Downside Breadth Widens: NYSI Negative, Volatility Rising—Maintain Tentative Short Bias

ImGeld Market Breadth Update — 2025-11-18

Executive Summary

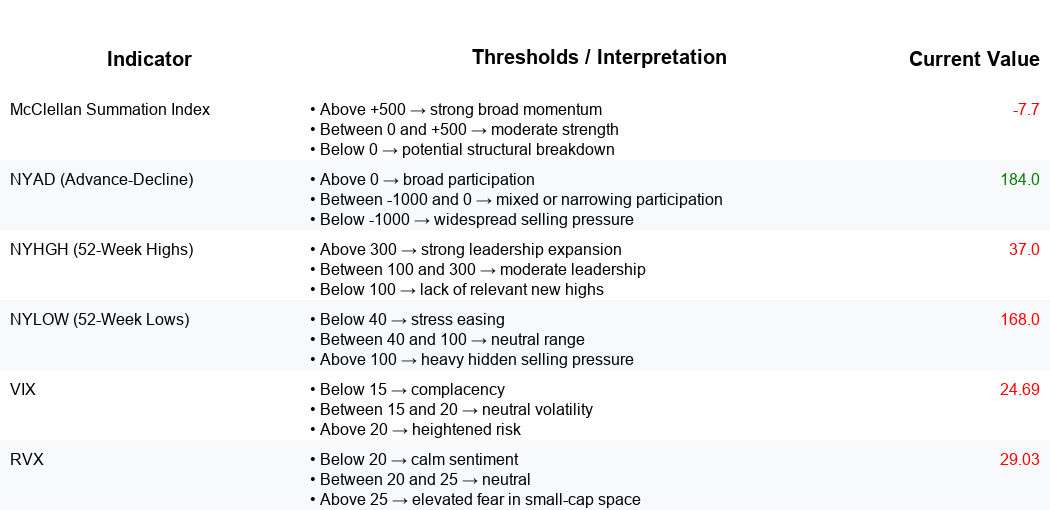

Breadth deteriorated across the last five sessions. NYSI (McClellan Summation Index) fell steadily and turned negative, while NYAD (Advance–Decline Line) printed three materially negative days with only a modest positive close today. Volatility expanded as VIX (CBOE Volatility Index) and RVX (Russell Volatility Index) advanced to the mid-20s and high-20s respectively. Selective, tactical long interest may emerge only in resilient mid-cap industries with defensive or counter-cyclical profiles; short opportunities remain valid in extended large-cap growth and cyclical industries where weakness is confirmed. Selectivity must be high.

Global Read

Participation is broadening to the downside: NYLOW (New 52-Week Lows) rose each day and NYHGH (New 52-Week Highs) contracted, signaling leadership narrowing and concentrated resilience. Volatility is firmly expanding, elevating whipsaw risk and favoring risk control. A one-day NYAD rebound contrasts with a five-day NYSI slide into negative territory, a minor divergence that, by the five-day consistency rule, is only tentative and not yet actionable as a trend change. The five-day pattern indicates a continuation phase of distribution rather than early accumulation or exhaustion.

Market Breadth Summary (Last Five Sessions)

Indicator Breakdown

1. NYSI (McClellan Summation Index): Firmly declining for five sessions (117.48 to -7.70), a decisive momentum break with a bearish inflection below zero.

2. NYAD (Advance–Decline Line): Weak breadth with heavy negatives on 11/13 and 11/17; today’s modest positive is insufficient to alter the deteriorating participation trend.

3. NYHGH (New 52-Week Highs): Contracted from 152 to 37, confirming leadership shrinkage and poor follow-through on breakouts.

4. NYLOW (New 52-Week Lows): Climbed from 41 to 168, evidencing persistent downside pressure and waning risk appetite.

5. Volatility Regime: VIX rose 17.5 to 24.7 and RVX 23.9 to 29.0, an expansionary regime that favors defensive posture, tighter stops, and shorter holding periods.

CTA

Market breadth is only the starting point.

Thinking of going long or short without knowing which industries are accelerating or breaking down?

Each industry moves in its own rhythm.

Stay informed. Unlock the ImGeld Industry Updates — subscribers only.