NYSI Up, NYAD Fades: Narrowing Leadership, Rising Volatility, Tilt Toward Tactical Shorts

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2025-12-16

Executive Summary (as of 2025-12-16)

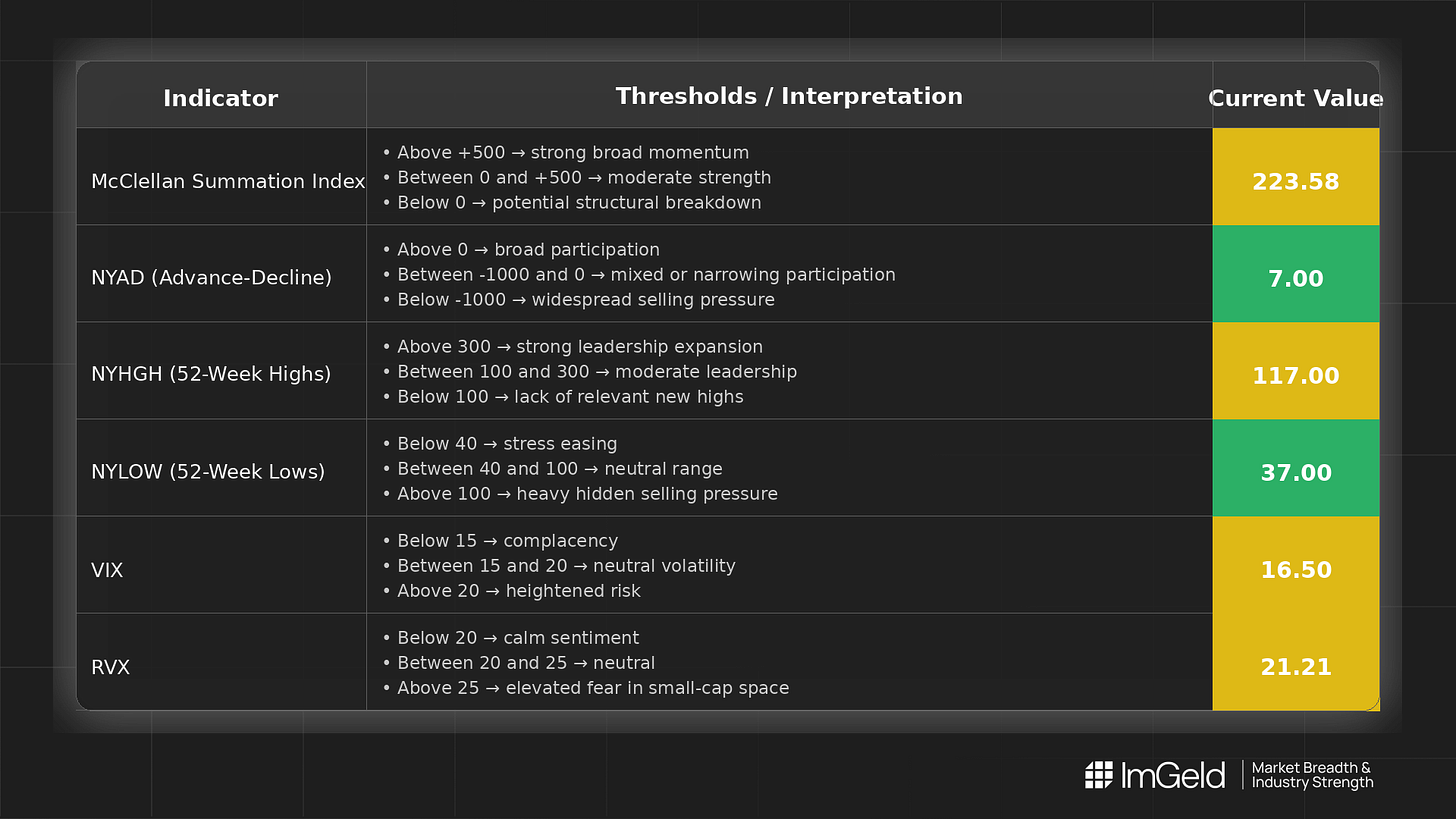

Breadth is mixed. NYSI (McClellan Summation Index) advanced steadily to 223.58 from 152.83 across five sessions, but NYAD (Advance–Decline Line) faded after two heavy down days and finished nearly flat (+7). Leadership narrowed as NYHGH declined and NYLOW rose. Volatility firmed, with VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) both higher, signaling an expansion in risk premium. Bias: tentative short. Long opportunities, if any, should be highly selective within resilient mid-cap industries showing persistent relative strength and stable earnings quality. Short setups remain valid in extended large caps where momentum is deteriorating.

Global Read

Participation is narrowing, evidenced by falling new highs and rising new lows, even as NYSI trends up. Leadership appears more concentrated and less durable, with fewer names sustaining breakouts. Volatility is expanding from subdued levels, increasing the cost of error. There is a divergence: NYSI continues to improve while NYAD cooled materially late in the period. Applying the five-day consistency rule, signals remain mixed rather than firmly bullish or bearish. The pattern leans toward early exhaustion of the recent advance rather than fresh accumulation, warranting tactical caution and tight selection.

Indicator Breakdown

1. NYSI (McClellan Summation Index)

Improving. Four advances and one plateau show medium-term breadth support, but the rate of ascent is moderating, raising the risk of a near-term pause if participation does not re-accelerate.

2. NYAD (Advance–Decline Line)

Weakening. Strong advances on 12/10–11 were followed by two sharp negatives and a flat finish, indicating inconsistent daily participation and fragile underlying demand.

3. NYHGH (New 52-Week Highs)

Leadership expansion is contracting, falling from 237 to 117 over the period. Breakout quality is weakening and becoming more selective.

4. NYLOW (New 52-Week Lows)

Downside pressure is rising, with lows increasing from 14 to 37. Risk appetite is slipping, and downside tails are lengthening.

5. Volatility Regime

VIX rose from 14.85 to 16.50 and RVX from 20.14 to 21.21, signaling a shift from compression to mild expansion. Expect wider ranges and more abrupt reversals; emphasize disciplined entries and risk control.

Tactical View

Maintain a tentative short bias. Focus any longs only in robust mid-cap industries with clear relative strength and earnings visibility. Large-cap exposures are better framed for shorts where breadth and momentum are breaking down. Selectivity and timing are critical.

CTA

Market breadth is only the starting point.

Thinking of going long or short without knowing which industries are accelerating or breaking down?

Each industry moves in its own rhythm.

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.