Neutral, Not Numb: Early Signs of Market Reacceleration

ImGeld Market Breadth Update — 2025-11-11

Executive Summary

Bias: NEUTRAL

Exposure: Long 65%, Short 0%, Cash 35%

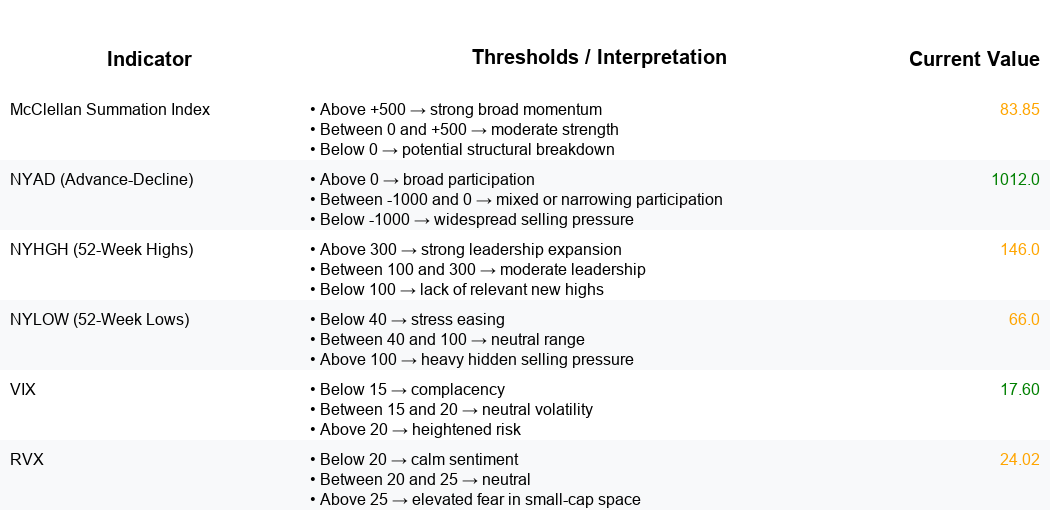

Breadth: NYSI (McClellan Summation Index) remains positive but fell over four sessions before a modest uptick; NYAD (NYSE Advance–Decline Line) was volatile but printed two consecutive strong positives.

Leadership: NYHGH (New 52-Week Highs) expanded; NYLOW (New 52-Week Lows) retreated from an extreme but remains elevated.

Volatility: VIX (CBOE Volatility Index) 17.6 and RVX (CBOE Russell 2000 Volatility Index) 24.02; tone easing with a persistent small-cap risk premium.

Tactics: Maintain neutral posture. Favor selective longs in sectors showing expanding new highs and firm bases; avoid names near new lows. Keep risk tight until lows compress further and NYSI inflects higher.

Global Read

NYSI: 138.64 → 83.85 over five sessions, remaining above 0 (constructive) but signaling momentum loss; slight turn higher on the latest print.

NYAD: -1015, +1014, -870, +1012, +1012; choppy sequence with a net positive 5-day sum, improving into the last two sessions.

NYHGH: 39 → 146, steady expansion in new highs, indicating improving leadership participation.

NYLOW: 99, 80, 137, 66, 66; risk-off spike on 11-07 (>100) faded, but current 66 is above the healthy threshold (<40), implying lingering stress in laggards.

Volatility: VIX 19.0 → 17.6 and RVX 24.82 → 24.02; both eased, while the RVX-VIX spread near 6.4 points continues to reflect higher small-cap risk.

Interpretation: Breadth strength is tentatively broadening, led by expanding new highs and back-to-back positive NYAD, but the elevated NYLOW count limits conviction. With NYSI above zero, the structure is constructive but not confirmed. Volatility compression supports risk-taking at the margin, yet confirmation requires further improvement in lows.

3–8 week outlook: Base-building with upside potential if NYSI turns decisively higher and NYLOW trends below 40 while VIX remains contained. Confirmation would be:

NYSI rising and holding above 0 with expanding NYHGH

NYLOW sustaining below 40

VIX stable sub-17 and RVX not re-accelerating

Invalidation would be:

NYSI rolling below 0

NYLOW returning above 100 for multiple sessions

VIX breaking above 20 or RVX materially widening versus VIX

Market Breadth Summary (Last Five Sessions):

Implementation Guidance

• For LONGS: focus on positions above the 200 / 150 SMA, confirming support, and prioritize industries with a High ImGeld Industry Score rating.

• For SHORTS: focus on positions below the 200 / 150 SMA, rejecting resistance, and prioritize industries with a Low ImGeld Industry Score rating.

Remember, fundamentals represent 80 percent of every decision while 20 percent comes from technical setup. Timing matters.

ImGeld subscribers can access the full set of technical indicators for each stock once it passes the fundamental screening.

Want to see which stocks align with this setup? → Check today’s Fundamental Report (paid)

Disclaimer: ImGeld content is for informational use only and not financial advice. Markets involve risk, and past performance doesn’t guarantee future results. Always consider your personal objectives before investing.