NYSI-NYAD Divergence, Contained Volatility: Mid-Cap Longs; Short Weakening Large Caps

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2025-12-03

Executive Summary

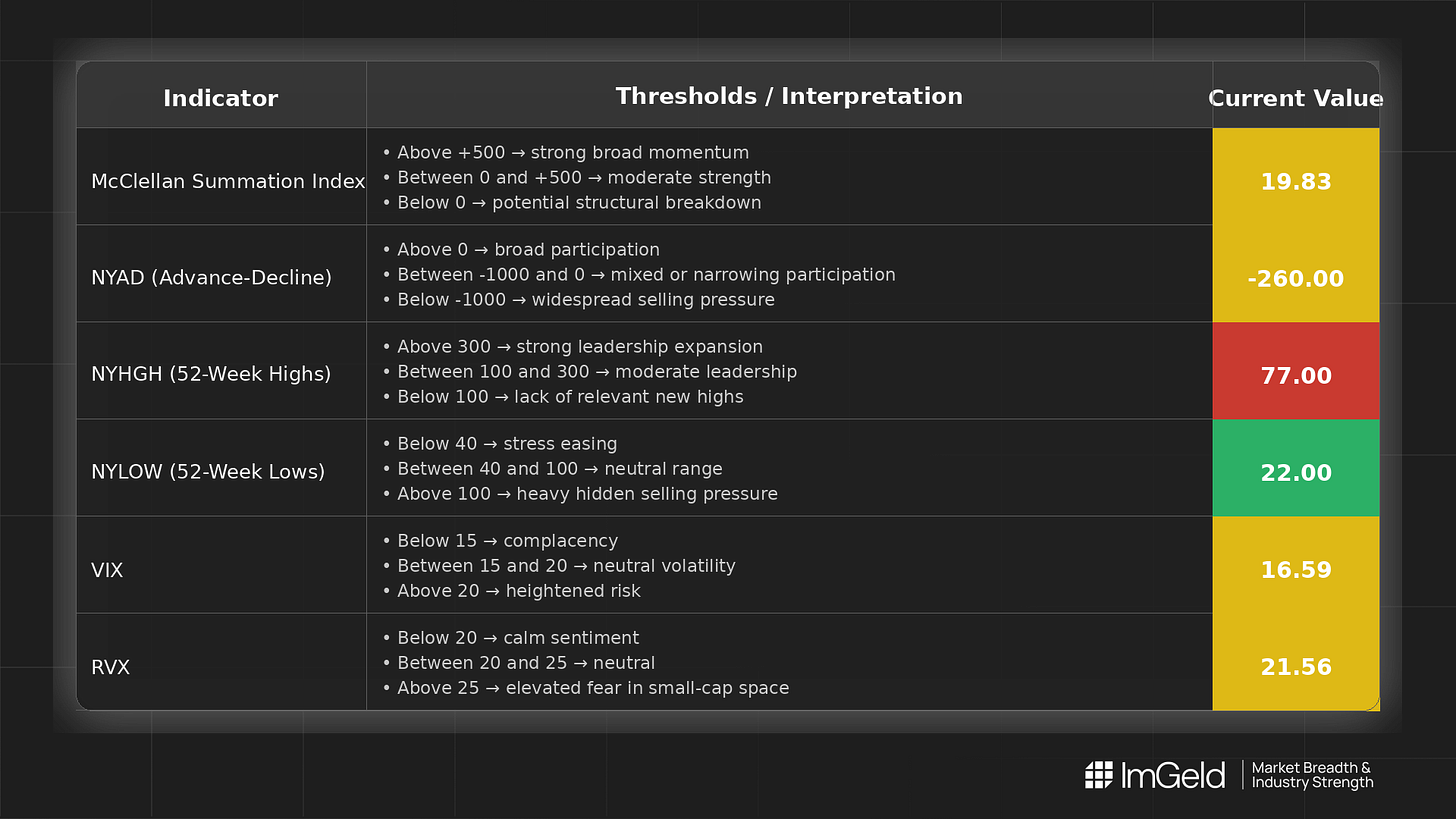

As of 2025-12-02, breadth is mixed and requires high selectivity. NYSI (McClellan Summation Index) sits positive at 19.83, but with only a single data point the directional read is tentative. NYAD (Advance–Decline Line) registered -260, signaling net decliners and narrowing participation. VIX (CBOE Volatility Index) at 16.59 and RVX (Russell Volatility Index) at 21.56 indicate a neutral-to-contained volatility tone.

Tactically, long opportunity is emerging selectively in mid-cap industries where new highs are persisting and new lows remain subdued. Short setups remain valid in large caps that exhibit deteriorating breadth and crowding. Selectivity is high given the divergence between positive NYSI and negative NYAD.

Global Read

Across the latest session, participation narrowed (negative NYAD) while leadership remained selective rather than broad, evidenced by NYHGH outpacing NYLOW. This points to concentration rather than widespread leadership. Volatility remains contained at current VIX/RVX levels, suggesting two-way action without stress but no confirmation of compression over a five-day window. A divergence is present: NYSI is positive while NYAD is negative, hinting at potential pullback risk within an otherwise resilient underlying structure. With only one day of consistent signals, the five-day consistency rule classifies the read as Tentative.

Indicator Breakdown

1. NYSI (McClellan Summation Index)

Structure is tentatively constructive at 19.83, but without five-day data the trend cannot be confirmed. The positive level suggests the broader up-impulse has not been fully impaired.

2. NYAD (Advance–Decline Line)

Daily participation weakened at -260, indicating net decliners and narrow breadth. This tempers risk-taking and argues for selective deployment rather than broad beta.

3. NYHGH (New 52-Week Highs)

At 77, leadership is present in pockets. This reflects selective expansion rather than a broad advance.

4. NYLOW (New 52-Week Lows)

At 22, downside pressure remains contained, consistent with risk appetite that is cautious but not stressed.

5. Volatility Regime

VIX at 16.59 and RVX at 21.56 reflect a neutral volatility regime. Without a five-day path, treat the tone as stable but susceptible to abrupt shifts; favor setups that can work in range-bound conditions with disciplined risk controls.

CTA

Market breadth is only the starting point.

Thinking of going long or short without knowing which industries are accelerating or breaking down?

Each industry moves in its own rhythm.

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.”