Early Accumulation: Select Mid-Cap Longs, Fade Large-Cap Rallies Amid Residual Volatility

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2026-01-21

Executive Summary Date: 2026-01-22

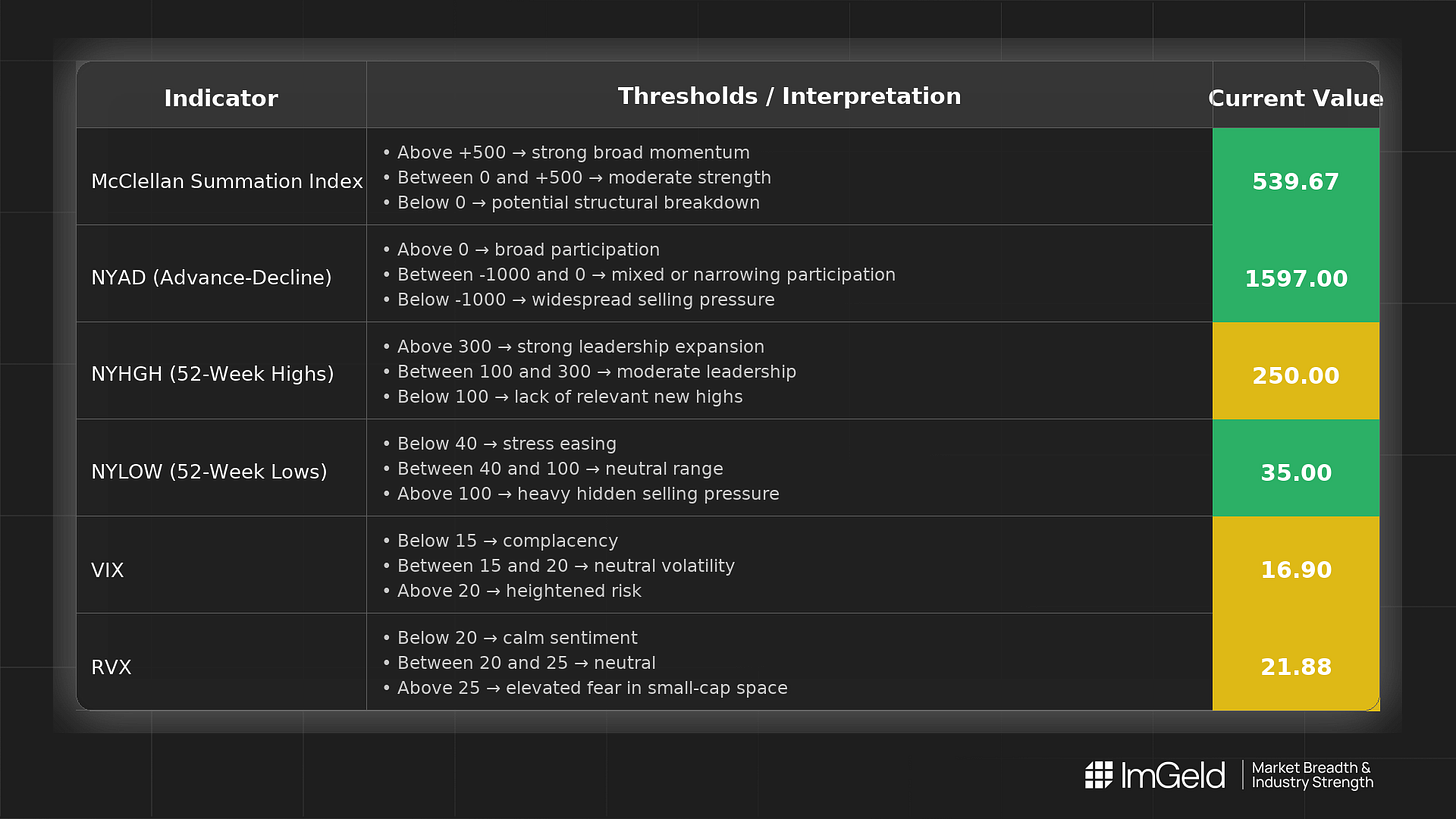

Breadth is edging constructive but remains uneven. The NYSI (McClellan Summation Index) advanced to 539.67, continuing its upward slope despite a brief dip on 01-20. The NYAD (Advance–Decline Line) was highly volatile, flipping from a deep negative on 01-20 to a strong positive on 01-21, leaving a modest net gain over five sessions. Volatility firmed midweek and then eased: VIX (CBOE Volatility Index) spiked to 20.09 on 01-20 before settling to 16.90; RVX (Russell Volatility Index) followed a similar path, closing at 21.88.

Tactically, selective long setups appear to be emerging in mid-cap industries where new highs are re-expanding and new lows are contained. Short opportunities remain valid in large caps showing deteriorating breadth on strength. Selectivity is essential given the choppy NYAD and residual volatility

Global Read

Participation narrowed into 01-20 and re-broadened on 01-21; leadership is rotating rather than concentrating, with new highs recovering toward prior levels. Volatility expanded sharply on 01-20 and is now compressing, but remains above early-week baselines. A mild divergence is present: NYSI is firmly improving while NYAD remains inconsistent, indicating underlying accumulation with unstable day-to-day flows. By the five-day consistency rule: NYSI is firmly improving (2–5 days consistent), NYAD remains mixed, and the overall pattern signals early accumulation that is tentative pending confirmation.

Indicator Breakdown

NYSI (McClellan Summation Index) Uptrend intact: 487.93 → 519.74 → 519.74 → 516.28 → 539.67. Structure is improving with higher highs and only one minor pullback.

NYAD (Advance–Decline Line) Choppy participation: 967 → -351 → -351 → -1560 → 1597. Breadth strengthened into 01-21 but lacks multi-day consistency; expect two-way internals.

NYHGH (New 52-Week Highs) Leadership contraction to 110 on 01-20 followed by a rebound to 250 on 01-21. Early signs of leadership expansion; needs follow-through.

NYLOW (New 52-Week Lows) Downside pressure peaked at 61 on 01-20 and eased to 35. Risk appetite improved, though not fully back to the lowest readings.

Volatility Regime VIX 15.84/15.86/15.86/20.09/16.90 and RVX 20.09/20.23/20.23/23.83/21.88 indicate a volatility shock that is being absorbed. Positioning should account for residual event risk; stagger entries and retain a cash buffer.

Tactical Implications

Long: Focus on mid-cap industries where new highs are rebuilding and lows remain muted (e.g., asset-light services, equipment suppliers, select regional financials). Favor names demonstrating persistent accumulation and relative strength through 01-20.

Short: Large caps exhibiting weakening breadth and rally exhaustion remain candidates to fade on strength.

CTA

Market breadth is only the starting point. Thinking of going long or short without knowing which industries are accelerating or breaking down? Each industry moves in its own rhythm. Stay informed. Unlock the ImGeld Industry Updates — subscribers only.