Improving Breadth, Benign Volatility: Early Accumulation Favors Selective Mid-Cap Longs

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2026-01-28

Executive Summary As of 2026-01-28,

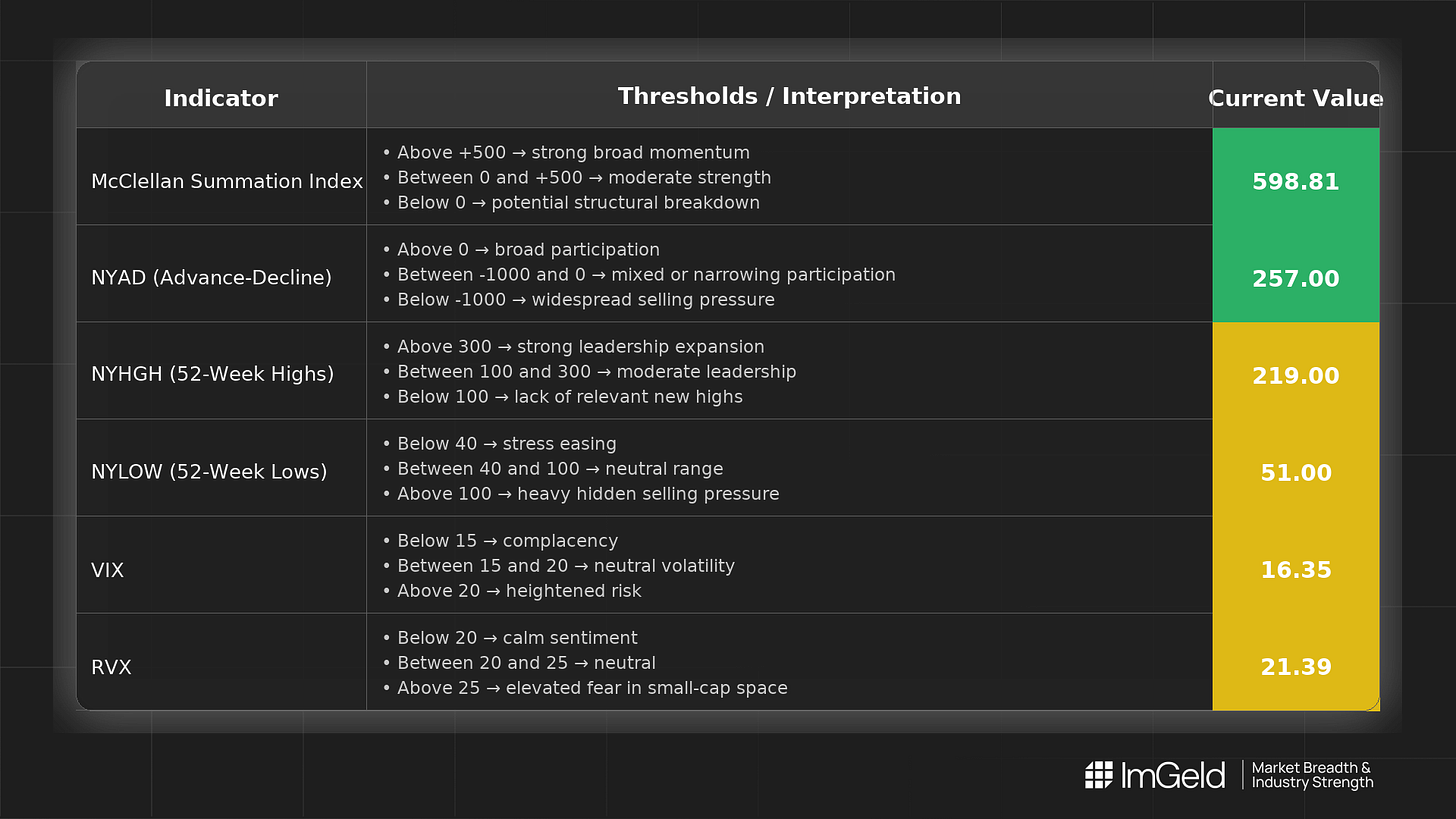

Breadth supports a tentative long bias. NYSI (McClellan Summation Index) advanced four of the last five sessions to 598.81, indicating improving intermediate momentum. NYAD (Advance–Decline Line) stayed positive each day but decelerated sharply from 1,597 to 257, signalling thinner day-to-day participation.

Volatility tone: VIX (CBOE Volatility Index) edged up from 15.64 to 16.35, while RVX (Russell Volatility Index) finished slightly lower at 21.39 after a mid-period uptick. This points to benign but two-sided conditions.

Tactically, selective long opportunities may be emerging in mid-cap industries showing stable new highs and relative strength on pullbacks. Short setups remain valid in large caps that are extended and deteriorating within industries exhibiting waning participation or rising new lows. Selectivity should remain high.

Global Read

Over the last five sessions, cumulative breadth improved while daily participation narrowed. Leadership cooled after the 01-22 surge and attempted a modest re-expansion on 01-28, implying concentration is still elevated and rotation incomplete. VIX shows mild expansion, while RVX is broadly stable to slightly compressing. A mild divergence appears with NYSI rising firmly as NYAD momentum fades, consistent with early accumulation without a full breadth thrust. Using the five-day consistency rule: NYSI is firmly improving; NYAD remains constructive but weakening. The pattern signals early accumulation that remains tentative given mixed leadership and a late-week uptick in new lows.

Indicator Breakdown

1. NYSI (McClellan Summation Index)

Structure is improving. Readings rose from 539.67 to 598.81, with only a one-day plateau, meeting the rule for firmly improving intermediate breadth.

2. NYAD (Advance–Decline Line)

Daily participation stayed positive but weakened materially in amplitude (1,597 to 257). This indicates a narrowing advance that remains constructive but lacks thrust.

3. NYHGH (New 52-Week Highs)

Leadership expansion peaked on 01-22 (302), then cooled to 185 and recovered to 219. This reflects a pause in leadership with tentative re-expansion, not yet broad-based.

4. NYLOW (New 52-Week Lows)

Lows were subdued through 01-27, then rose to 51 on 01-28. Downside pressure is still moderate but bears watching if the uptick persists.

5. Volatility Regime

VIX lifted off trough levels toward 16.35, suggesting mild, tradable swings rather than stress. RVX oscillated but ended slightly lower at 21.39, implying small-cap and mid-cap volatility remains contained. The mix supports selective positioning rather than broad beta exposure.

CTA

Market breadth is only the starting point.

Thinking of going long or short without knowing which industries are accelerating or breaking down?

Each industry moves in its own rhythm.

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.