The Calm Before a Turn? Breadth Fractures as Volatility Firms

IMGELD Market Breadth Update: 2025-11-10 16:54:07

Executive Summary (As of 2025-11-07)

Bias: NEUTRAL

Exposure: Long 50%, Short 25%, Cash 25%

Breadth: NYSI (McClellan Summation Index) remains above zero but fell steadily over five sessions, signaling waning momentum. NYAD (NYSE Advance–Decline Line) was highly volatile, netting slightly negative for the week.

Volatility: VIX (CBOE Volatility Index) drifted up toward 19, while RVX (CBOE Russell 2000 Volatility Index) held near 25, preserving a wide small-cap risk premium.

Tactical: Favor selective large-cap quality for long exposure. Use short exposure in weak, high-beta or small-cap laggards. Maintain cash buffer given rising NYLOW and choppy NYAD.

Global Read

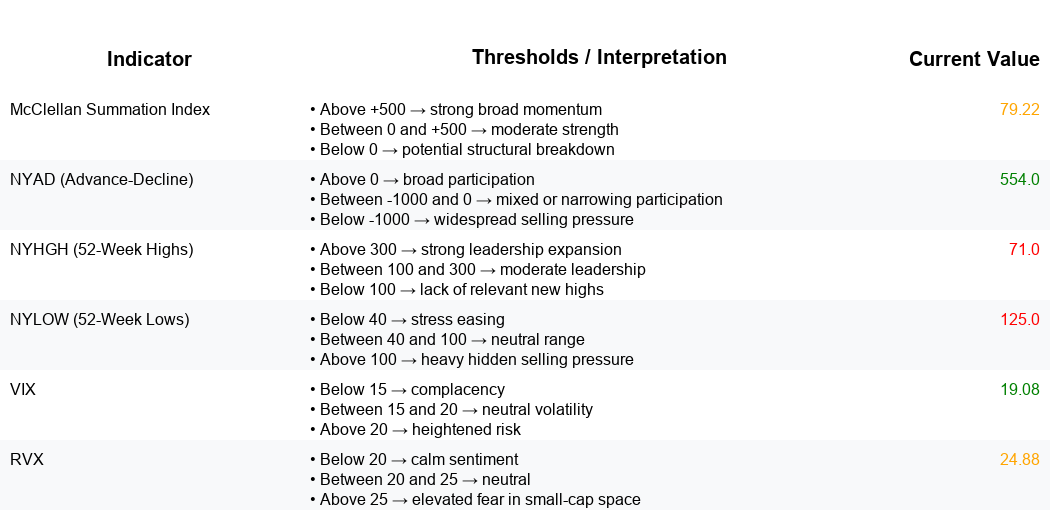

NYSI slid from 200.6 to 79.22 over five sessions, still constructive above zero but deteriorating. NYAD swung sharply negative early, then rebounded with two strong positive days, netting roughly -91 on the week. The combination indicates unstable participation and a loss of thrust.

Leadership and stress signals diverged. NYHGH (New 52-Week Highs) improved midweek, rising to 92 before easing to 71, while NYLOW (New 52-Week Lows) stayed elevated and ended at 125. Thresholds: NYSI above 0 = constructive, below 0 = weakening; NYLOW below 40 = healthy, above 100 = risk-off. Friday’s NYLOW >100 flags a risk-off skew despite some leadership pockets.

Volatility tone firmed: VIX moved 17.4 to 19.1, RVX 23.4 to 24.9. The persistent RVX premium suggests continued pressure in small caps and cyclicals. Interaction across indicators points to breadth that is bifurcated and narrowing, not broadening. Rising lows alongside rising highs implies selective leadership with a widening tail of weak issues.

3–8 week outlook: Neutral with downside risk if stress persists. Confirmation for an improved setup would include NYSI stabilizing and turning higher while staying above zero, a sustained positive NYAD run, NYLOW falling and holding below 40, and VIX drifting sub-17 with RVX compressing. Invalidation would be NYSI rolling below zero, NYLOW remaining above 100 for multiple sessions, and volatility sustaining above 20–22, which would shift bias toward Tentative Short.

Market Breadth Summary (Last Five Sessions):

Implementation Guidance

• For LONGS: focus on positions above the 200 / 150 SMA, confirming support, and prioritize industries with a High ImGeld Industry Score rating.

• For SHORTS: focus on positions below the 200 / 150 SMA, rejecting resistance, and prioritize industries with a Low ImGeld Industry Score rating.

Remember, fundamentals represent 80 percent of every decision while 20 percent comes from technical setup. Timing matters.

ImGeld subscribers can access the full set of technical indicators for each stock once it passes the fundamental screening.

Want to see which stocks align with this setup? → Check today’s Fundamental Report (paid)