Neutral Bias as Breadth Plateaus; Barbell Positioning with Volatility Contained

IMGELD Market Breadth Update: 2025-10-29 13:41:42

Executive Summary

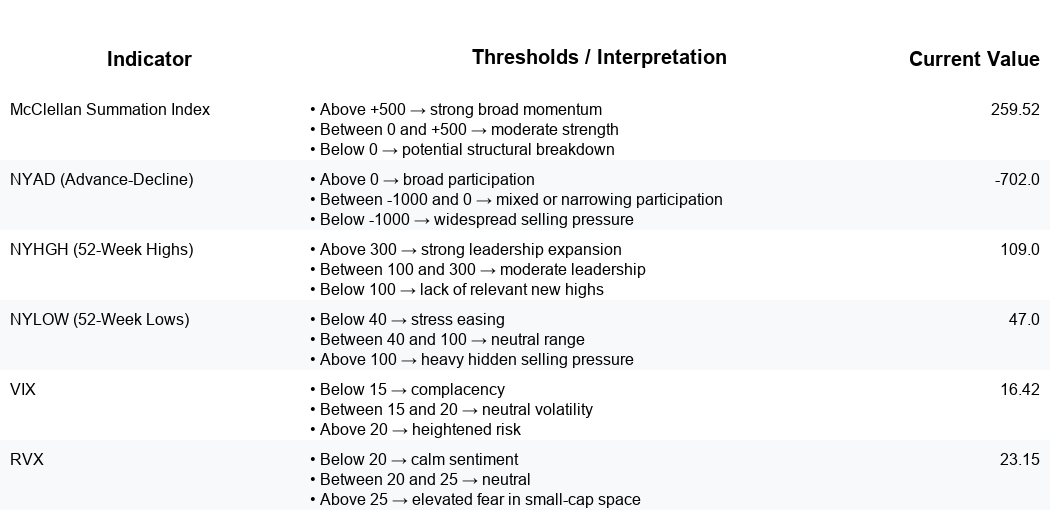

As per 2025-10-28 market closing data, the portfolio bias NEUTRAL, with an indicative allocation of 30% Long, 35% Short, and 35% Cash. Breadth momentum (NYSI) is rising and positive, while NYAD is choppy with a negative latest session, indicating uneven participation. Volatility tone is contained to neutral (VIX 16.42, RVX 23.15) with a mild late uptick. Tactically, employ a barbell: maintain selective longs in leaders with resilient breadth and risk-manage via tactical shorts in laggards where internal metrics are deteriorating.

Global Read

Structural breadth improved early in the period but showed signs of stalling into the latest session. The McClellan Summation Index (NYSI) advanced from 176.66 to 259.52 and remains above zero (NYSI above 0 = constructive, below 0 = weakening), signaling net-positive internal momentum. The Advance–Decline readings were volatile (-456, +710, +710, +186, -702), ending weak and underscoring fragile follow-through despite a net positive five-day sum.

Leadership breadth was mixed: new highs expanded from 48 into the 100–140 band mid-period, then faded to 109. New lows held below 40 for four sessions before rising to 47 on the last day (NYLOW below 40 = healthy, above 100 = risk-off), a cautionary shift but not risk-off. Volatility remained in neutral corridors: VIX drifted from 18.6 to the mid-16s, and RVX eased into low-23s, with modest firming at the close that does not yet signal stress.

Conclusion: breadth is constructive but plateauing, with participation inconsistent and leadership narrowing. The 3–8 week outlook is neutral to cautiously constructive, contingent on renewed breadth expansion and contained volatility.

Confirmation would include: NYSI sustained above zero and pushing toward 300–500; a sequence of positive NYAD breadth; NYHGH sustained >100 alongside NYLOW <40; VIX anchored below 18–20 and RVX below 24. Invalidation would be a rollover in NYSI toward or below zero, NYLOW expanding >100, and a volatility break higher (VIX >20–22, RVX >25), which would warrant trimming gross and tilting net short.

Implementation Guidance

• For LONGS: focus on positions above the 200 / 150 SMA, confirming support, and prioritize industries with a High ImGeld Industry Score rating.

• For SHORTS: focus on positions below the 200 / 150 SMA, rejecting resistance, and prioritize industries with a Low ImGeld Industry Score rating.

Remember, fundamentals represent 80 percent of every decision while 20 percent comes from technical setup. Timing matters.

ImGeld subscribers can access the full set of technical indicators for each stock once it passes the fundamental screening.