Divergent Breadth, Firming Volatility: Maintain Defensive Tilt in Choppy, Downside-Skewed Market

IMGELD Market Breadth Update: 2025-10-30

Executive Summary

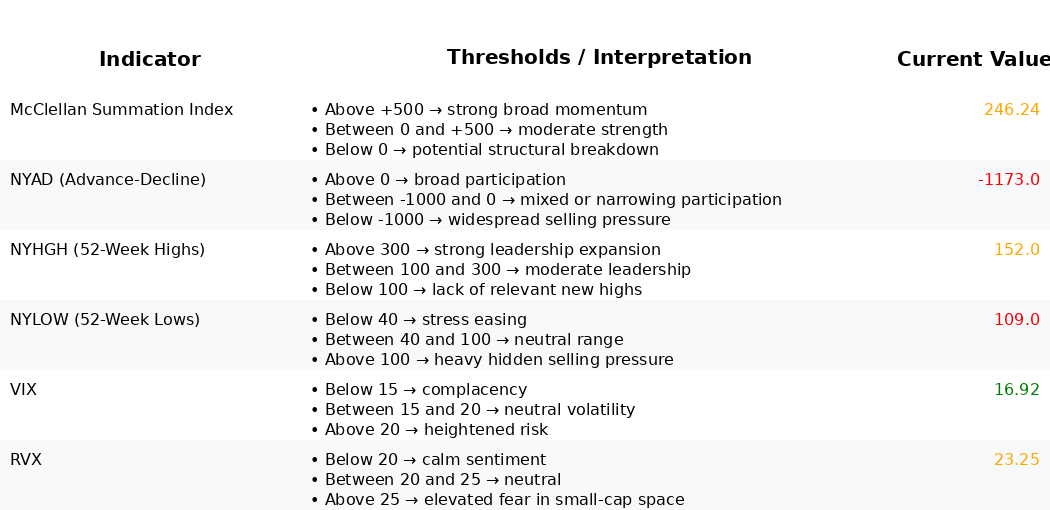

Over the past five session, portfolio bias is NEUTRAL with downside risk not confirmed. Indicative allocation: 25% Long, 50% Short, 25% Cash. Breadth is mixed: the NYSE McClellan Summation Index (NYSI) remains positive and higher versus five sessions ago (220.9 to 246.2) but slipped day over day; the Advance–Decline (NYAD) turned decisively negative the last two sessions. Volatility is firming but contained, with VIX rising from 15.97 to 16.92 and RVX from 22.93 to 23.25. Tactical focus: maintain defensive tilts, emphasize shorts in structurally weak groups, and run selective longs only in leaders holding trend strength. Preserve the cash buffer pending confirmation from breadth and volatility.

Global Read

Breadth signals are now divergent. NYSI remains above zero, a constructive condition, but momentum flattened with a pullback on the final session, reflecting stalling internal thrust. NYAD deteriorated sharply from early-week positives to back-to-back negatives (-702, -1173), indicating broad participation weakened into the decline.

Leadership is bifurcated. NYHGH contracted through mid-week then rebounded to 152, signaling resilient leaders. In contrast, NYLOW rose from 16 to 109, crossing above 100, which historically flags risk-off pressure if persistent. Thresholds: NYSI above 0 is constructive; NYLOW below 40 is healthy while sustained readings above 100 indicate distribution and elevated downside risk.

Volatility tone is tightening but not disorderly. VIX and RVX both drifted higher, with the RVX-VIX spread steady to slightly wider, implying small-cap risk premium remains elevated. The vol backdrop does not preclude risk-taking but argues for measured exposure and active hedging.

3–8 week outlook: Base case is a choppy, range-bound regime with a mild downside skew until breadth re-accelerates. Confirmation of downside would be a rollover in NYSI toward and through zero, NYLOW remaining above 100 for several sessions, continued negative NYAD, and VIX pushing into 18–20. An improvement case requires NYAD turning positive on breadth thrust days, NYLOW reverting below 40, NYHGH sustaining 100–300, and NYSI advancing toward the +300 zone while VIX stays contained near or below mid-16s. Until then, maintain a balanced but defensively skewed stance with tight risk controls and factor dispersion awareness.

Market Breadth Summary (Last Five Sessions)

Implementation Guidance

• For LONGS: focus on positions above the 200 / 150 SMA, confirming support, and prioritize industries with a High ImGeld Industry Score rating.

• For SHORTS: focus on positions below the 200 / 150 SMA, rejecting resistance, and prioritize industries with a Low ImGeld Industry Score rating.

Remember, fundamentals represent 80 percent of every decision while 20 percent comes from technical setup. Timing matters.

ImGeld subscribers can access the full set of technical indicators for each stock once it passes the fundamental screening.