Improving Breadth, Modest Volatility Rise: Select Mid-Cap Longs, Short Overextended Large Caps

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2026-01-08

Executive Summary Date: 2026-01-09

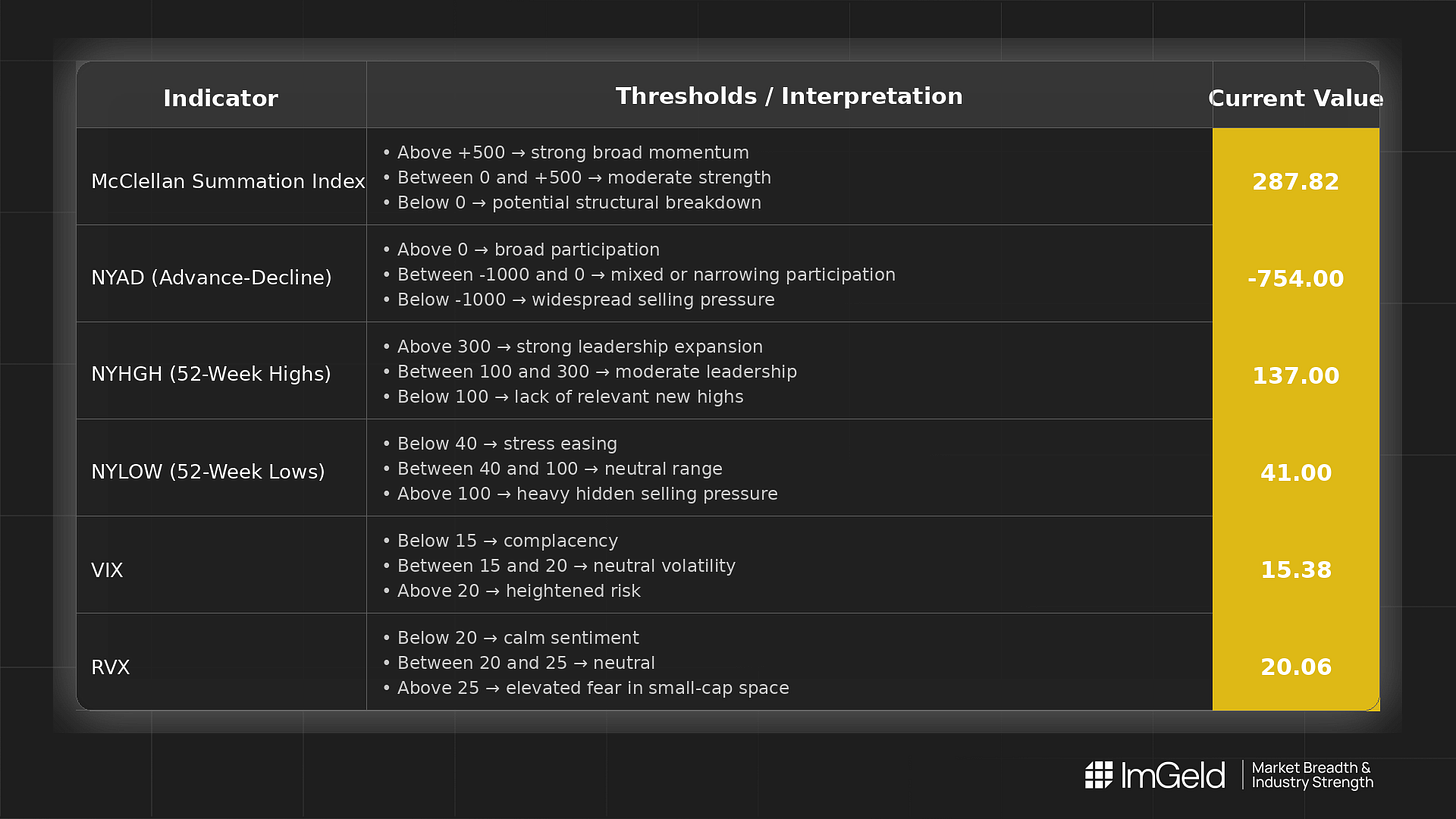

Breadth improved late in the period. NYSI (McClellan Summation Index) turned higher over the last two sessions, rising to 287.82, signaling a firmly improving structure. NYAD (Advance–Decline Line) was mixed: strong mid-period advances were followed by a -754 reading on the latest day, tempering confirmation. Volatility is edging higher from a low base, with VIX (CBOE Volatility Index) lifting to 15.38 and RVX (Russell Volatility Index) to 20.06, implying a modest expansion in realized and implied risk.

Tactically, selective long openings may be emerging in mid-cap industries showing persistent new-highs expansion and constructive pullback behavior. Short setups remain valid in overextended large-cap leadership where breadth has narrowed and sensitivity to volatility is rising. Selectivity and entry discipline are paramount.

Global Read

Participation broadened mid-week as new highs expanded, then narrowed into the final session. Leadership is rotating beneath the surface rather than cleanly concentrating, with NYSI’s firm upturn contrasted by a soft NYAD close. Volatility is modestly expanding after a compressed stretch, arguing for tighter risk controls. There is a mild divergence: NYSI is firmly improving while NYAD’s latest negative print signals hesitation in day-to-day participation. The five-day pattern leans toward early accumulation, but confirmation remains incomplete given the mixed daily breadth.

Indicator Breakdown

NYSI (McClellan Summation Index) After an early dip and plateau, NYSI advanced sharply over the last two sessions (259.16 to 287.82). Structure is improving firmly on a two-day consistency basis.

NYAD (Advance–Decline Line) Daily participation was positive on Jan 2, Jan 5, and Jan 6, then reversed on Jan 7. Breadth remains mixed, with the latest setback indicating uneven follow-through.

NYHGH (New 52-Week Highs) Leadership expanded materially (34 to 207 before easing to 137). Despite the fade, readings remain elevated versus the start of the period, supportive of selective momentum in resilient groups.

NYLOW (New 52-Week Lows) Lows stayed contained in the 31–45 range, dipping mid-week and ticking up on the final day. Downside pressure is subdued but not absent, consistent with a cautious risk-on tone.

Volatility Regime VIX rose from 14.51 to 15.38 and RVX from 19.31 to 20.06 into the close, a gentle expansion off depressed levels. This backdrop favors staggered entries, tighter stops, and maintaining hedges while allowing for selective longs.

Tactical Implications

Long: Focus on mid-cap industries with sustained leadership signals and improving breadth, such as industrial automation suppliers, aerospace and defense components, specialty chemicals, and niche software and IT services. Favor pullbacks within names printing or approaching new highs.

Short: Overextended large-cap leadership where breadth has narrowed remains vulnerable, particularly in mega-cap communication platforms and consumer internet, and selectively in large-cap discretionary where reactions to rising volatility can be outsized.

CTA

Market breadth is only the starting point. Thinking of going long or short without knowing which industries are accelerating or breaking down? Each industry moves in its own rhythm. Stay informed. Unlock the ImGeld Industry Updates — subscribers only.