Early Accumulation, Fading Thrust: Favor Selective Mid-Cap Longs, Hedge Overextended Large-Caps

IMGELD Market Breadth Update Based on Last 5 Days Till the Data: 2026-01-26

Executive Summary Date: 2026-01-27

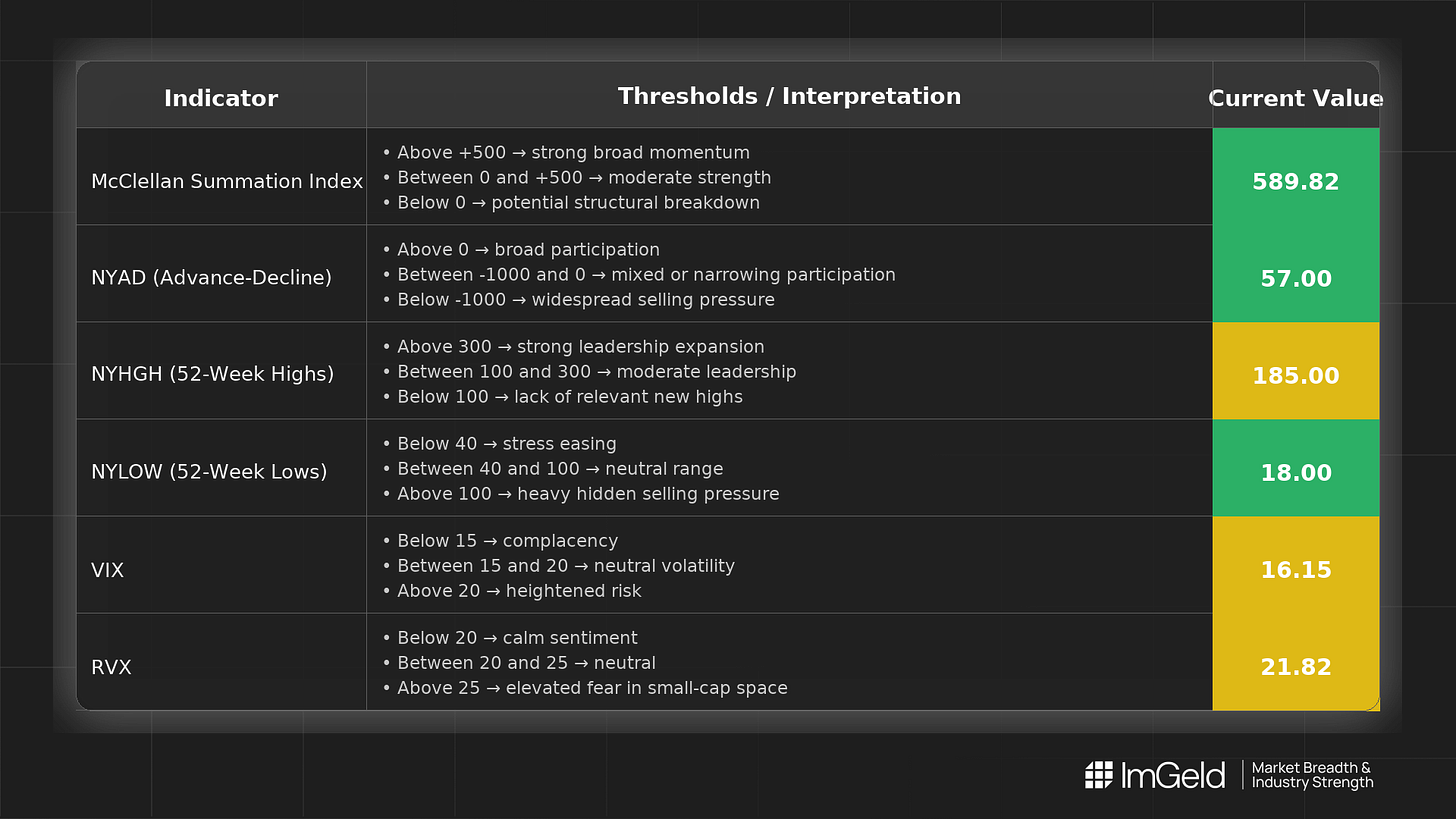

Breadth improved over the last five sessions with an upslope in NYSI (McClellan Summation Index) and a three-day positive stretch in NYAD (Advance–Decline Line), albeit with diminishing thrust into the latest session. VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) faded from an early spike and stabilized, supporting a cautiously constructive tone. Tactically, long opportunities are emerging in selective mid-cap industries showing persistent new-high activity and resilient pullback demand. Large-cap shorts remain valid in crowded, overextended leadership where breadth is not confirming price strength. Selectivity is high.

Global Read

Participation broadened midweek and then narrowed into 2026-01-26. Leadership rotated positively with a surge in new highs on 2026-01-22 before cooling. Volatility compressed after an early-week shock, indicating risk appetite without complacency. A mild divergence is visible: NYSI is firmly improving while NYAD’s daily thrust decelerated, signaling early accumulation rather than a clean continuation. By the five-day consistency rule, NYSI strength is firmly improving, while NYAD participation remains tentative. Net message: early accumulation with fading momentum into the latest session; stay selective and avoid chasing.

Indicator Breakdown

NYSI (McClellan Summation Index) Rising from 516 to 590 over the last three sessions, indicating improving intermediate breadth and constructive internal momentum.

NYAD (Advance–Decline Line) Sequence of -351, -1560, +1597, +679, +57 shows a strong midweek reversal followed by loss of thrust. Participation strengthened, then stalled; confirm up moves only when daily breadth re-accelerates.

NYHGH (New 52-Week Highs) Climbed from 110 to 302 before easing to 185. Leadership expansion is intact but cooling; favor mid-cap industries where new highs persist despite the fade.

NYLOW (New 52-Week Lows) Compressed from 61 to the mid-teens, ticking slightly higher to 18. Downside pressure remains muted, consistent with a constructive, selective risk tone.

Volatility Regime VIX spiked to 20.09 then stabilized near 16; RVX eased from 23.83 to near 22. Post-spike compression supports a cautiously constructive backdrop, but the RVX premium argues for disciplined risk control in smaller capitalizations and the use of hedges against headline shocks.

Tactical Take

Long: Focus on mid-cap industries with improving breadth and earnings revision traction, such as industrial technology, specialty chemicals, aerospace suppliers, and software infrastructure where pullbacks hold higher lows.

Short: Large-cap, index-heavy leadership that is extended with lagging breadth and deteriorating advance–decline participation remains suitable for tactical shorts or hedges.

CTA

Market breadth is only the starting point. Thinking of going long or short without knowing which industries are accelerating or breaking down? Each industry moves in its own rhythm. Stay informed. Unlock the ImGeld Industry Updates — subscribers only.