Rotation to Mid-Caps as Breadth Broadens; Volatility Compresses—Selective Long, Short Overextended Large Caps

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2025-12-11

Executive Summary

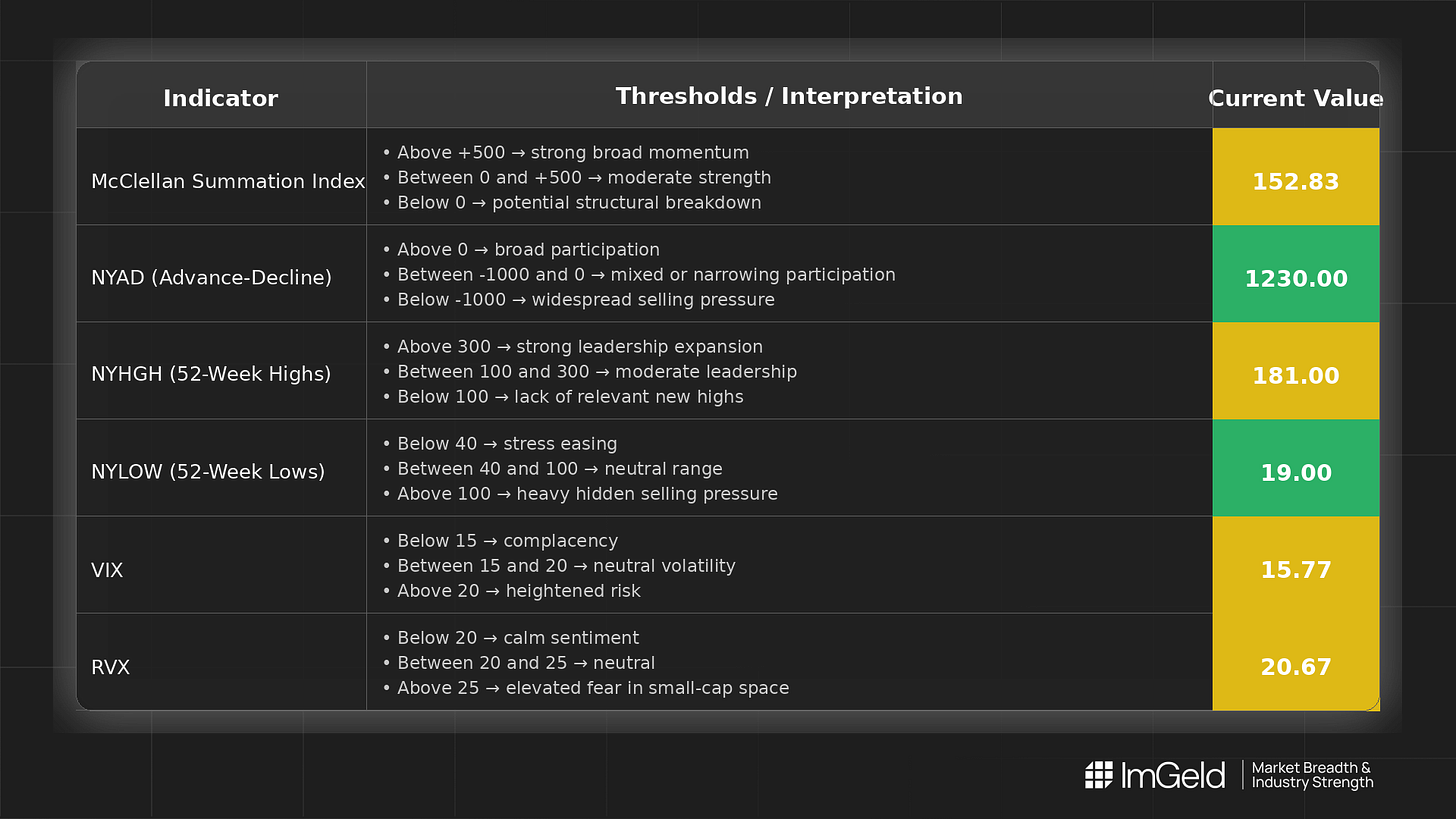

Breadth improved over the last five sessions. NYSI (McClellan Summation Index) advanced steadily to 152.83, while NYAD (Advance–Decline Line) flipped from early weakness to a strong +1,230 on the final day. NYHGH (NYSE New 52-Week Highs) expanded to 181 as NYLOW (NYSE New 52-Week Lows) fell to 19. VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) spiked mid-period and then compressed into the close.

Tactically, a tentative long bias is warranted with high selectivity. Long opportunities are emerging in mid-cap industries displaying improving breadth and fresh highs. Short setups remain valid in overextended large caps where participation is narrowing, particularly in crowded defensives and select mega-cap growth.

Global Read

Participation is broadening into week’s end after a mid-period slump; leadership is rotating away from a narrow large-cap complex toward more diversified mid-cap leadership. Volatility is compressing after a brief expansion, supportive of incremental risk-taking with risk controls. A brief divergence appeared when NYSI rose despite a sharp NYAD downtick on 12/08, but this resolved as NYAD turned decisively positive. Using the five-day consistency rule: participation remains mixed, but the last two sessions are firmly constructive. The pattern signals early accumulation rather than exhaustion.

Indicator Breakdown

1. NYSI (McClellan Summation Index)

Structure is improving. Four consecutive higher readings (flat-to-up early, strong upswing late) indicate positive momentum and increasing participation depth.

2. NYAD (Advance–Decline Line)

Daily breadth weakened into 12/08 (−945) but reversed to +249 and +1,230, showing strengthening participation. Overall five-day mix remains uneven, but the impulse has turned supportive.

3. NYHGH (New 52-Week Highs)

Leadership expansion reasserted: after dipping to mid-80s, new highs accelerated to 181, consistent with improving trend leadership and broader breakout candidates.

4. NYLOW (New 52-Week Lows)

Downside pressure is ebbing. New lows rose briefly to 38, then fell to 19, indicating improving risk appetite and fewer breakdowns.

5. Volatility Regime

VIX moved 15.41 → 16.93 → 15.77; RVX 20.79 → 22.11 → 20.67. The mid-week expansion faded into compression, aligning with a constructive but selective risk backdrop. Low-to-moderate implied volatility favors continuation if breadth persists.

Tactical Implications

- Long: Focus on mid-cap industries where breadth and highs are expanding, such as industrial machinery, building products, specialty chemicals, semiconductor equipment, regional banks, and renewable power equipment. Favor names pressing new highs with rising volume and positive A/D within their industries.

- Short: Large-cap laggards with narrowing participation remain vulnerable, notably crowded defensives and select mega-cap software where leadership is concentrated and fading.

CTA

Market breadth is only the starting point.

Thinking of going long or short without knowing which industries are accelerating or breaking down?

Each industry moves in its own rhythm.

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.