Broadening Leadership and Softer Volatility Keep the Path of Least Resistance Up

ImGeld Market Breadth Update - 2025-10-28

Executive Summary

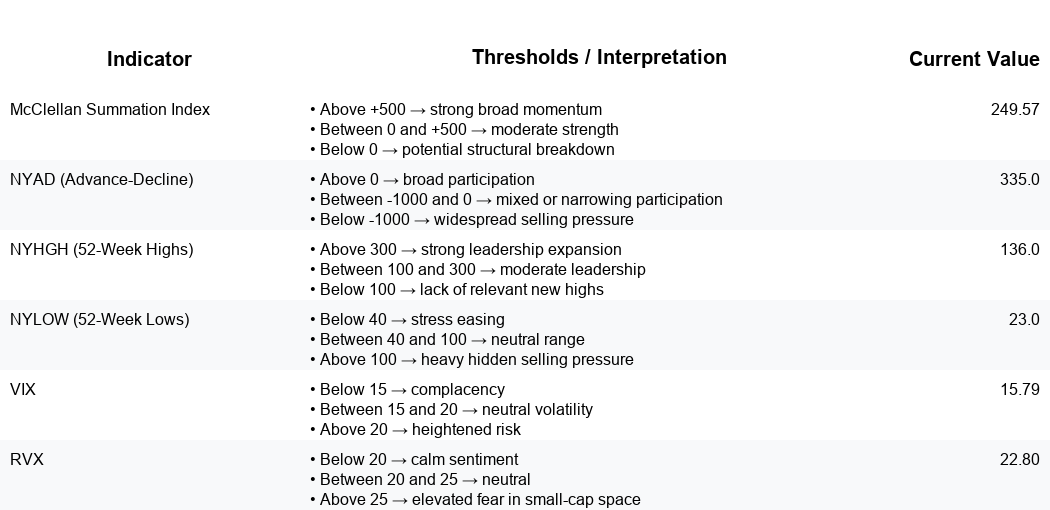

As per 2025-10-27 closing data, the portfolio bias remains LONG with an indicative allocation of 75% Long, 0% Short, and 25% Cash. Breadth momentum continues to improve with the McClellan Summation Index rising(NYSE) to 249.57 and NYAD net positive across four of the last five sessions. Volatility is contained as VIX declines to 15.79 and RVX eases to 22.80. Maintain constructive risk exposure, focusing long capital on leaders above their 200/150-day SMA within industries showing strong ImGeld Industry Scores. Keep a modest cash buffer for tactical adds on pullbacks and avoid shorts until breadth deteriorates.

Global Read

Structural breadth strengthened over the last five sessions. NYSI advanced from 176.66 to 249.57, positive and rising, signaling improving participation. NYAD rebounded from -456 to a sequence of positive readings (+710, +710, +186, +335), indicating steady demand. Leadership improved as NYHGH expanded from 48 into a stable 120 to 140 range, while NYLOW remained suppressed at 16 to 23. This combination reflects accumulation rather than distribution.

Volatility supports the setup. VIX trended down from 18.6 to 15.79, and RVX eased from 24.85 to 22.80 despite a brief uptick, keeping tail-risk pressure moderate. The RVX-VIX spread remains elevated but narrowing, consistent with improving small-cap risk sentiment.

Breadth is broadening. NYSI above 0 is constructive; current readings in the +200 to +300 zone reinforce positive momentum. NYLOW below 40 is healthy; readings well under that threshold reduce near-term downside risk. The interaction of expanding new highs, contained new lows, and falling volatility argues for a constructive 3 to 8 week outlook.

Confirmation would come from: NYSI continuing to rise or base above zero, NYAD remaining net positive on pullbacks, NYHGH sustaining 100+, NYLOW staying below 40, and VIX remaining below 18 with a stable-to-narrowing RVX spread. Invalidation would be signaled by NYSI rolling over and trending toward or below zero, persistent negative NYAD, NYLOW rising above 40 toward 100, VIX breaking above 20 with RVX > 25, and new highs slipping below 50.

Market Breadth Summary (Last Five Sessions)

Implementation Guidance

• For LONGS: focus on positions above the 200 / 150 SMA, confirming support, and prioritize industries with a High ImGeld Industry Score rating.

• For SHORTS: focus on positions below the 200 / 150 SMA, rejecting resistance, and prioritize industries with a Low ImGeld Industry Score rating.

Remember, fundamentals represent 80 percent of every decision while 20 percent comes from technical setup. Timing matters.

ImGeld subscribers can access the full set of technical indicators for each stock once it passes the fundamental screening.