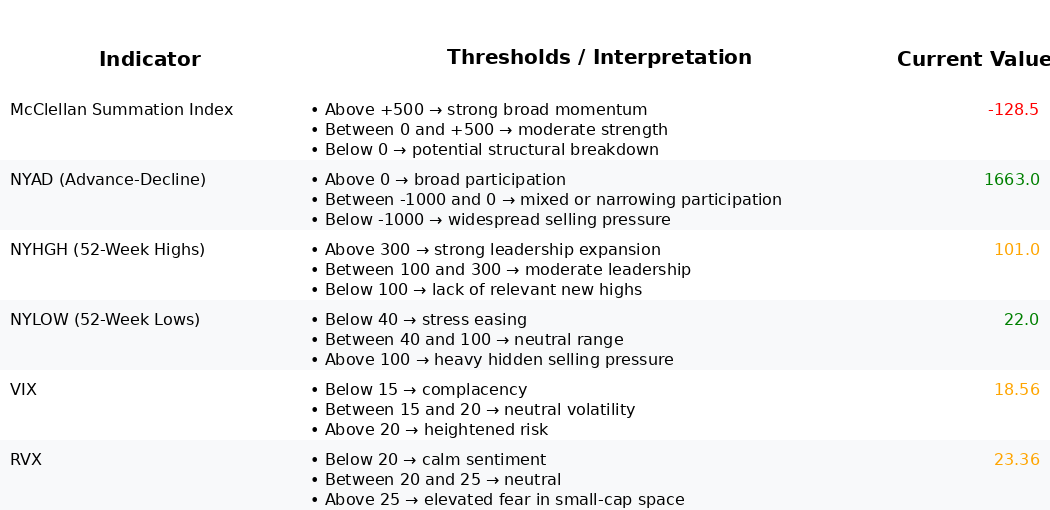

Indicator Breakdown

1. NYSI (McClellan Summation Index)

Declined from -53.24 to -153.03 into 11/24, then improved to -128.47 on 11/25. Structure remains net declining but shows tentative stabilization; confirmation requires sustained upward momentum.

2. NYAD (Advance–Decline Line)

Weak to start (−650, −1542), then three consecutive strong positives (+1690, +735, +1663). Breadth is strengthening Firmly across the last three sessions, indicating broadening participation.

3. NYHGH (New 52-Week Highs)

Expanded from 33 to 101 by 11/25. Leadership is Firmly re-accelerating, consistent with early-cycle accumulation in select mid-cap industries.

4. NYLOW (New 52-Week Lows)

Compressed from 152 to 22 over the period. Downside pressure is Firmly easing, reflecting improving risk appetite.

5. Volatility Regime

VIX fell from 26.42 to 18.56; RVX from 29.59 to 23.36. Both are Firmly compressing, supportive of breakouts. The modestly wider RVX–VIX spread signals a lingering small-cap risk premium, but the trend is constructive for mid-caps.

CTA

Market breadth is only the starting point.

Thinking of going long or short without knowing which industries are accelerating or breaking down?

Each industry moves in its own rhythm.

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.