Market Breadth at a Crossroads: Fragility Without Confirmation

Market Breadth signals caution, yet volatility and new lows show no clear confirmation of a breakdown

Portfolio Bias : Neutral

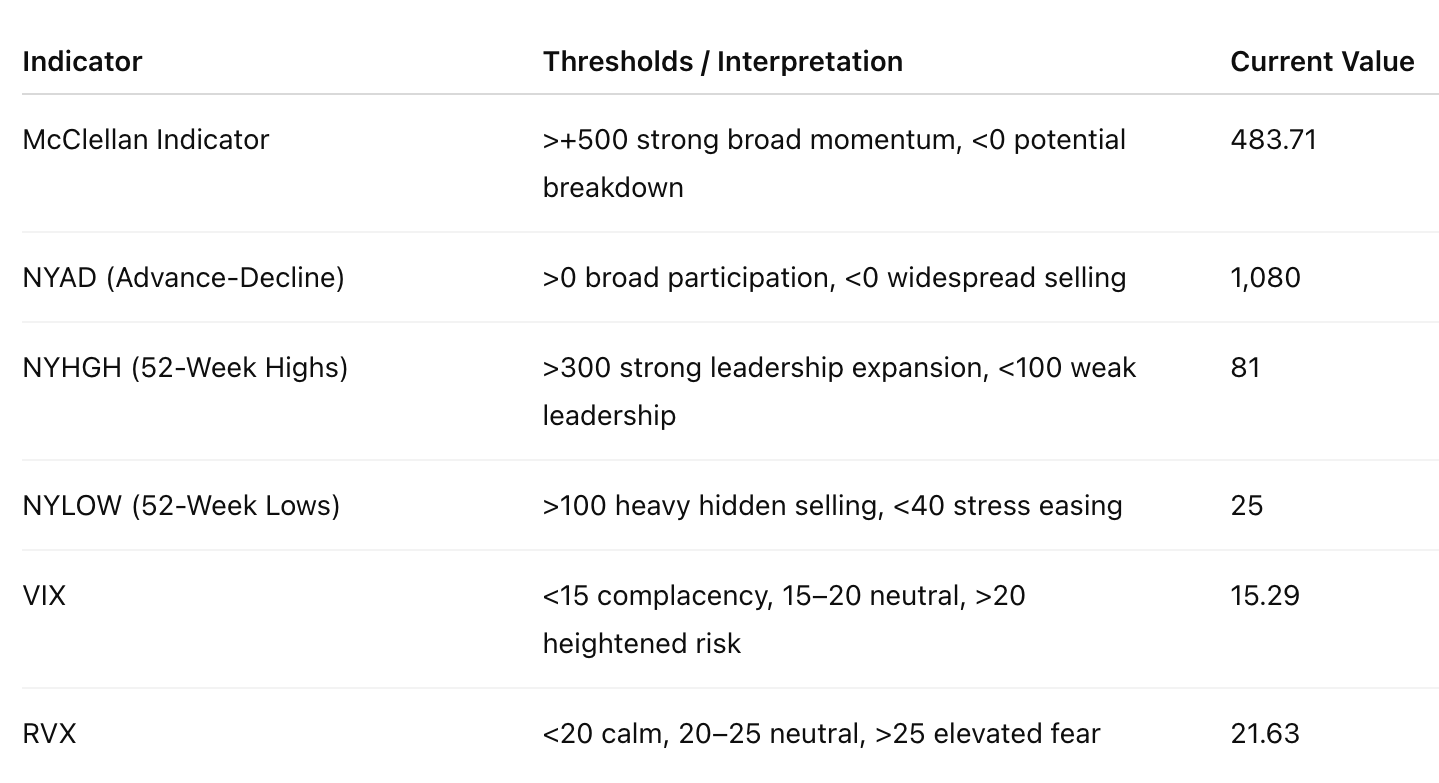

As per 01-Oct Market closing data the portfolio bias remains NEUTRAL with downside risk not confirmed, based on the last five trading sessions.

While declining breadth, a weak McClellan Indicator, and lack of new highs point to fragility, the easing of new lows and stable volatility prevent confirmation of a SHORT bias.

A renewed spike in new lows combined with consistent deterioration in participation would be required to shift toward a Tentative SHORT bias.

For LONGS: Focus on positions above the 200/150 SMA, confirming support, and prioritize industries with a High ImGeld Industry Score rating.

For SHORTS: Focus on positions below the 200/150 SMA, rejecting resistance, and prioritize industries with a Low ImGeld Industry Score rating.

Remember, fundamentals account for 80% of each decision, while 20% comes from technical analysis and technical setup, timing matters. ImGeld Subscribers can access a full set of technical indicators for each stock selected after passing the fundamental analysis screening.

Global Read

As per 01-Oct closing data, the McClellan Indicator has been steadily declining while leadership remained extremely weak, indicating fragile participation.

New lows stayed low and volatility held neutral, which prevents confirmation of a clear bearish breakdown. Unless leadership improves and participation broadens, the market remains vulnerable, but downside risk is not yet confirmed.