The Surface Still Shines, But the Undercurrent’s Slowing, Breadth Softens as the Market Tests Its Nerve

ImGeld Market Breadth Update — 2025-10-31

Executive Summary

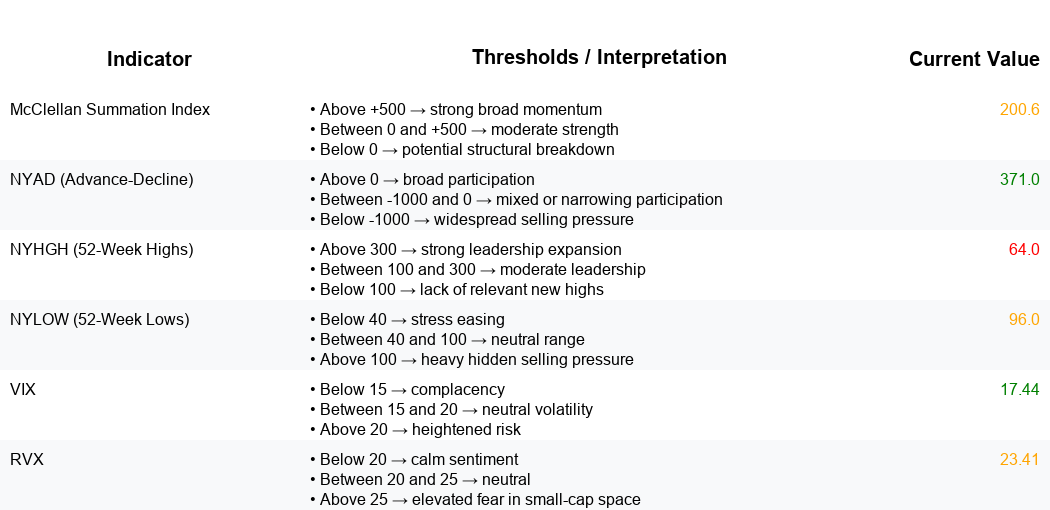

As of 2025-10-31, the portfolio bias is NEUTRAL with an indicative allocation of 65% Long, 0% Short, and 35% Cash. Breadth momentum is fading from constructive levels. The NYSE McClellan Summation Index (NYSI) remains positive but has declined over the last four sessions, while the Advance–Decline data (NYAD) is net negative for the period, indicating distribution pressure. Volatility tone has firmed modestly, with VIX and RVX drifting higher but still within neutral corridors. Tactically, maintain selective long exposure in leaders holding trend strength, favor higher quality and liquidity, and avoid aggressive shorting until breadth breaks further. Keep a cash buffer and consider index hedges if new lows re-accelerate.

Global Read

Breadth narrowed over the last five sessions. NYSI eased from 259.52 to 200.60 and remains above zero, which is constructive, yet the direction is lower, signaling a loss of internal momentum. NYAD printed three materially negative sessions against two positives, leaving a net downside bias and pointing to waning participation.

Leadership metrics weakened. NYHGH trended down from 124 to 64, while NYLOW rose from 22 to a midweek peak of 130, then eased to 96. New lows above 100 mark a risk-off threshold, and although Friday improved, readings near 100 remain a caution flag. The mix suggests narrowing leadership and rising internal stress rather than broad accumulation.

Volatility is firming but contained. VIX rose from 15.97 to 17.44 and RVX from 22.93 to 23.41. This shift increases the cost of error without indicating outright panic. The volatility backdrop is neutral to cautious.

Three to eight week outlook: base-building or choppy consolidation with downside risk if new lows persist near or above 100 and NYAD remains negative. A constructive path would be defined by NYSI turning higher while staying above zero, NYLOW falling back below 40, NYHGH rebuilding above the 100 to 150 zone, and VIX stabilizing. A bearish invalidation would be NYSI breaking below zero with sustained NYLOW above 100 alongside a further rise in VIX, which would trigger a cut in gross and possibly initiate targeted shorts.

Market Breadth Summary

Implementation Guidance

• For LONGS: focus on positions above the 200 / 150 SMA, confirming support, and prioritize industries with a High ImGeld Industry Score rating.

• For SHORTS: focus on positions below the 200 / 150 SMA, rejecting resistance, and prioritize industries with a Low ImGeld Industry Score rating.

Remember, fundamentals represent 80 percent of every decision while 20 percent comes from technical setup. Timing matters.

ImGeld subscribers can access the full set of technical indicators for each stock once it passes the fundamental screening.