Late-Week Breadth Broadens; Tentative Mid-Cap Longs, Fade Crowded Large Caps

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2025-12-22

Executive Summary

As of 2025-12-19, breadth improved late week but remains uneven. NYSI (McClellan Summation Index) is net higher over five sessions with a midweek dip and a final day plateau. NYAD (Advance–Decline Line) flipped from three negative sessions to two consecutive positive sessions, indicating a late-week broadening. VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) spiked midweek then eased, ending modestly above Monday, keeping a cautious volatility tone.

Tactically, a tentative long bias is supported, but only with high selectivity in mid-cap industries showing rising new highs and contained new lows. Short opportunities remain valid in large caps where rallies are narrowing and vulnerable to mean reversion.

Global Read

Participation broadened into the back half of the week as NYAD turned positive for two straight days, while NYSI held a constructive, albeit moderating, uptrend. Leadership is attempting to rebuild after an early-week contraction in new highs; improvement is partial and not yet decisive, implying leadership remains somewhat concentrated. Volatility expanded midweek and then compressed, leaving a neutral to cautious volatility regime. A mild divergence appeared early as NYSI stayed firm despite negative NYAD, now partially resolved by the late-week NYAD improvement. By the five-day consistency rule, late-week breadth improvement is firmly positive over two days, but the overall pattern remains mixed, signaling early accumulation rather than a confirmed continuation.

Indicator Breakdown

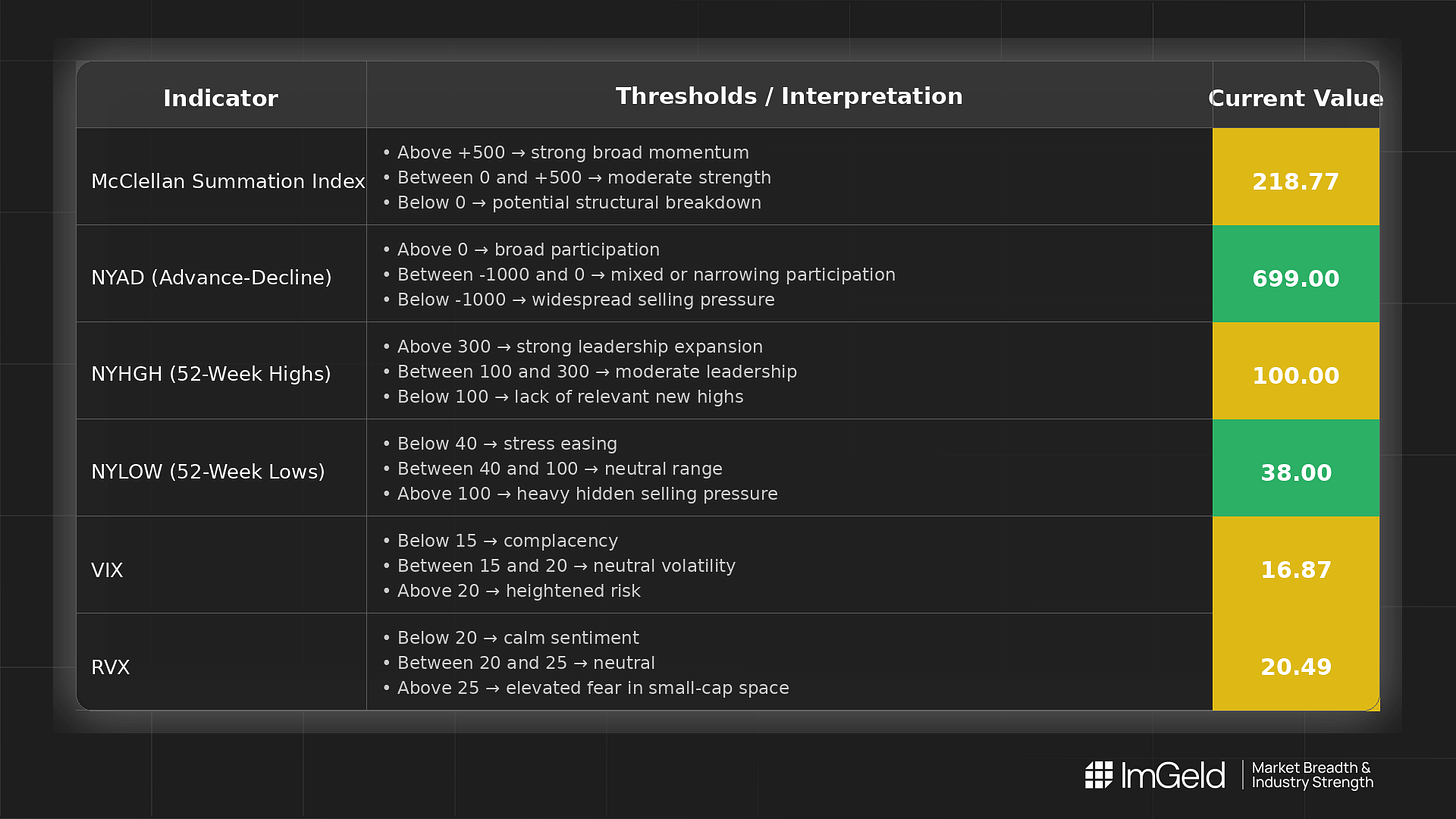

1. NYSI (McClellan Summation Index)

Structure is improving net of noise: 210.1 to 222.03, a pullback to 214.04, then stabilization at 218.77. Momentum is constructive but has stalled near the prior uptick, consistent with tentative accumulation.

2. NYAD (Advance–Decline Line)

Participation weakened for three sessions (-924, -658, -304) before turning positive for two consecutive days (+699, +699). This is firmly improving at the margin, but the five-day profile remains mixed.

3. NYHGH (New 52-Week Highs)

Leadership contracted sharply early (166 to 56), then recovered to 100 and held. Expansion is rebuilding but has not exceeded Monday’s level, indicating only moderate leadership broadening.

4. NYLOW (New 52-Week Lows)

Lows rose from 21 to 40 and ended at 38. Downside pressure is elevated versus Monday but contained, suggesting improving risk appetite with residual fragility.

5. Volatility Regime

VIX moved 15.74 to 17.62 and settled at 16.87. RVX moved 20.35 to 21.61 and settled at 20.49. The pattern shows a midweek expansion followed by compression, keeping a balanced but cautious backdrop that favors selective positioning and disciplined risk controls.

Tactical View

- Longs: Focus only on mid-cap industries demonstrating improving participation and rising new highs with stable lows. Entries should be staggered and conditional on sustained positive NYAD.

- Shorts: Large caps with crowded leadership and weakening breadth remain viable for tactical fades, especially into strength if NYHGH stalls and NYLOW drifts higher.

CTA

Market breadth is only the starting point.

Thinking of going long or short without knowing which industries are accelerating or breaking down?

Each industry moves in its own rhythm.

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.