Mixed Signals Keep Breadth in Question

Five-session analysis shows fragile leadership and neutral volatility, keeping downside risk tentative.

Portfolio Bias: Tentatively SHORT

As per 26-Sep Market closing data the portfolio bias remains tentatively SHORT based on the last five trading sessions.

While declining breadth, a weak McClellan Indicator, and lack of leadership point to growing downside risk, the easing of new lows and stable volatility prevent confirmation of a firmly SHORT stance.

A renewed spike in new lows and consistent deterioration in participation would be required to move toward a firmly SHORT bias.

For LONGS: Focus on positions above the 200/150 SMA, confirming support, and prioritize industries with a High ImGeld Industry Score rating.

For SHORTS: Focus on positions below the 200/150 SMA, rejecting resistance, and prioritize industries with a Low ImGeld Industry Score rating.

Remember, fundamentals account for 80% of each decision, while 20% comes from technical analysis and technical setup, timing matters. ImGeld Subscribers can access a full set of technical indicators for each stock selected after passing the fundamental analysis screening.

Global Read

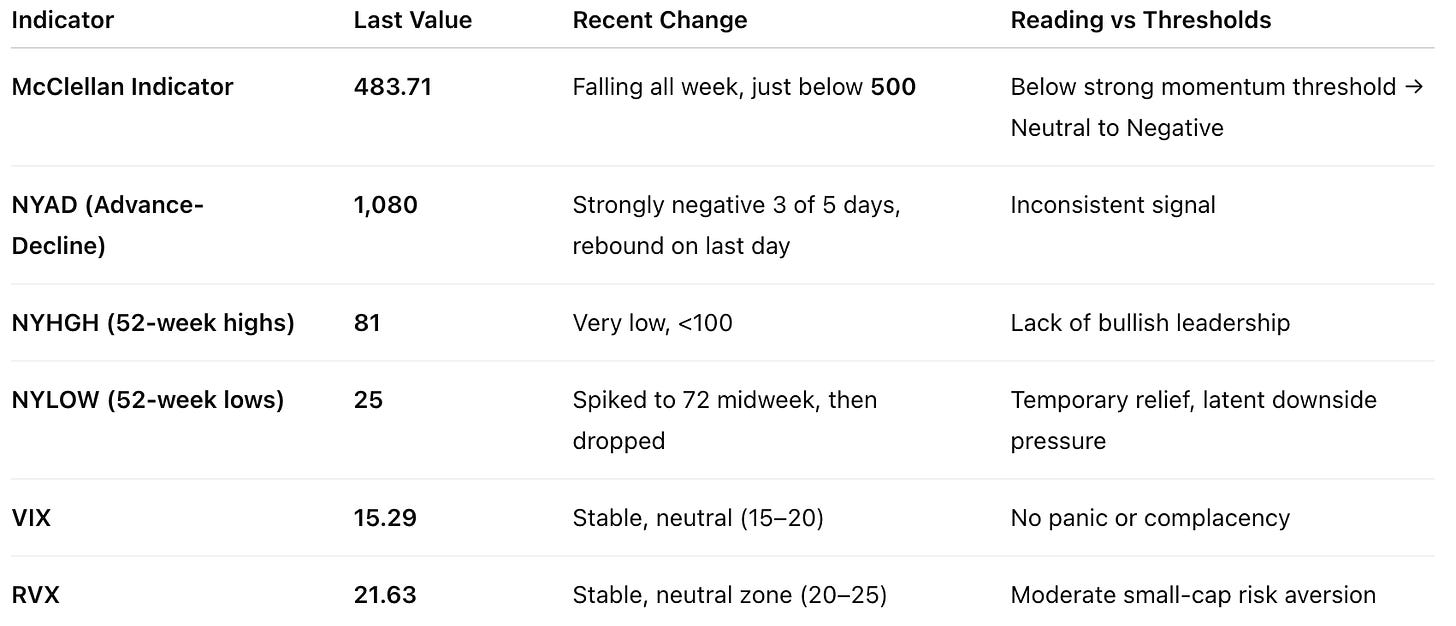

Based on the last five trading sessions, the McClellan Indicator has been steadily declining while leadership remained extremely weak, indicating fragile participation.

New lows spiked midweek but eased into the close, while volatility stayed neutral, which prevents confirmation of a clear bearish breakdown.

Unless leadership improves and participation broadens, downside risk remains elevated but unresolved.

Market Breadth Summary (Last Five Sessions)

Indicators Used

McClellan Indicator: >+500 strong broad momentum, <0 potential breakdown. Current: 483.71

NYAD (Advance-Decline Line): >0 broad participation, <0 widespread selling. Current: 1,080

NYHGH (New 52-Week Highs): >300 strong leadership expansion, <100 weak leadership. Current: 81

NYLOW (New 52-Week Lows): >100 heavy hidden selling, <40 stress easing. Current: 25

VIX: <15 complacency, 15–20 neutral, >20 heightened risk. Current: 15.29

RVX: <20 calm, 20–25 neutral, >25 elevated fear. Current: 21.63