Narrowing Breadth, Rising New Lows: Early Distribution; Favor Selectivity, Tight Risk Controls

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2026-01-30

Executive Summary

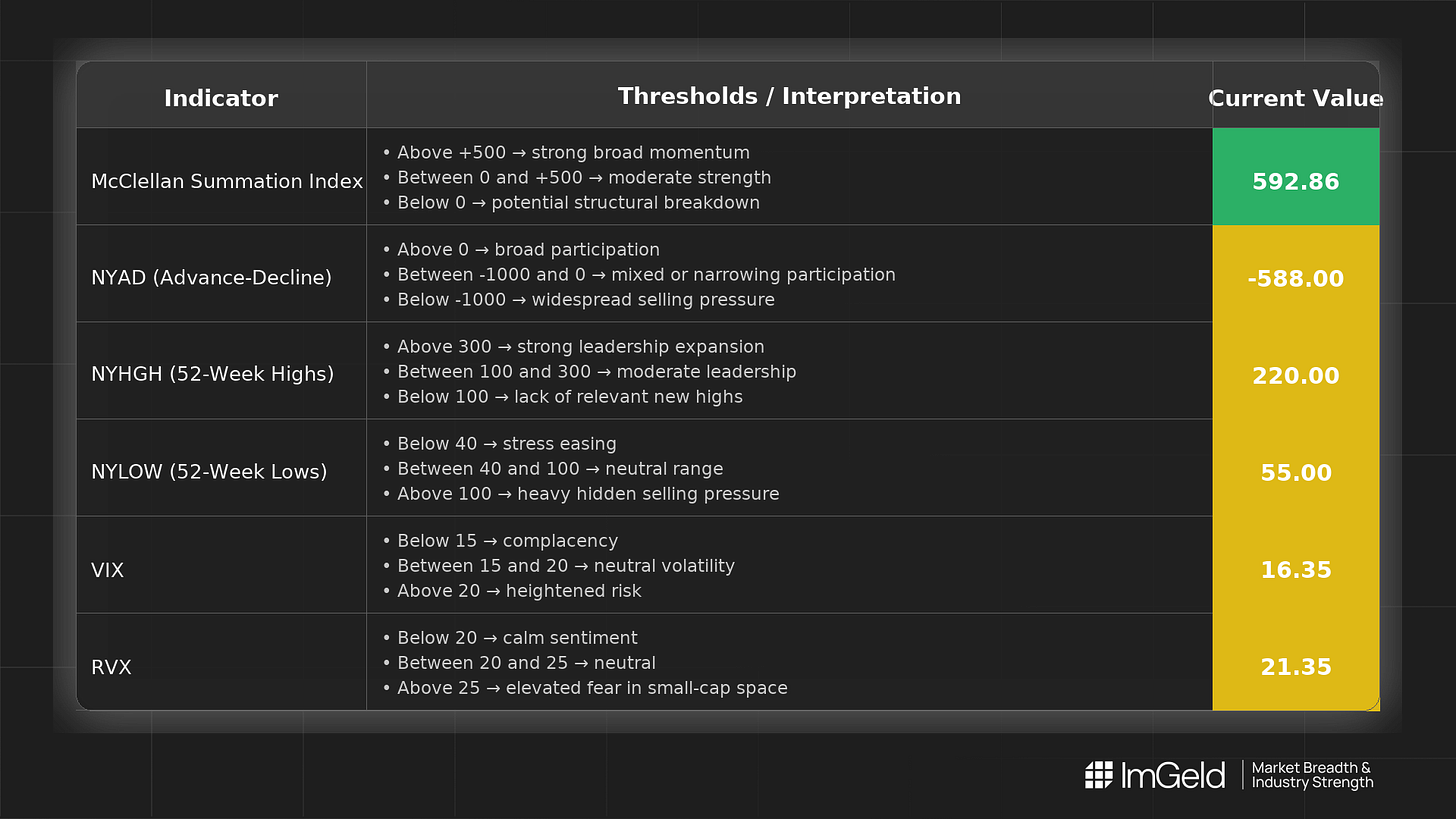

As of 2026-01-29, breadth has turned mixed-to-soft. NYSI (McClellan Summation Index) advanced into 1/27 and has since plateaued, signaling slowing momentum. NYAD (Advance–Decline Line) flipped sharply negative for two consecutive sessions, indicating a deterioration in participation. Volatility tone is mildly firmer but contained, with VIX (CBOE Volatility Index) edging up to the mid-16s and RVX (Russell Volatility Index) steady in the low-21s. Tactically, long opportunities are emerging only selectively in resilient mid-cap industries where highs are holding and lows remain contained. Short setups remain valid in weakening leadership, particularly in overextended large caps and mid-cap laggards within industries showing rising new lows. Selectivity and tight risk controls are warranted.

Global Read

Over the past five sessions, participation is narrowing: NYHGH (New 52-Week Highs) retreated from last week’s peak and stabilized below prior levels, while NYLOW (New 52-Week Lows) rose persistently. Leadership appears more concentrated, not broadening. Volatility has modestly expanded and then stabilized, which supports two-way trading but not capitulation. A divergence has emerged: NYSI remains elevated and flat, yet NYAD has printed two back-to-back deeply negative days. By the five-day consistency rule, NYAD weakness is firmly in place (2 days), NYLOW pressure is firmly rising (3 days), while NYHGH stabilization remains constrained (mixed). The five-day pattern leans toward early distribution and potential exhaustion of the prior advance rather than fresh accumulation.

Indicator Breakdown

1. NYSI (McClellan Summation Index)

Improved into 1/27 (598.81) and then eased to a flat 592.86 for two sessions. Structure is plateauing after an advance, suggesting fading upside impulse.

2. NYAD (Advance–Decline Line)

Sequence: 679, 57, 257, -588, -588. Participation weakened materially with two consecutive heavy negatives, indicating broad selling pressure late in the window.

3. NYHGH (New 52-Week Highs)

From 302 down to 185, then steady around 219–220. Leadership expansion has cooled and is not re-accelerating, pointing to selective rather than broad strength.

4. NYLOW (New 52-Week Lows)

From 14 to 55 over five days, holding elevated the last two sessions. Downside pressure is firmly rising and risk appetite is softening.

5. Volatility Regime

VIX rose from 15.64 to 16.35 and held; RVX ticked higher then flattened near 21.35. Mildly higher but stable volatility favors disciplined sizing and supports maintaining hedges while avoiding complacency.

CTA

Market breadth is only the starting point.

Thinking of going long or short without knowing which industries are accelerating or breaking down?

Each industry moves in its own rhythm.

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.