Selective Long Bias: Breadth Deteriorates, Volatility Firms, Favor Quality Large Caps

IMGELD Market Breadth Update: 2025-11-01 10:12:00

Executive Summary

Over the past five session, portfolio bias remains LONG with an indicative allocation of 65% Long, 0% Short, and 35% Cash. Breadth momentum is positive but deteriorating: the McClellan Summation Index (NYSI) stays above zero yet rolled over across the last three sessions, while the NYSE Advance–Decline (NYAD) skewed net negative over the week. Volatility tone is softening risk appetite, with VIX and RVX grinding higher but not disorderly. Tactically, keep long exposure focused on resilient leaders above key moving averages and with strong ImGeld Industry Scores, tilt toward higher quality and larger caps given the elevated RVX versus VIX, and maintain a cash buffer. Avoid initiating broad short exposure until breadth breaks decisively, but de-emphasize cyclicals and small caps where internal weakness is more evident.

Global Read

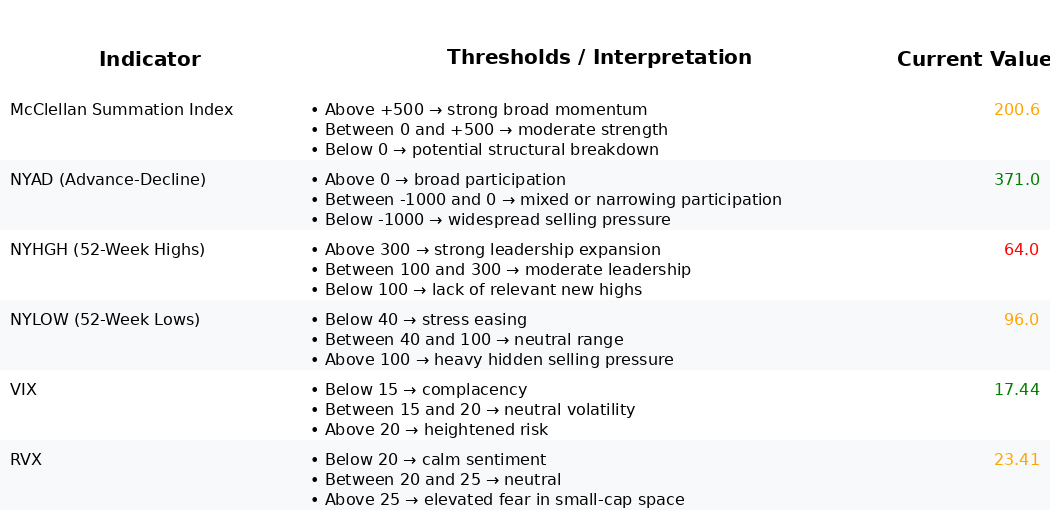

Breadth narrowed over the last five sessions. NYSI declined from 259.52 mid-week to 200.60, remaining positive but losing momentum. NYAD printed four volatile sessions with a net weekly sum of approximately -2,188, indicating distribution pressure despite a Friday rebound. Leadership quality weakened: NYHGH compressed from 124 to 64, while NYLOW expanded from 22 to a mid-week spike at 130 and finished elevated at 96. This sits above the healthy threshold (<40) and approached risk-off levels (>100) mid-week.

Volatility drifted higher: VIX rose from 15.97 to 17.44 and RVX from 22.93 to 23.41, keeping risk premia in a neutral-to-cautious zone. The RVX–VIX spread signals relatively greater small-cap fragility.

Interpretation: participation is narrowing, leadership thinning, and volatility edging up. While NYSI above zero remains constructive, the pattern of lower highs in NYSI plus elevated new lows argues for selective risk, not aggressive beta.

3–8 week outlook: cautiously constructive provided NYSI stabilizes above zero and turns higher, NYLOW recedes below 40, and VIX/RVX remain contained. Confirmation would be several sessions of positive NYAD, NYHGH returning to the 100–150 range, NYLOW consistently sub-40, and VIX slipping back toward 16 with a steady RVX. Invalidation would be an NYSI break below zero accompanied by persistent NYLOW above 100 and a volatility upshift, particularly a sustained VIX > 20 or a decisive RVX expansion, which would trigger a reduction in gross and a reassessment of the long bias

Market Breadth Summary

.

Implementation Guidance

• For LONGS: focus on positions above the 200 / 150 SMA, confirming support, and prioritize industries with a High ImGeld Industry Score rating.

• For SHORTS: focus on positions below the 200 / 150 SMA, rejecting resistance, and prioritize industries with a Low ImGeld Industry Score rating.

Remember, fundamentals represent 80 percent of every decision while 20 percent comes from technical setup. Timing matters.

ImGeld subscribers can access the full set of technical indicators for each stock once it passes the fundamental screening.