Industry Leadership Remains Firmly Polarized

Clear strength in upstream cyclicals contrasts with broad defensive deterioration.

Executive Summary

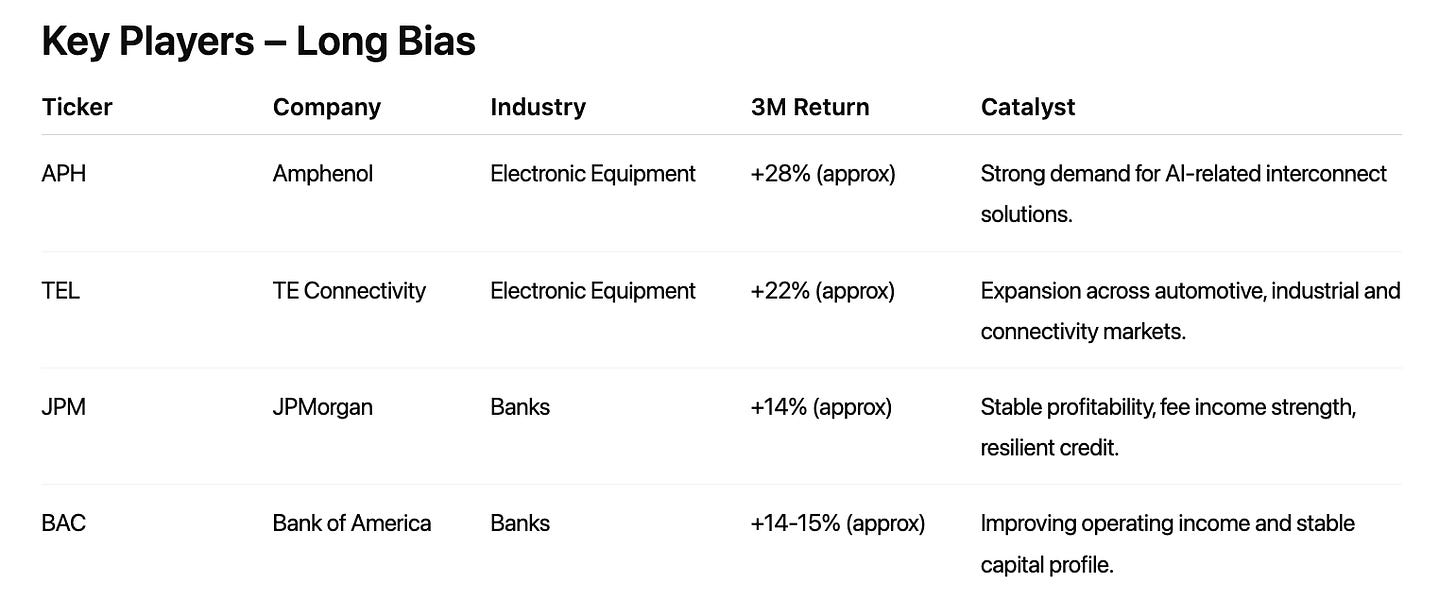

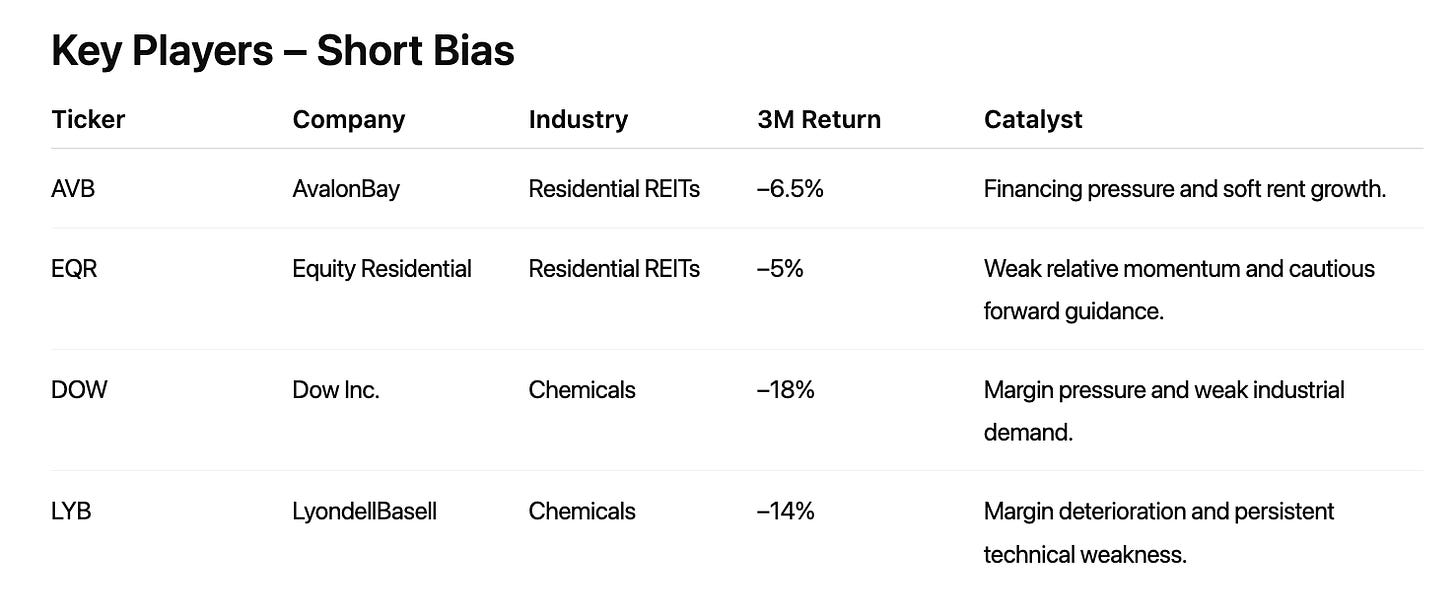

Industry momentum remains sharply polarized. Strength continues to cluster around electronic hardware, components, and large diversified banks, supported by the AI-driven capex cycle and stable credit dynamics. On the other hand, defensives — such as food products, personal care, media, chemicals, and residential REITs — remain under pressure from weak demand, margin stress, or elevated financing sensitivity.

The nearly 80-point spread between the top and bottom industries confirms a late-stage momentum environment where leadership is narrow and selective rather than broad. This favors targeted long-short positioning over broad beta exposure.

For portfolio construction, opportunity remains concentrated in industries tied to infrastructure, connectivity, and credit resilience. Shorts appear more compelling in sectors exposed to rate pressure or structural demand weakness.

Top 5 Growing Industries

1. Electronic Equipment, Instruments & Components

Clear leadership. AI-linked infrastructure demand supports orders and margins. Pullbacks are shallow and quickly absorbed.

2. Banks

Solid balance sheets, resilient credit trends, and stable fee income continue to attract institutional flows. Many franchises posted double-digit recent returns.

3. Metals & Mining

