Fragile Breadth, Contained Volatility: Favor Selective Mid-Cap Longs, Fade Tiring Large Caps

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2026-01-19

Executive Summary Date: 2026-01-20,

breadth remains constructive but fragile. NYSI (McClellan Summation Index) advanced steadily for four sessions and then plateaued, while NYAD (Advance–Decline Line) delivered three strong positive days before turning negative. VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) stayed contained, reflecting a stable, low-to-moderate volatility regime. Tactically, a tentative long bias applies: favor highly selective mid-cap long setups in industries showing expanding leadership and resilient participation, while maintaining short opportunities in large caps where leadership is narrowing and rallies are tiring.

Global Read

Participation broadened early in the week and narrowed into the close. Leadership rotated toward concentration as new highs faded and new lows ticked up. Volatility compressed modestly, which is supportive but necessitates discipline. A mild divergence is present with NYSI still rising as NYAD turned negative late, suggesting hesitation rather than a full reversal. By the five-day consistency rule, signals remain tentative, consistent with early accumulation that paused into the long weekend. Selectivity is elevated: pursue mid-cap longs only where industry-level breadth is confirming, and keep large-cap shorts where deterioration is evident.

Indicator Breakdown

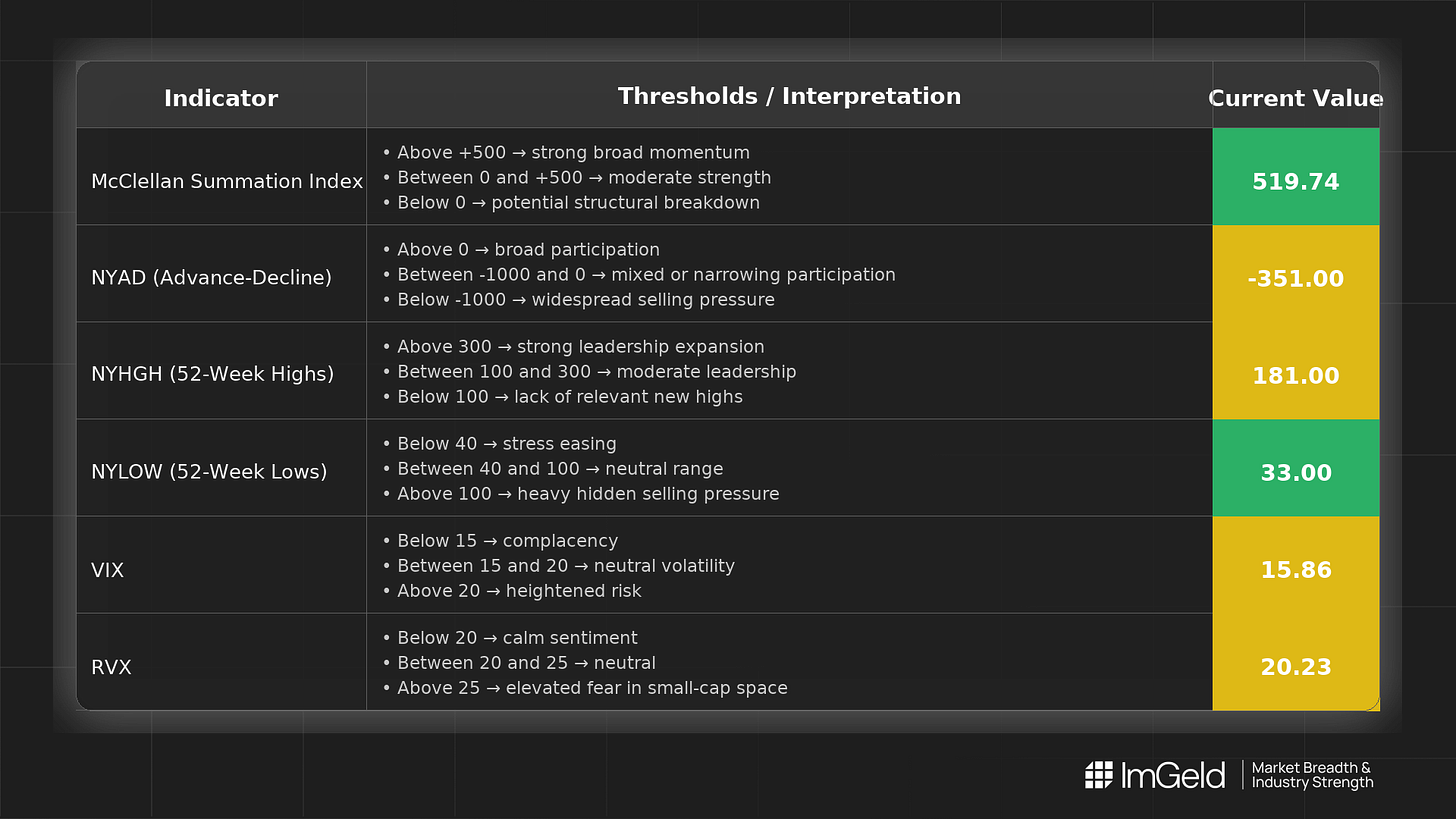

NYSI (McClellan Summation Index) Improving. Rose from 402.56 to 519.74 over the five sessions, with four consecutive gains followed by a flat print. Structure is advancing, momentum eased marginally at the end.

NYAD (Advance–Decline Line) Mixed. Daily advances progressed from 189 to 804 to 967, then reversed to -351 and held, indicating participation that built through midweek and weakened into the close.

NYHGH (New 52-Week Highs) Leadership expansion faded. Prints were 237, 210, 256, 181, 181. Midweek expansion did not sustain, implying narrower leadership into the last session.

NYLOW (New 52-Week Lows) Contained but edging up. Readings of 28, 30, 28, 33, 33 show downside pressure remains modest, with a slight uptick to monitor for continuation.

Volatility Regime VIX ranged 15.98 to 16.75 and ended near 15.86. RVX ranged 20.09 to 20.59 and ended near 20.23. Overall tone is stable and slightly compressing, supportive of selective mid-cap accumulation on dips while keeping hedges and tight risk controls.

CTA

Market breadth is only the starting point. Thinking of going long or short without knowing which industries are accelerating or breaking down? Each industry moves in its own rhythm. Stay informed. Unlock the ImGeld Industry Updates — subscribers only.