Leadership Narrows as Volatility Compresses: Selective Mid‑Cap Longs, Short Crowded Large‑Cap Tech

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2025-12-24

Executive Summary

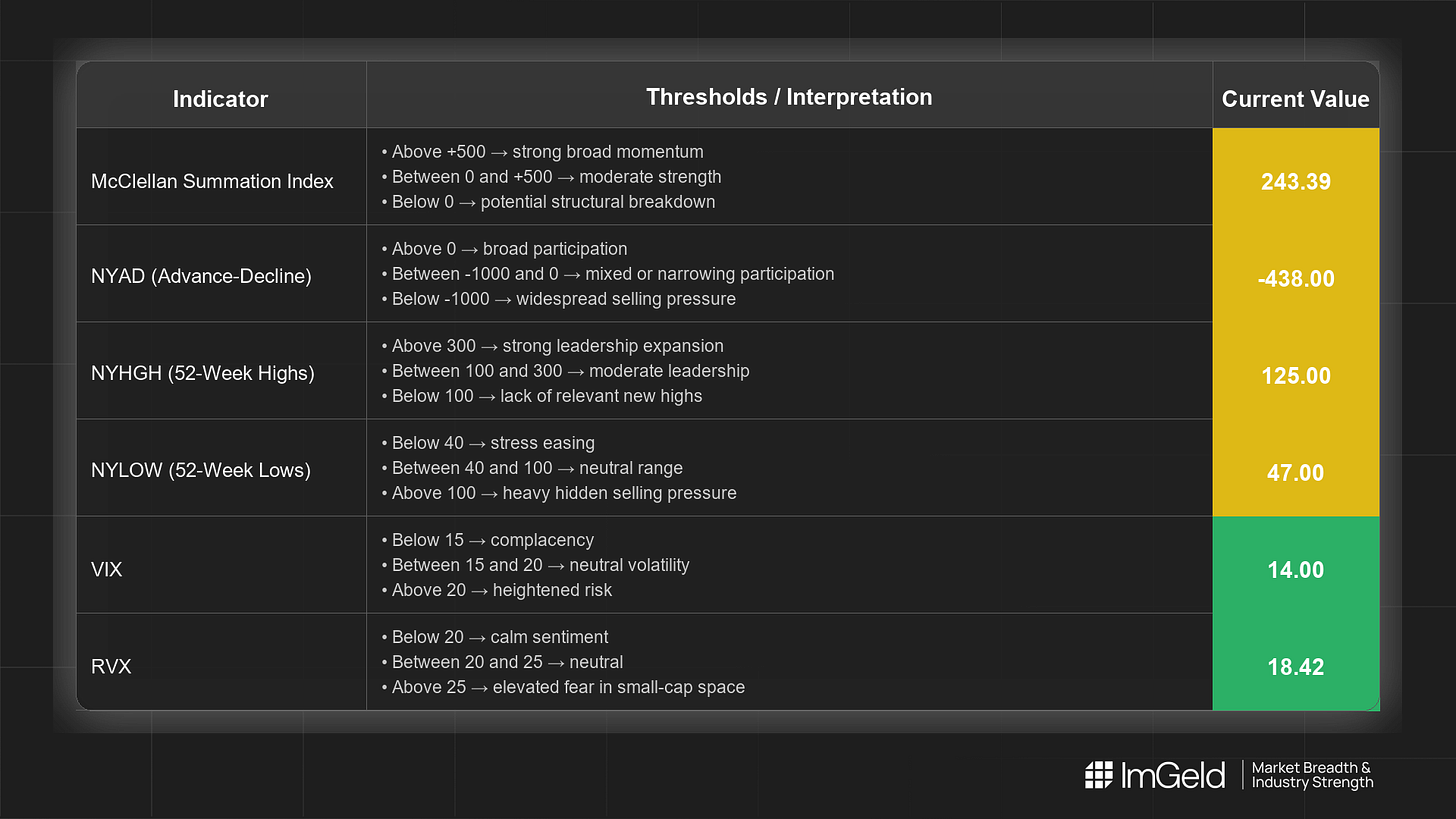

Breadth firmed through early week with NYSI (McClellan Summation Index) rising and then pausing, while NYAD (Advance–Decline Line) flipped negative in the last two sessions. NYHGH (New 52-Week Highs) expanded then eased, and NYLOW (New 52-Week Lows) ticked up, signaling some fatigue. Volatility compressed, with VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) drifting lower.

Tactically, maintain a balanced stance with high selectivity. Emerging long opportunities are in mid-cap industries where new highs persist and down-day damage is shallow. Short setups remain valid in crowded large-cap leadership within software, semiconductors, and internet-related industries, where participation is narrowing

Global Read

Over five sessions, participation broadened into 12/22 and then narrowed as NYAD turned negative, while NYSI continued higher. Leadership is becoming more concentrated, evidenced by easing new highs and a rise in new lows. Volatility is firmly compressing. A mild divergence appears as NYSI improves while NYAD weakens late in the period, arguing for a pause rather than a breakdown. The five-day pattern remains a continuation with a short-term pause, not an exhaustion, given firm NYSI and contained volatility.

Indicator Breakdown

1. NYSI (McClellan Summation Index)

Structure is improving. The index advanced from 218.77 to 243.39 over the last five sessions and plateaued on the final day. By the five-day consistency rule, the improvement is firmly in place.

2. NYAD (Advance–Decline Line)

Participation strengthened for three sessions (+699, +699, +721) and then weakened for two consecutive sessions (-438, -438). This remains mixed, with near-term breadth deterioration that warrants selectivity.

3. NYHGH (New 52-Week Highs)

Leadership expanded from 100 to 143 early, then eased to 125. This indicates leadership expansion is intact but becoming more selective, consistent with concentration at the top.

4. NYLOW (New 52-Week Lows)

Lows rose from 38 to 47 late in the week, a modest increase that signals slight downside pressure returning and a cooling of risk appetite.

5. Volatility Regime

VIX eased from 16.87 to 14.00 and RVX from 20.49 to 18.42 over five sessions. Compression is firmly in place, favouring range-bound and mean-reversion tactics. Low volatility supports maintaining mid-cap longs with tight risk controls while using weakness in participation to press shorts in crowded large-cap leadership.

CTA

Market breadth is only the starting point.

Thinking of going long or short without knowing which industries are accelerating or breaking down?

Each industry moves in its own rhythm.

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.