Improving Breadth, Compressed Volatility: Early Accumulation Points to Selective Mid‑Cap Longs

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2025-12-04

Executive Summary

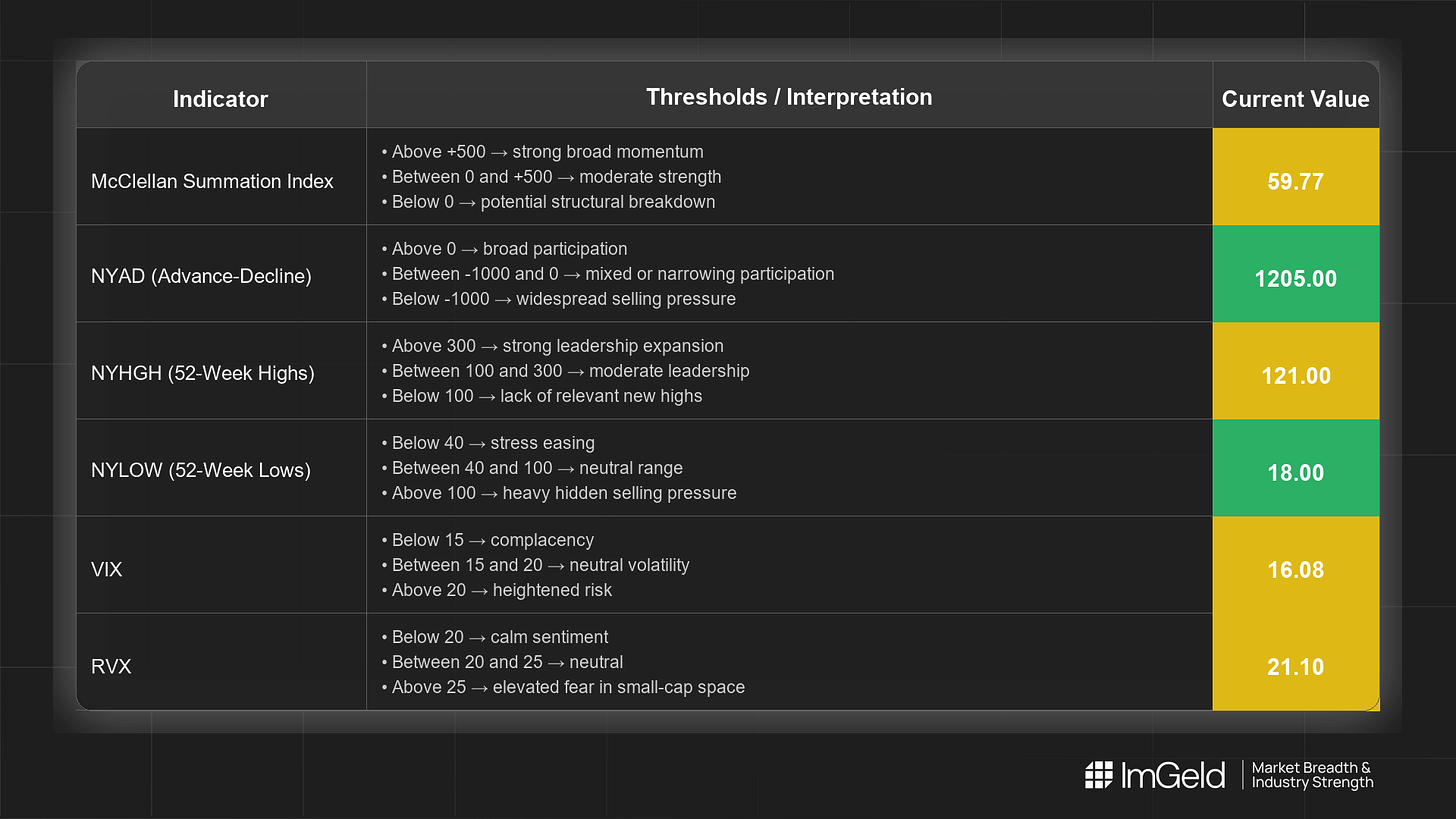

Breadth improved over the last five sessions. NYSI (McClellan Summation Index) reversed from -85.46 to +59.77, signaling an upswing in underlying momentum. NYAD (Advance–Decline Line) was mixed (two advances, two declines, strong advance today), indicating participation is not yet firm. NYHGH (New 52-Week Highs) rebounded to 121 after a mid-period trough, while NYLOW (New 52-Week Lows) eased from 21 to 18 but remains above late last week’s floor. VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) compressed steadily, supporting risk deployment with selectivity.

Tactically, long opportunities may be emerging in mid-cap industries showing improving participation and expanding 52-week highs. Short setups remain valid in large caps within industries with persistent weakness and rising lows. Selectivity remains high given mixed daily breadth.

Global Read

Participation is broadening, but it Remains mixed by the five-day consistency rule given alternating NYAD prints. Leadership appears to be rotating rather than concentrating, as new highs re-accelerated while lows stayed elevated relative to last week. Volatility is Firmly compressing across VIX and RVX. A midweek divergence emerged with NYSI improving while NYAD dipped; the strong close resolved this in favor of improvement. The five-day pattern is consistent with Tentative early accumulation rather than continuation or exhaustion.

Indicator Breakdown

1. NYSI (McClellan Summation Index)

Structure is Firmly improving: a persistent climb with a positive crossover to 59.77, indicating rising intermediate breadth energy.

2. NYAD (Advance–Decline Line)

Daily participation was choppy: +1181, +867, -818, -249, +1205. The strong finish improves tone, but confirmation requires additional advancing sessions.

3. NYHGH (New 52-Week Highs)

Leadership expansion dipped into mid-period weakness (125 → 76) and recovered to 121. Expansion is Tentative but constructive.

4. NYLOW (New 52-Week Lows)

Downside pressure rose early (4 → 21) and eased to 18. Risk appetite is improving, yet lows remain higher than late last week, warranting selective exposure.

5. Volatility Regime

VIX drifted from 17.19 to 16.08; RVX from 22.07 to 21.10. Both are Firmly compressing, favoring incremental long deployment in mid-caps while preserving a cash buffer for potential volatility reversion.

CTA

Market breadth is only the starting point.

Thinking of going long or short without knowing which industries are accelerating or breaking down?

Each industry moves in its own rhythm.

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.