Credit euphoria.

Is this time different ?

Nobody talks about credit euphoria.

Everyone watches stock valuations. PE ratios. Bubble charts.

But the real signal is in the bond market.

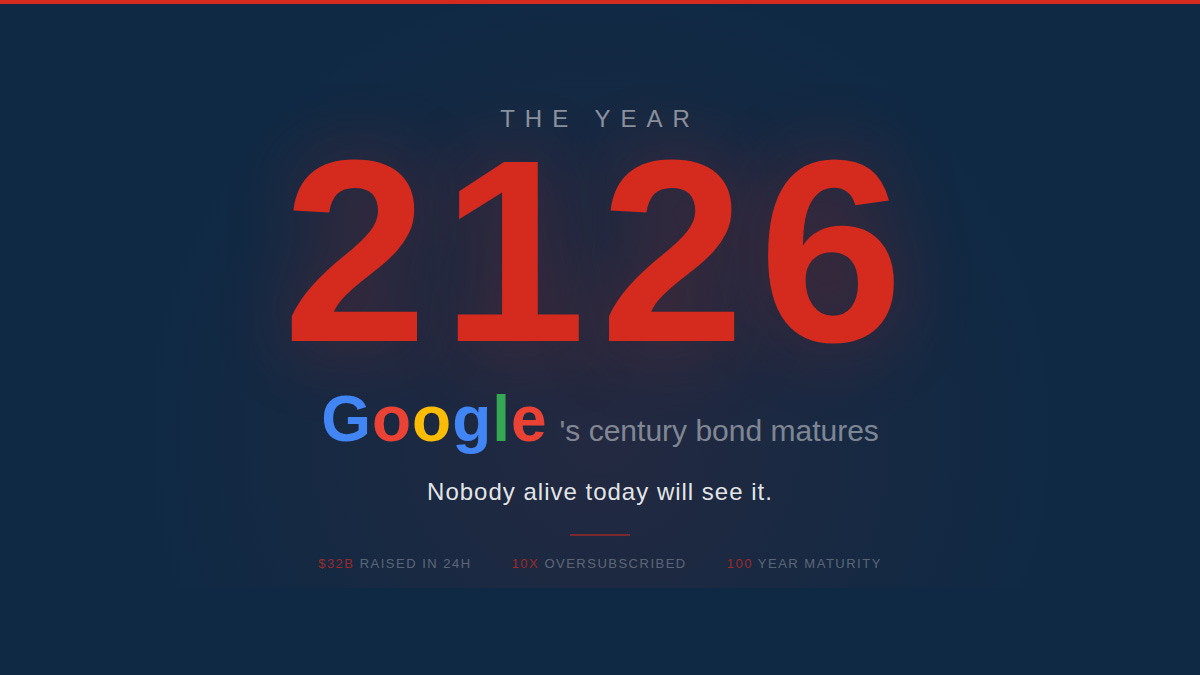

When investors lend $32 billion in 24 hours to a single company — including a 100-year bond that was 10x oversubscribed — that’s not rational analysis.

That’s euphoria.

Equity bubbles get headlines.

Credit bubbles get ignored.

Until they don’t.

2007: Nobody questioned mortgage bonds.

1997: Nobody questioned lending to Motorola for 100 years.

2026: Nobody questions lending to Google for 100 years.

The pattern:

→ Dominant narrative

→ Unlimited confidence

→ Record-duration debt

→ “This time is different”

It’s never different.