Highs Are Expanding… The Question Is: Are You in the Right Industries?

IMGELD Market Breadth Update: 2025-11-13

Executive Summary

Bias: TENTATIVE LONG

Allocation: 65% Long, 0% Short, 35% Cash

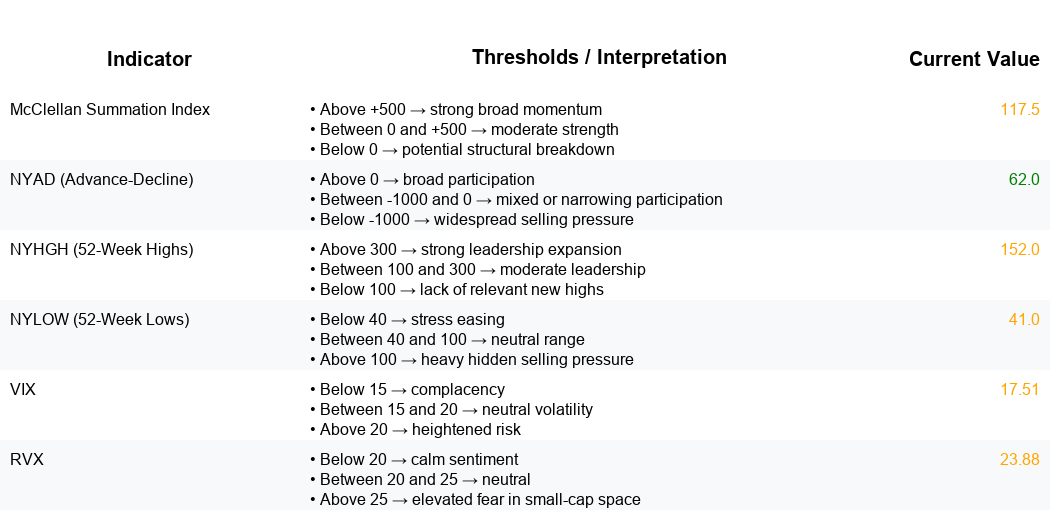

Breadth: NYSI (McClellan Summation Index) at 117.48 remains positive; NYAD (NYSE Advance-Decline Line) prints positive at 62.0. NYHGH (New 52-Week Highs) at 152 outpaces NYLOW (New 52-Week Lows) at 41.

Volatility: VIX (CBOE Volatility Index) 17.51; RVX (CBOE Russell 2000 Volatility Index) 23.88. Tone is contained with a persistent small-cap risk premium.

Tactical: Favor high-quality names within industries showing expanding highs and resilient breadth. Maintain selective exposure; avoid crowded small-cap beta until RVX compresses or lows fall decisively.

Global Read

Five-session dynamics point to constructive but tentative participation: NYSI above 0 is supportive, indicating an improving intermediate thrust; NYAD positive suggests net buying interest. Leadership is present with highs exceeding lows, yet NYLOW at 41 sits marginally above the “healthy” threshold of sub-40, warranting vigilance.

Volatility is moderate. VIX sub-20 aligns with a risk-on tilt, while RVX > VIX reflects persistent small-cap fragility. The RVX premium keeps the quality and liquidity bias intact.

Breadth strength appears to be cautiously broadening rather than narrowing, but with a plateau risk if highs stall or lows rise.

Thresholds:

• NYSI above 0 = constructive (current 117.48)

• NYLOW below 40 = healthy; above 100 = risk-off

• Current 41 is near the healthy boundary

3–8 week outlook: Base case is a measured advance with rotation into quality growth within strong industries, contingent on stable volatility and steady highs.

Confirmation would be: NYSI advancing and holding >150, NYHGH >200 on multiple sessions, NYLOW sustained <40, VIX ≤18 with RVX trending lower.

Invalidation would be: NYSI rolling over toward 0 and turning negative, NYLOW >100, VIX >22 or RVX >30, and a reversal in the A-D profile.

Market Breadth Summary

Implementation Guidance

• For LONGS: focus on positions above the 200 / 150 SMA, confirming support, and prioritize industries with a High ImGeld Industry Score rating.

• For SHORTS: focus on positions below the 200 / 150 SMA, rejecting resistance, and prioritize industries with a Low ImGeld Industry Score rating.

Fundamentals represent 80% of every decision, while 20% comes from technical setup. Timing matters.

ImGeld subscribers can access the full set of technical indicators for each stock once it passes the fundamental screening.

Want to see which stocks match today’s setup? → Go check today’s Fundamental Report

Disclaimer: ImGeld content is for informational use only and not financial advice. Markets involve risk, and past performance doesn’t guarantee future results. Always consider your personal objectives before investing.