Green on the Surface, Weak Underneath, Volatility Knocks, Breadth Fades

IMGELD Market Breadth Update: 2025-11-07 10:07:37

Executive Summary (2025-11-07)

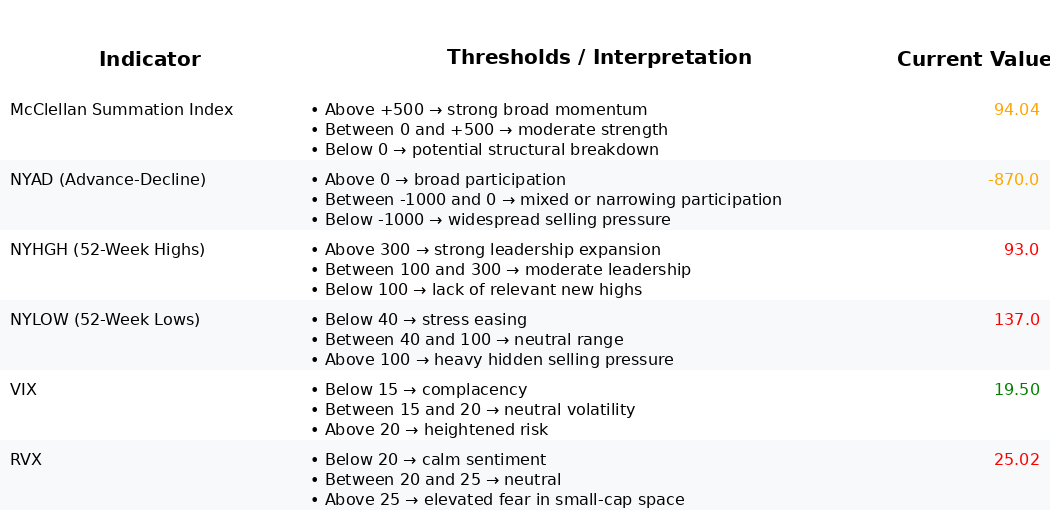

Over the past five sessions, the portfolio bias is TENTATIVE SHORT, with an indicative allocation of 20% Long, 40% Short, and 40% Cash. Breadth momentum weakened as the NYSI declined from 200.6 to 94.04 (still positive but deteriorating), while NYAD was net negative over the period (cumulative approximately -1,515) with notable whipsaws. Volatility (VIX/RVX) is edging higher toward 19.5/25.0, signaling a firmer risk premium but not a disorderly regime.

Tactically, emphasize short exposure in structurally weak areas failing at resistance and maintain elevated cash. Keep longs selective in high-quality, high relative-strength groups holding their 200/150-day SMAs. Tighten risk parameters given the fragile breadth and firming volatility.

Global Read

Structural breadth has narrowed. NYSI remains above zero at 94, but it fell sharply over the last five sessions, indicating fading internal momentum. NYAD printed a net negative profile with alternating large down and up days, suggesting distribution pressure outweighs accumulation.

Leadership is inconsistent: NYHGH improved late in the week (92–93) but remains sub-100, implying limited expansion at the top. NYLOW hovered near 100 and spiked to 137 on 11-07, which is a risk-off threshold (healthy is <40). This mix points to narrowing participation with rising downside tail risk.

Volatility is firming. VIX rose from 17.4 to 19.5 and RVX from 23.4 to 25.0; the RVX–VIX spread remains elevated, reflecting greater small-cap risk sensitivity. While not a volatility shock, the tone argues for a cautious risk budget.

3–8 week outlook: cautious-to-defensive. The current setup favors a drift lower or choppy downside unless participation stabilizes and new lows recede. Confirmation of the TENTATIVE SHORT bias would include:

- NYSI breaking below zero and trending down

- Persistent negative NYAD

- NYLOW sustaining above 100

- VIX pushing and holding above 20 with RVX >25

Market Breadth Summary (Last Five Sessions):

Invalidation would be:

- Two to three consecutive strong positive NYAD sessions

- NYLOW falling back below 40–50 with NYHGH expanding >150

- NYSI turning higher and reclaiming >150

- VIX compressing below ~18 and RVX <24

Until then, breadth is weakening, leadership is narrow, and volatility is unsupportive of aggressive risk-on positioning.

Implementation Guidance

• For LONGS: focus on positions above the 200 / 150 SMA, confirming support, and prioritize industries with a High ImGeld Industry Score rating.

• For SHORTS: focus on positions below the 200 / 150 SMA, rejecting resistance, and prioritize industries with a Low ImGeld Industry Score rating.

Remember, fundamentals represent 80 percent of every decision while 20 percent comes from technical setup. Timing matters.

ImGeld subscribers can access the full set of technical indicators for each stock once it passes the fundamental screening.