Five-Day Breadth Rally, VIX Compression Signals Risk-On Rotation to Mid-Caps

ImGeld Market Breadth Update Of Last Five Days Till Date | 2025-11-27

Executive Summary

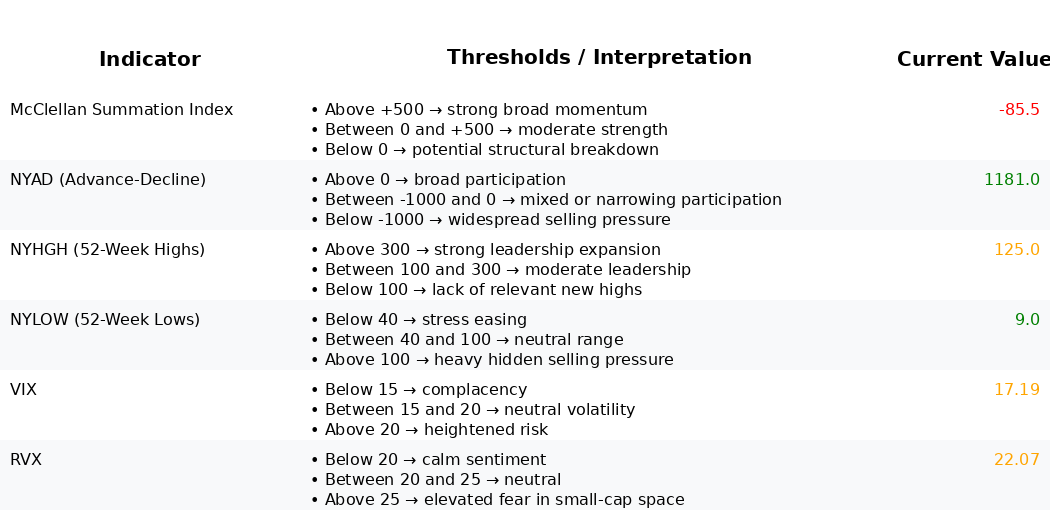

Breadth improved across the last five sessions with a tentative risk-on tone. NYSI (McClellan Summation Index) turned up from -153.03 to -85.46, stabilizing the last session, while NYAD (Advance–Decline Line) printed positive for five straight days. Volatility compressed as VIX (CBOE Volatility Index) fell from 23.43 to 17.19 and RVX (Russell Volatility Index) from 27.10 to 22.07. New highs accelerated and new lows collapsed, signaling expanding leadership and easing downside pressure. Tactical bias: tentative long. Selective long opportunities are emerging in mid-cap industries with improving leadership and consistent net advances. Short opportunities remain valid in select large caps where breadth lags and leadership fails to confirm.

Global Read

Participation is broadening, evidenced by five consecutive positive NYAD prints and a steady rise in new highs alongside a sharp contraction in new lows. Leadership is rotating from narrow leaders toward a wider set of groups, indicated by the jump in NYHGH and persistent positive daily breadth. Volatility is firmly compressing, improving the risk-reward for trend continuation. A mild divergence persists as NYSI remains negative but is rising, while NYAD is strongly positive; this is typical of early accumulation rather than exhaustion. By the five-day consistency rule: breadth expansion via NYAD is firmly constructive, volatility compression is firmly in place, leadership expansion is firmly improving, while the NYSI turn is tentative pending further follow-through.

Indicator Breakdown

1. NYSI (McClellan Summation Index)

Structure improved over the last three sessions after a lower low on 11/24, then plateaued. The upturn is tentative but directionally constructive.

2. NYAD (Advance–Decline Line)

Daily participation strengthened with five consecutive positive readings (1690, 735, 1663, 1213, 1181). Momentum moderated slightly late in the period but breadth remains supportive.

3. NYHGH (New 52-Week Highs)

Leadership expansion is firm. New highs increased from 37 to 125 across the window, signaling broadening upside sponsorship.

4. NYLOW (New 52-Week Lows)

Downside pressure eased materially. New lows fell from 99 to single digits, consistent with improving risk appetite.

5. Volatility Regime

VIX declined from 23.43 to 17.19 and RVX from 27.10 to 22.07, stabilizing at the lows in the last session. Compression supports carry and breakout attempts but calls for disciplined risk controls.

Tactical Take

- Long: Focus on mid-cap industries showing improving high–low dynamics and persistent net advances, such as semiconductor equipment, diversified industrials, specialty finance, and specialty chemicals.

- Short: Select large-cap pockets with weak breadth and poor leadership confirmation remain viable for fades, particularly in software and household products where new highs are scarce.

CTA

Market breadth is only the starting point.

Thinking of going long or short without knowing which industries are accelerating or breaking down?

Each industry moves in its own rhythm.

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.