Cautiously Constructive: Breadth Broadens, VIX Eases; Selective Longs Pending NYLOW Below 40

IMGELD Market Breadth Update: 2025-11-12

Executive Summary (as of 2025-11-11)

Bias: TENTATIVE LONG

Exposure: 65% Long, 0% Short, 35% Cash

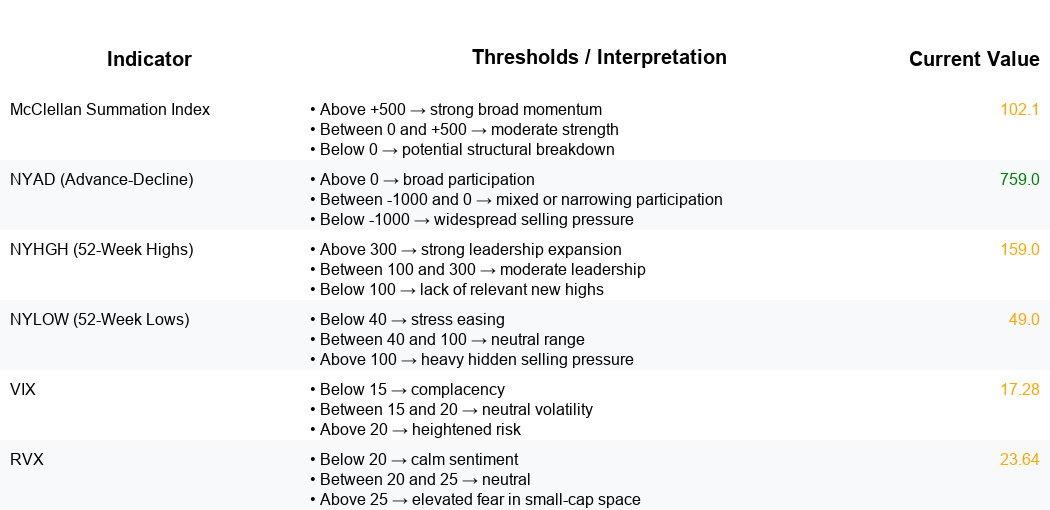

Breadth: NYSI (McClellan Summation Index) remains above zero, declining early in the period with a positive inflection on the latest session; NYAD (NYSE Advance–Decline Line) is net positive over five sessions despite choppiness.

Volatility: VIX (CBOE Volatility Index) and RVX (CBOE Russell 2000 Volatility Index) both trended lower; VIX near high teens, RVX mid‑20s.

Leadership is improving: NYHGH (New 52-Week Highs) expanded steadily while NYLOW (New 52-Week Lows) fell from a midweek spike but remains just above the “healthy” threshold.

Tactical: Favor selective longs in established leaders and liquid large caps; be selective with small caps until RVX compresses further and NYLOW sustains sub‑40. Avoid broad shorts; keep a cash buffer for volatility pockets.

Global Read

Participation: NYSI is constructive (>0) with a late-session turn higher after four days of easing. This supports a tentative positive bias but requires follow‑through.

Underlying flow: NYAD was volatile (−1015, +1014, −870, +1012, +759) yet summed net positive, indicating improving breadth into the latest two sessions.

Leadership breadth: NYHGH rose 39 → 159, signaling expanding leadership.

Weakness breadth: NYLOW moved 99 → 49, improving from a risk-off spike (137 on 11/07) but still above the healthy threshold (<40).

Volatility tone: VIX declined 19.0 → 17.28; RVX 24.82 → 23.64. Both are easing, supportive for risk, with the small-cap risk premium still elevated.

Interpretation: Breadth is tentatively broadening. Participation firmed late, leadership expanded, and downside breadth receded. However, the NYLOW reading near 50 and only a nascent NYSI upturn argue for patience.

Thresholds:

NYSI above 0 = constructive (in place). A rising NYSI would confirm.

NYLOW below 40 = healthy; above 100 = risk-off. Current 49 is improving but not yet healthy.

3–8 week outlook: Bias modestly constructive contingent on continued breadth improvement and contained volatility. Confirmation would be: NYSI turning and sustaining higher above zero, NYAD maintaining positive breadth on balance, NYLOW sustaining below 40, and VIX/RVX maintaining a downtrend. Invalidation would be: NYSI rolling back below zero, NYLOW prints >100 for multiple sessions, or a persistent VIX break >20 with broad NYAD deterioration.

Market Breadth Summary (Last Five Sessions)

Implementation Guidance

• For LONGS: focus on positions above the 200 / 150 SMA, confirming support, and prioritize industries with a High ImGeld Industry Score rating.

• For SHORTS: focus on positions below the 200 / 150 SMA, rejecting resistance, and prioritize industries with a Low ImGeld Industry Score rating.

Remember, fundamentals represent 80 percent of every decision while 20 percent comes from technical setup. Timing matters.

ImGeld subscribers can access the full set of technical indicators for each stock once it passes the fundamental screening.

Want to see which stocks align with this setup? → Check today’s Fundamental Report (paid)