Supported by improving industrial expectations and flows toward real assets. Supply discipline reinforces the trend.

4. Technology Hardware, Storage & Peripherals

Cloud and AI capex keep demand strong in servers and storage. Earnings revisions remain positive.

5. Communications Equipment

Benefiting from network upgrades and higher traffic needs. Technical strength and superior relative performance remain intact.

Why they dominate

Strong earnings visibility and capex-driven demand.

Direct exposure to AI, cloud, industrial automation.

Stable backlogs and resilient margins.

Institutional flows favoring hardware and high-quality financials.

Persistent technical leadership versus the broad market.

Bottom 5 Weakening Industries

1. Food Products

Margin pressure from costs and promotions. Weak volume trends and rotation away from defensives.

2. Personal Care Products

Soft volumes and consumer trading-down behavior. Rallies fail to hold.

3. Media

Irregular advertising trends and business-model disruption. Limited institutional sponsorship.

4. Chemicals

Soft industrial demand and persistent pricing pressure. Several stocks down double digits.

5. Residential REITs

High financing costs and slower rent growth. Recent performance remains negative with cautious guidance.

Why they lag

Weak demand or volume softness.

Margin compression and poor pricing power.

High sensitivity to interest rates and financing.

Business-model pressure or structural transition.

Investor flows shifting toward cyclicals and AI-driven sectors.