Resilient Breadth, Cooling Momentum

A neutral bias prevails as the McClellan Index eases but new highs extend and volatility stays contained.

About this report This Market Breadth Update tracks the internal dynamics of the New York Stock Exchange (NYSE) market, the largest and broadest equity marketplace in the world. It reflects the behavior of over 2,000 listed stocks, not just the S&P 500, providing a deeper view of overall market participation and underlying momentum.

IMGELD Market Breadth Update: 2025-10-07

Executive Summary

As per 2025-10-06 market closing data

, the portfolio bias remains NEUTRAL with upside potential not confirmed, based on the last five trading sessions.

Breadth momentum has cooled as the McClellan Index trends lower but remains well above zero, keeping the backdrop constructive rather than bearish.

New highs are building toward the 200 area while new lows are contained below 40, with VIX and RVX anchored in neutral ranges.

Confirmation would require 2–3 consecutive sessions with the McClellan Summation Index stabilizing and turning higher, NYHGH (new 52-week highs) expanding toward 200 or more, and NYLOW (new 52-week lows) staying below 40.

A deterioration with the McClellan Summation Index dropping below zero alongside a rising VIX would confirm a downside break.

• For LONGS: focus on positions above the 200/150 SMA, confirming support, and prioritize industries with a High ImGeld Industry Score rating.

• For SHORTS: focus on positions below the 200/150 SMA, rejecting resistance, and prioritize industries with a Low ImGeld Industry Score rating.

Remember, fundamentals represent 80% of every decision while 20% comes from technical setup. Timing matters. ImGeld subscribers can access the full set of technical indicators for each stock once it passes the fundamental screening.

Global Read

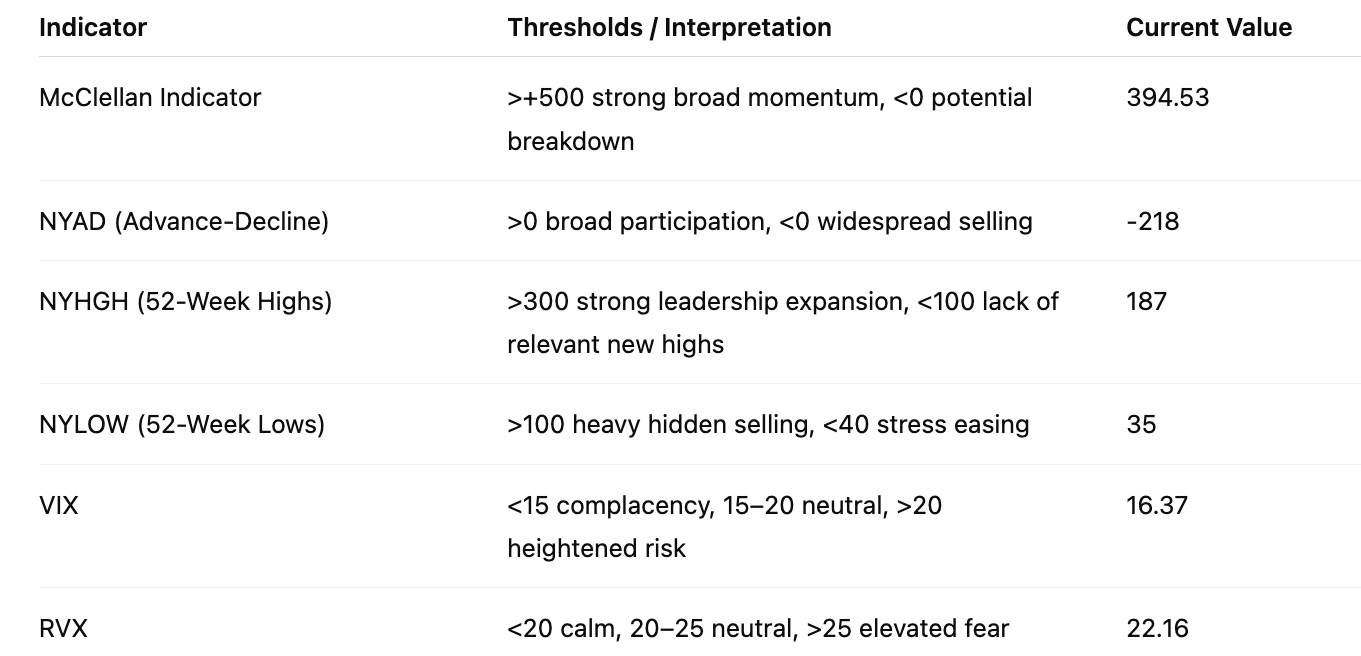

As per 2025-10-06 closing data, the McClellan Index eased for a fourth session but remains positive, indicating slowing yet intact structural momentum. NYAD turned negative on the day after earlier strong prints, reflecting mixed participation. New 52-week highs improved to 187 while lows remained contained at 35, showing some emergence of relevant new highs but not yet a decisive expansion. VIX at 16.37 and RVX at 22.16 sit in neutral territory; over the next 3–8 weeks, a choppy but mildly upward-biased range is likely if highs continue to expand and lows stay subdued.

Market Breadth Summary (Last Five Sessions):