The Market Holds Its Breath, Breadth Falters, Volatility Sleeps, and Momentum Hangs in Suspension as Traders Weigh the Next Break in Direction.

IMGELD Market Breadth Update: 2025-11-04 10:14:43

Executive Summary

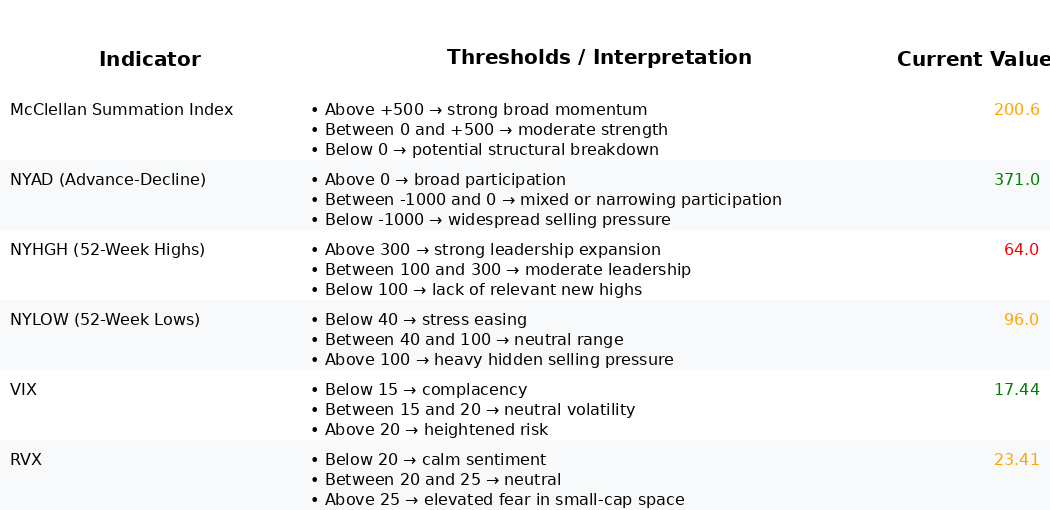

As of 2025-11-04, the portfolio bias is NEUTRAL with indicative allocation of 30% Long, 35% Short, and 35% Cash. Breadth momentum is stalled: the McClellan Summation Index (NYSI) holds positive at 177.53 while the NYSE Advance–Decline data (NYAD) is negative at -422, signaling soft participation. Volatility remains contained to neutral with CBOE Volatility Index (VIX) at 17.17 and CBOE Russell 2000 Volatility Index (RVX) at 23.76. Tactical stance: keep a barbell approach. Selective longs in high-quality leaders showing relative strength, offset by tactical shorts in structurally weak laggards. Maintain a sizable cash buffer until new lows recede and participation broadens.

Global Read

Breadth has plateaued over the recent window. McClellan Summation Index (NYSI) remains firmly above zero, indicating residual internal momentum, but it is unchanged over the last two sessions, highlighting a stall. Advance–Decline data (NYAD) is negative, reflecting persistent net decliners and pointing to distribution pressure beneath the surface. Leadership is uneven: NYHGH at 72 is modest, while NYLOW at 96 is elevated relative to healthy conditions. Thresholds: McClellan Summation Index (NYSI) above 0 is constructive, below 0 is weakening. NYLOW below 40 is healthy, above 100 is risk-off. Current NYLOW is just below the risk-off line, warranting caution.

Volatility tone is neutral. CBOE Volatility Index (VIX) at 17.17 and CBOE Russell 2000 Volatility Index (RVX) at 23.76 reduce tail-risk stress but do not confirm aggressive risk-taking. The interaction between breadth and volatility suggests a wait-and-see regime: participation is not deteriorating sharply, yet it is not broadening.

Five-day dynamics indicate consistency without progress. McClellan Summation Index (NYSI) flat, Advance–Decline data (NYAD) negative, NYHGH stable and subdued, NYLOW elevated, and volatility steady. This profile signals breadth is not broadening and is likely plateauing with mild distribution.

3–8 week outlook: neutral to range-bound with two-sided opportunity. Upside confirmation would be a sustained expansion in participation and leadership: Advance–Decline data (NYAD) turning positive for several sessions, NYLOW dropping below 40, NYHGH expanding toward 150–200, with CBOE Volatility Index (VIX) remaining near or below 17 and CBOE Russell 2000 Volatility Index (RVX) near or below 23–25. Invalidation of a constructive path would be McClellan Summation Index (NYSI) rolling down toward and through zero, NYLOW pushing and holding above 100–120, and volatility lifting toward VIX > 20 and RVX > 28. Such a shift would favor increasing short exposure and cash until breadth resets.

Market Breadth Summary

Implementation Guidance

• For LONGS: focus on positions above the 200 / 150 SMA, confirming support, and prioritize industries with a High ImGeld Industry Score rating.

• For SHORTS: focus on positions below the 200 / 150 SMA, rejecting resistance, and prioritize industries with a Low ImGeld Industry Score rating.

Remember, fundamentals represent 80 percent of every decision while 20 percent comes from technical setup. Timing matters.

ImGeld subscribers can access the full set of technical indicators for each stock once it passes the fundamental screening.